You graduated from one of the top universities in the world. You just started a great new job in your adopted country and you're being paid well. Everything is going just as you had hoped, but you're still saddled with a huge student loan at a high interest rate that takes a big chunk of your monthly wages. Plus, your family back home probably has collateral attached to that loan limiting their financial options.

It's a bleak picture, but there is a way to improve your situation: Refinance your educational loan. You might have even considered it already, but you remain a foreigner in your new country. You're not a citizen, you don't have a Social Security number, and you don't have a credit history in your adopted country. All of these factors make it difficult for you to approach a bank to refinance a loan that was taken out in your country of origin.

A little over a year ago, a remedy to this situation was introduced, one that had not existed previously in the refinancing marketplace. Last year, the UK-based company Prodigy Finance began offering to refinance student loans that originated from a foreign country.

Prodigy Finance has been in the business of providing student loans to foreign students for more than 10 years. But the firm recognized that foreign students who had not taken out loans from Prodigy were burdened with crushing interest rates on those loans from their origin country and had no avenue for refinancing them in their adopted countries.

“For example, someone from India has taken out a student loan in Rupees equivalent to $50,000 at somewhere around 14% interest rate, with their family's house on the line as collateral—a very complicated and difficult situation," said Ricardo Fernandez, head of new businesses and strategic partnerships at Prodigy Finance. “All of a sudden we tell them that we can refinance their $50,000 loan, reduce their interest rate to 7% and eliminate the need for the cosigner. We can do this all without collateral and they can develop their credit history in the US."

While graduates from business schools are likely familiar with refinancing loans, many engineering students are not, according to Fernandez. Prodigy has been trying to get the word out to these people through a number of channels such as the schools from which they graduate, alumni associations, and engineering companies that are employing these graduates, to name a few.

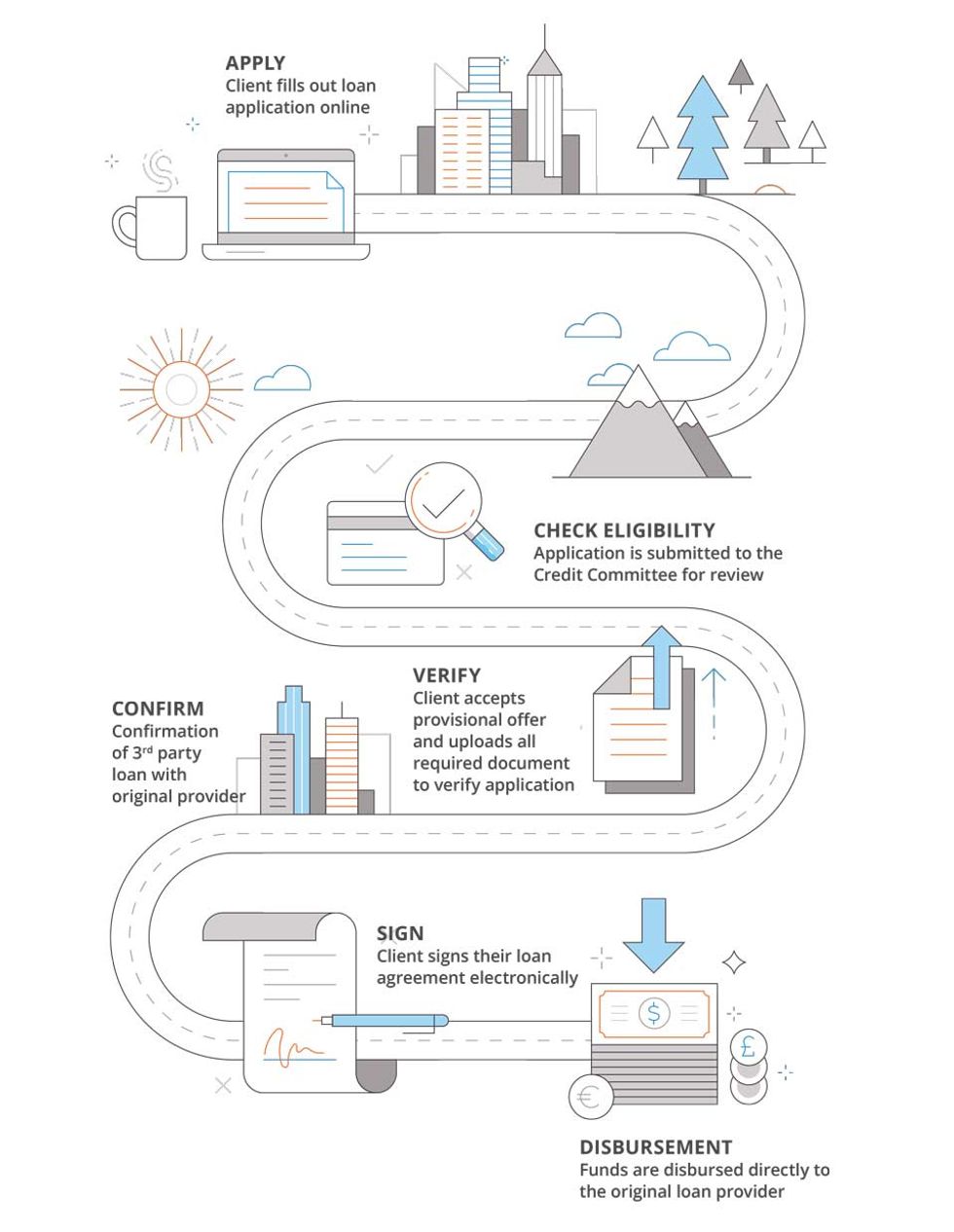

After raising awareness in the foreign graduate community, they just need to get them to the Prodigy Finance website where the entire process can be executed online.

“Once they click on our website, it's a very easy and fast application," said Fernandez. “In five minutes, they can get a quote by giving some information about the school they went to, some employee information, some financial information. Then they get a provisional offer."

At this point, the potential refinancer can decide whether they like the interest rates—which vary between from 6% to 9%—and the duration of the loan, which can be set at between seven years to 20 years. Additionally, any co-signers of the original loan can be released from any further loan responsibilities.

If the refinancers agree to the terms of their new loan, then the verification process begins. This involves uploading documents online. These would include your ID, passport, and recent pay slips from your job all to verify that the information you provided in your application is true. After all these documents are uploaded, the final approval of the loan can often be completed on the same day. Finally, the refinance payment is made to the bank that provided the original loan.

“We settle the money directly with the counter-party bank," explains Fernandez. “It's a very smooth process. Basically, we substitute the loan and you now have a Prodigy Finance loan versus a State Bank of India loan or a Discover loan or a Sallie Mae loan or a Credila loan. And you become a client of Prodigy Finance. So a pretty straightforward process."

Prodigy has also created an app from which you can manage the loan online, making payments or setting up an automatic debit with a recurring monthly payment.

Fernandez added: “Once a person understands the value of this, the value proposition is quite good. It really does make sense. Instead of paying $900 a month, you're paying $600, you're releasing your family from any sort of debt burden, and you're building up a credit history in the US. All of it makes a lot of sense."