Winter’s arrival in England adds an unpleasant chill to already dreary, drizzly days. I wasn’t surprised at the resigned mood in the conference room as graduate students and postdocs shuffled in for our weekly lab meeting in November 2011. Many of us hailed from balmier climates—California, Spain, Italy, the Caribbean islands. We were all here, amid the dreaming spires of Oxford University, to learn from Professor Henry Snaith, an up-and-coming scientist studying brand new materials for solar power. The goal of this work, and that of hundreds of other research groups all over the world, was to create new alternatives to today’s silicon-based solar photovoltaics. Without such efforts, the extraordinary solar power revolution could soon peter out.

Henry—he insists on being called by his first name—is not your average physics prof. A former rugby player at Cambridge University, he’s energetic, athletic, and competitive. He once took the lab team skiing in the Alps and beat us down every run. And he is a brilliant scientist with a spooky intuition about how materials behave at the nanoscale, in the realm of atoms and electrons.

Still, on that bleak day, Henry’s name wasn’t widely known in the academic world. That lab meeting proved to be a turning point in his career—and in the development of solar power.

At the meeting, Mike Lee, one of my fellow graduate students, described a startling discovery. At Henry’s behest, he had flown to Japan to track down a chemical recipe that Tsutomu Miyasaka’s lab, at Toin University of Yokohama, had invented for making a novel type of photovoltaic cell.

Back at Oxford, Mike experimented with variants on the Miyasaka formula. Working late one night, he accidentally flipped two of the chemical concentrations. The surprising result, Mike told us, was a solar cell that was more than 10 percent efficient—that is, it was able to convert more than 10 percent of the sun’s energy striking it into electricity.

Compared with the record efficiency for a silicon solar cell, which then hovered around 25 percent, Mike’s cell was unremarkable. But it was a major leap for a material not already in commercial use, and there was a clear path to improve the efficiency to 20 percent and possibly much higher.

The material Mike had tweaked to such dramatic effect is known as a perovskite. Perovskites are a large class of compounds that have the crystal structure AMX3. In perovskites used for solar cells, A is typically an organic molecule, M is a metal, and X is a halogen.

Although various perovskites are found in nature, what Mike fabricated at Oxford was a synthetic perovskite that combined inorganic atoms, as is usual in natural perovskites, with an organic polymer. High-efficiency solar cells are normally made entirely of inorganic materials such as silicon, which have a nearly perfect crystalline structure that is crucial for their performance. Organic polymers are commonly used in plastics, but they have historically been considered inefficient and unreliable as solar materials.

Mike’s hybrid exploited the best elements of its inorganic and organic constituents. Like silicon, it naturally forms near-perfect crystals. Like organic materials, it could be produced at low temperatures, making it possible to deposit the material on flexible, lightweight materials such as plastic or ultrathin metal mesh.

By contrast, making a traditional silicon solar cell requires expensive equipment and high temperatures that rule out the use of flexible substrates. Once produced, silicon cells must be encased in heavy protective sheets of glass.

