In July, China’s Ministry of Commerce announced fresh export restrictions on gallium and germanium, two metals whose global supplies both overwhelmingly originate in China. Firms that export either metal or any from a list of gallium and germanium compounds and substrates now have to request a government license, explicitly naming their end users.

Observers believe the controls, which took effect on 1 August, are a response to United States-led restrictions on selling advanced semiconductors and related equipment to Chinese customers. Gallium and germanium have wide-ranging uses, including in optical fibers, LEDs, solar panels, infrared sensors, radiation detectors, and advanced computer chips. A shortage of either metal could cause far-reaching production delays and disruptions for those products.

But so far, the controls appear to have had little impact. And analysts suggest that even if Chinese gallium and germanium supplies suffer a bottleneck, other sources of the metals may be able to ramp up production to compensate.

“Overall, there are not yet signs of shortages wreaking havoc on supply chains,” says Brian Hart, a fellow at the Center for Strategic and International Studies (CSIS), a Washington, D.C.–based think tank.

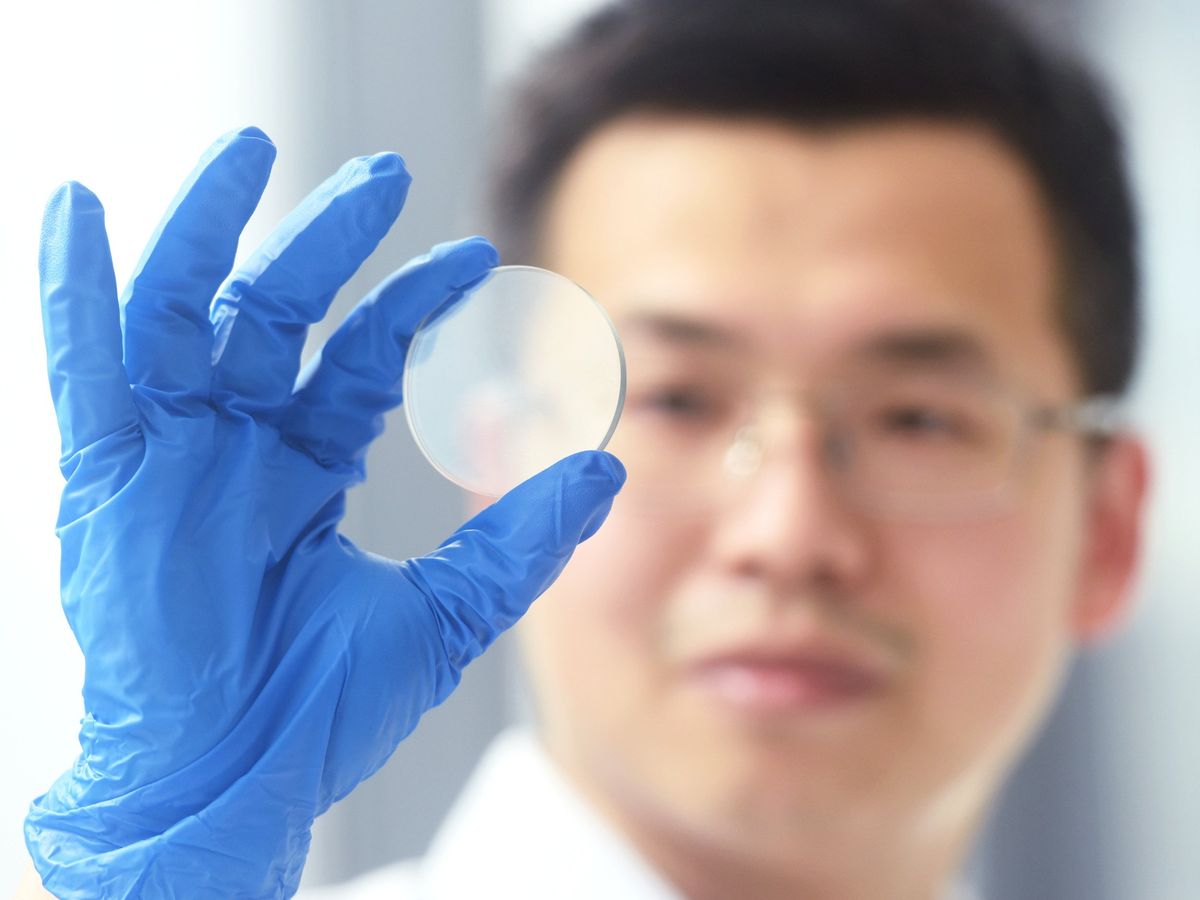

Gallium wafers are going nowhere

Today, China accounts for about 98 percent of the world’s raw gallium production. The country’s dominance is no accident: Gallium is easily obtained as a by-product of refining bauxite into aluminum, and in the late 2000s and early 2010s, the Chinese government mandated that aluminum refineries also extract gallium. This policy created a glut of cheap gallium that muscled international competitors out of business.

Most of China’s gallium is used, both inside and outside the country, to craft gallium arsenide wafers. GaAs wafers are used in RF equipment, LEDs, and—perhaps most prominently—solar cells. GaAs as a compound is also subject to the export controls, making it a potential bottleneck, because much of the world’s supply of the compound comes from within China. Another of the controlled compounds is gallium nitride, used to fashion blue LEDs, lighting, blue laser diodes, and mobile-phone and electric-vehicle chargers.

When China first announced the restrictions in July, many gallium users denied they would face problems. At the moment, there is little reason to think the situation has changed.

A spokesperson for Sumitomo Electric confirmed that they had not experienced any disruptions to their GaAs wafer production. Furthermore, Navitas Semiconductor, a company that produces GaN-based power equipment, relies on Taiwan Semiconductor Manufacturing Co. to manufacture GaN wafers. “They’ve been using non-Chinese sources for a while, and they’ve confirmed with us that they don’t see an issue in going ahead,” says Stephen Oliver, a vice president at Navitas.