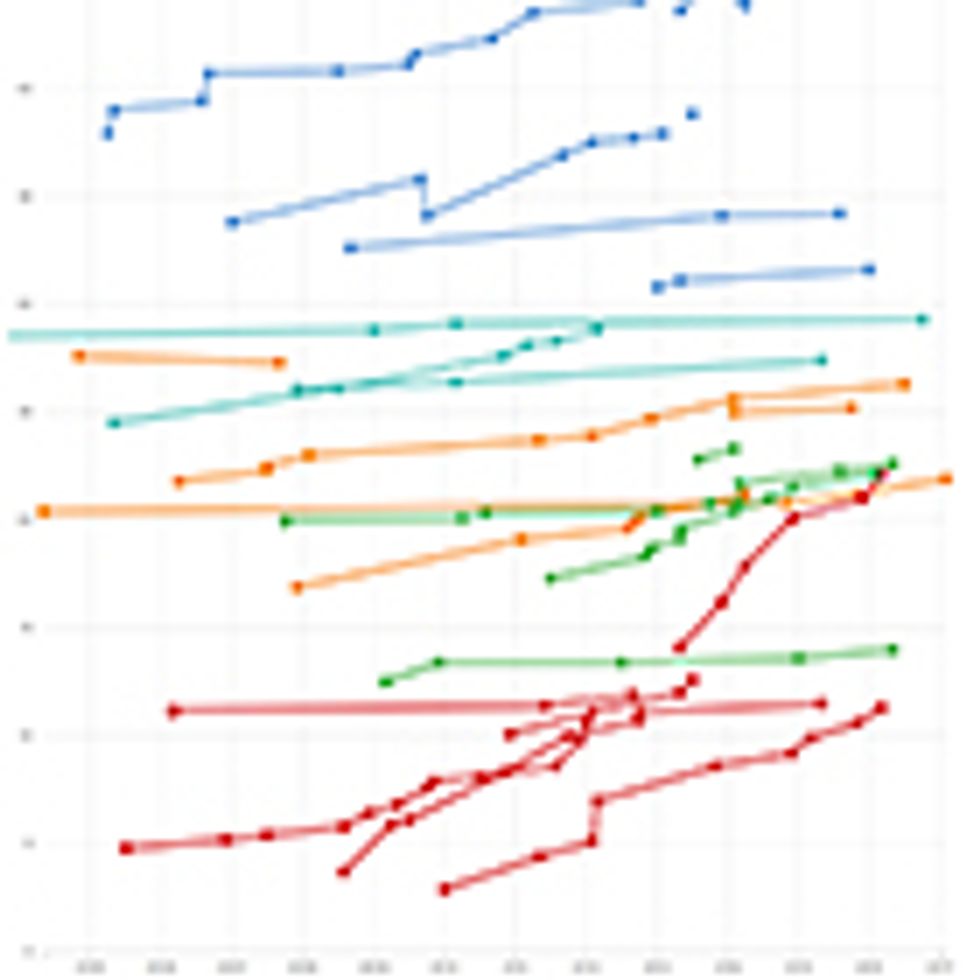

After Mike’s results were published, the news sparked a solar R&D gold rush. Scientists from around the world have since pushed up the efficiency of perovskite solar cells faster than that of any other solar technology in history, reaching nearly 24 percent for a pure-perovskite cell [PDF] and 28 percent for a tandem silicon-perovskite cell by the end of 2018. Researchers believe perovskite efficiency could top 35 percent in the coming years.

Meanwhile, the installation of traditional solar photovoltaic (PV) panels has grown enormously. In 2008, solar PV worldwide stood at just 15 gigawatts; in 2018, it topped 500 GW. And yet, for all that extraordinary growth, solar power still meets less than 3 percent of electricity demand worldwide.

In the not-so-distant future, solar power could become ubiquitous. Rather than manufacturing heavy, rigid solar panels that are limited in how cheaply and widely they can be deployed, the solar industry could instead print flexible rolls of high-efficiency solar coatings. By midcentury, entire cityscapes could be wrapped in these electricity-generating solar materials.

Realizing that future will mean commercializing new PV materials, including perovskites, that already exist in the lab or as prototypes but still require extensive effort to bring to market. These other solar PV materials include organic and quantum-dot solar PV cells, which now boast efficiencies of roughly 16 percent and 17 percent, respectively. They have the potential to be even more versatile than perovskite and run the gamut of the color and transparency spectrum.

Still, the frenzy in academic circles surrounding the efficiency of a fingernail-size sliver of material has very little to do with designing and manufacturing a commercial product that will survive outside for decades, as current silicon panels do. Far more investment is needed to commercialize advanced PV technologies. Although the U.S. Congress and the Trump administration have increased federal funding for advanced PV R&D in each of the last two years, the fiscal year 2019 allotment of US $72 million for PV R&D is less than what it was during President Obama’s first term and will not be nearly enough to support the commercialization of these exciting new technologies. In Europe and Asia, government funding and private investment in advanced solar have been similarly slow to materialize. Private investors, meanwhile, seem to be waiting for more government support for research, development, and demonstration. Without substantially more support—at least double today’s levels—these promising new technologies could well remain lab-bench novelties.

Neglecting innovation could be disastrous for solar power’s long-term prospects. Limited to existing technology, the percentage of power that we get from solar could stagnate, failing to substantially displace fossil fuels and handicapping the transition to clean energy.

This gloomy outlook may seem counterintuitive. After all, the world is experiencing a solar boom, fueled by the falling price of conventional silicon PV. Between 2008 and 2018, the price of such panels plummeted from more than $4 per watt to less than 30 U.S. cents per watt. If you extrapolate from recent progress, you might assume that solar needs no major technological improvements to continue its meteoric ascent.

But mere extrapolation misses an important fact: As the amount of solar power on the grid increases, installing even more solar PV becomes economically unattractive and technically complicated. It’s a matter of supply and demand.

Think about a region in which solar power penetration is already high, such as California. Because every solar panel pumps out electricity when the sun is overhead, rising solar PV generation can flood the power grid in the middle of the day, creating an oversupply of electricity. Later, when the sun sets and customer demand peaks during dinnertime, solar electricity is in short supply.

As a result of the mismatch in supply and demand, the value of electricity plunges in the daytime, when solar power is abundant, and spikes in the evening, when solar power is scarce. Therefore, as more solar is installed, the value to the power system of installing yet another solar panel, to provide even more supply during periods of surplus, rapidly declines. This phenomenon is known as value deflation.

California, an early adopter of solar power, provides a cautionary example of value deflation. In 2018, solar generated over 15 percent [PDF] of the state’s electricity overall, and on some particularly sunny afternoons, it supplied over half.

As a result, the wholesale price of electricity at midday would plunge, occasionally going negative. When that happened, suppliers would pay customers to accept their electricity, because it’s cheaper to do that than to shut down and restart production. The drop in price reflected the glut of solar power on the grid.

Having a large amount of solar power on the grid also means that whenever that generation falls off sharply—such as when the sun sets or when a thick bank of clouds rolls in—other power plants have to swiftly ramp up to meet customer demand. These plants burn fuel idling on standby, and they also suffer wear and tear from constant cycling. The resulting costs are real, but they don’t show up in the sticker price of solar panels.

Batteries and other forms of energy storage can soak up some of the excess supply. Battery prices continue to fall, while new battery technologies continue to be rolled out. More capable smart grids will make it easier to match intermittent solar supply with customer demand. But those trends probably won’t be enough to enable today’s solar technology to deliver value greater than its cost.

Thanks to its ambitious mandates, California continues to install more solar power. But at a global scale, countries—especially in the developing world—will be unable to deliver affordable energy to customers if they install more solar than is economically justified.

For solar power to remain economical will require its cost to fall faster than its value. For the foreseeable future, the cost of solar based on existing silicon PV technology will continue to fall. Recently, the U.S. Department of Energy set a target cost for utility-scale solar in the United States of just 3 cents per kilowatt-hour by the year 2030, roughly half its cost in 2017.

But the problem, as my collaborator Shayle Kann and I argued in a 2016 paper in Nature Energy, is that even halving the cost of traditional solar PV won’t be enough. Even then, the cost would still be roughly double the level needed to outpace value deflation.

You may be wondering whether simply replacing silicon with a cheaper, more efficient PV material can really solve solar’s value deflation problem. After all, the panels represent only a portion of the total costs of a solar installation. But new, higher-efficiency materials can make an outsize difference to solar project economics. Higher efficiencies enable the installation to pump out more power with fewer panels. And fewer panels means less land, labor, and related equipment. This math applies to utility-scale plants as well as rooftop installations.