Gallium and germanium are not hard to come by

In fact, OIiver downplays the risk of a gallium shortage, citing the same ease of production that allowed China to gain a large chunk of the market in the first place. Should a global gallium bottleneck emerge, he says, existing aluminum producers—of which China is a leader, but is hardly dominant—may easily be able to ramp up gallium production on the side.

The same could be said of germanium. Like gallium, germanium is typically extracted as a by-product: usually from zinc, lead, or coal mines. China controls around 68 percent of the world’s refined germanium, either through domestic production—its coal mines account for around half global production—or through Chinese-owned facilities in Southeast Asia.

Germanium compounds play specialized roles in a host of devices, such as optical fibers, night-vision equipment, and LEDs. Germanium is also key to fabricating cutting-edge nanosheet transistors. Furthermore, germanium plays a role in the manufacture of some gallium-containing devices, including gallium arsenide solar panels.

“Production of these products outside of China could face delays,” CSIS’s Hart says.

But, like gallium, germanium’s source as a by-product of mining activity means that established zinc, lead, or coal producers may be able to pump out more of the metal in a pinch. Andrew Buss, from the market research firm IDC, toldThe Register that he believes expanding germanium production outside China would not be particularly tricky.

Watching for metal ripples

If there is a shortage, Hart predicts that the first to react will be Japan and South Korea, two heavy importers of Chinese gallium and germanium. South Korea’s large LCD manufacturing industry, for instance, is reliant on Chinese exports for the gallium in its chips. In August, Japan’s trade minister threatened to refer the export controls to the World Trade Organization if the Japanese government felt they were unfair. No such WTO case has yet come.

At the moment, clear signs of a shortage are difficult to find. Gallium and germanium exports from China plummeted in August—but only after a surge in July, likely caused by overseas firms rushing to acquire the metals before restrictions went into effect. In September, China’s Ministry of Commerce issued its first export licenses.

“Most companies were likely able to stockpile some of their short-term needs prior to the controls going into effect, and China appears willing to approve some export permits even for U.S.-based firms,” says Hart. “However, things could look different down the road if China chooses to tighten restrictions and choke off access more aggressively.”

- The Toughest Transistor Yet ›

- The Nanosheet Transistor Is the Next (and Maybe Last) Step in Moore’s Law ›