In India, where my company, ReNew Power, is the largest owner of solar and wind power plants, higher-efficiency and lower-cost solar panels could transform project economics. When we budget the costs of a solar farm, the solar panels are by far the largest capital cost—and therefore are the biggest driver of our financial return and the price at which we are able to sell renewable energy. Other costs such as construction labor or installation materials are substantially cheaper than in the developed world. In 2018, India surpassed the United States as the world’s second-largest market for solar power, behind only China, and advanced solar panel technologies could turbocharge its renewable revolution.

Lower costs and higher efficiencies aren’t the only advantages. Because they’re flexible and lightweight, perovskites and other emerging technologies could extend solar into new applications. Perovskites, for example, could be quickly sprayed and rolled onto flexible substrates, much as newspapers are spooled through high-volume printing presses. The ease of transporting solar rolls rather than rigid panels would reduce shipping costs. And once a solar roll reaches its destination, the ability to unroll and install it with minimal equipment would further slash the cost.

Cheap, lightweight solar coatings could also enable rooftop solar power for people in the developing world who currently live under roofs too flimsy to support traditional silicon panels. And in urban centers around the world, semitransparent solar coatings could be wrapped around skyscrapers and other building facades. Because new solar materials can take on a range of colors and transparencies, building-integrated PV could enhance, rather than constrain, an architect’s palette—imagine power-generating stained glass. [For more on the potential of these building-incorporated solar materials, see "The Dawn of Solar Windows."]

The problem with realizing this vision of ubiquitous solar power is that the investment required to commercialize the breakthrough technologies isn’t close to where it needs to be. Today, solar panel manufacturing is dominated by Chinese companies, and many of these companies reinvest less than 1 percent of their revenue into R&D—a paltry sum. The R&D they do conduct focuses on incremental improvements to their existing silicon products.

Indeed, most people in the industry view today’s silicon solar panels as the end point of more than a half century of innovation. Rather than investing in new technologies, they focus on ruthless cost cutting. If you’re a homeowner looking to install solar panels on your roof, that fierce competition works in your favor. But if you’re a policymaker considering the long-term prospects for renewable energy, that shortsightedness is worrisome.

Outside investment in solar power R&D, whether from private investors or government funding, is similarly scarce. There’s an unhappy history that can’t be ignored. Many venture capitalists who invested in solar startups in the late 2000s collectively lost billions of dollars [PDF] after cheap imports began flooding the market. Few private investors these days have the appetite for betting on new solar technologies.

One failed startup, Solyndra, gained notoriety for losing half a billion U.S. taxpayer dollars, after it defaulted on a federally guaranteed loan in 2012. The ensuing partisan furor over Solyndra led the U.S. Department of Energy’s annual funding for PV R&D to plunge from over $200 million in President Obama’s first term to just $50 million in his second term.

Far more public funding will be needed to scale up promising technologies from the lab bench to the marketplace. The Trump administration has been unwilling to fund commercial-scale demonstration projects or manufacturing facilities for advanced solar PV technologies. Advanced solar funding is also stagnant in Europe, Japan, and South Korea. Only China’s government, a relative newcomer to PV research, is sharply ramping up its funding [PDF]. So despite the breathtaking potential of new technologies such as perovskites, the odds are stacked against their commercial debut.

Henry Snaith knows that tall barriers stand in the way of an upstart that aims to challenge the dominant player in any industry. But that hasn’t stopped him from trying. In 2010 he cofounded a startup, Oxford PV, which this year plans to bring its first tandem perovskite-solar cells to market. Henry’s approach—to add a perovskite layer to an ordinary silicon solar cell, without altering the production process—is an evolution en route to a revolution.

Here’s how Oxford PV’s tandem device works. Silicon solar cells harvest energy from the infrared part of sunlight’s spectrum, but they’re not so great in the visible and ultraviolet. The chemical composition of perovskites can be tweaked to target optimal absorption of a particular part of the spectrum. So a carefully tuned perovskite absorbs energy in the visible and ultraviolet, leaving infrared light to pass through to the silicon layer below. With such a perovskite layer, commercial silicon solar panels experience an efficiency boost of about a third. Although Oxford PV is currently out in front, other startups in the United States, Europe, and Asia are racing to catch up.

In the near term, Oxford PV could woo traditional solar panel manufacturers to use its technology to boost their panel efficiencies. The fact that the enhanced panels will look and act like existing panels maximizes their chance of market acceptance. And the evolutionary approach will help startups bring perovskite technology up to commercial specs without having to compete with dominant silicon technology.

Even so, manufacturers have their work cut out for them. They will need to hone the process for producing perovskites at high volume and quality. In addition, they must demonstrate that the perovskite will last multiple decades; silicon PV panels have warranties of 20 years or more. They will also have to show that their products don’t leak toxic lead, a chemical constituent of the most efficient perovskites.

All of this will be easier if perovskite makers join forces with silicon solar manufacturers, taking advantage of existing methods of sealing panels, manufacturing them at scale, and stress testing them in harsh environments.

Once firms like Oxford PV have refined their ability to manufacture perovskite layers for tandem devices, they can turn to pure-perovskite devices that are flexible, lightweight, and aesthetically pleasing.

Although perovskites are currently the leading alternative solar cell materials, other promising materials, including organic and quantum-dot materials, are being actively investigated and rapidly improved. In the long run, a panoply of solar materials could offer a huge range of color, transparency, and flexibility, as well as unmatched efficiency.

But we aren’t there yet. Most of the private funding for perovskite startups has been raised by Oxford PV, which has pulled in about $99 million, according to Crunchbase. A handful of other startups have sprouted around the world, including Saule Technologies in Poland and Swift Solar in the United States—both of which are led by former graduate students and postdocs of Henry Snaith. They are racing to commercialize flexible, lightweight solar coatings. Yet these and other companies face a chilly private investment climate and massive barriers to breaking into a solar industry dominated by silicon behemoths.

In addition to paltry private funding, government support is also desperately needed, so that startups can get far enough in developing their technologies to convince major manufacturers and outside investors to partner with them. One priority is to fund advanced solar R&D more generously, so that academic scientists around the world can work on making more efficient, longer-lasting solar cells from breakthrough materials. In addition, policymakers should support research into the manufacturing techniques and equipment needed to translate lab inventions into viable products. A final priority is to fund commercial-scale demonstration projects that private investors might find too risky.

The United States, for example, could kick-start solar innovation by increasing funding to the Department of Energy’s Solar Energy Technologies Office (SETO), which funds breakthrough solar R&D, as well as ARPA-E, which makes farsighted investments in energy-related technologies. Many SETO and ARPA-E teams subsequently raise private funding. The U.S. government should also invest in manufacturing research at facilities such as the National Renewable Energy Laboratory and help build shared manufacturing facilities, staffed by experts, to help firms commercialize their technologies domestically.

Currently, U.S. solar manufacturers have a tiny share of the global solar market, which is dominated by China. President Trump’s strategy to bring back manufacturing has been to erect trade barriers. But the main effect of that policy is to raise the cost of deploying solar in the United States; it’s unlikely to stimulate much investment in domestic manufacturing. Investments in innovation, on the other hand, would give U.S. firms a leg up, and in the coming decades superior U.S. products could replace outdated ones.

It will probably take many companies like Oxford PV to improve the odds of commercializing new solar technologies. Fortunately, there is no shortage of great ideas out there. To reach its massive potential, solar will require those ideas to win the support they deserve.

This article is adapted from Taming the Sun: Innovations to Harness Solar Energy and Power the Planet(MIT University Press, 2018).

About the Author

Varun Sivaram is chief technology officer of ReNew Power, India’s largest renewable energy company.

Interactive: The World’s Most Efficient Photovoltaic Cells

Interactive: The World’s Most Efficient Photovoltaic Cells