Chinese tech giants Alibaba and Baidu have pulled out of the quantum-computing race after shutting down their research units just over a month apart from each other. But experts say it would be premature to read this as any marked cooling of China’s overall interest in quantum computing.

Last November, the e-commerce and cloud-computing behemoth Alibaba announced that it was shuttering its quantum-computing research lab and donating all of its equipment to Zhejiang University, in Hangzhou. Then in January, leading search provider Baidu followed suit, offloading its research facility to the Beijing Academy of Quantum Information Sciences.

“There are so few private sector players involved in China’s quantum ecosystem, and those were two of the biggest.” —Sam Howell, Center for a New American Security

Neither company explained the decision, although leading commentators speculated that the moves could signal a coming winter in quantum computing—or, on the other hand, an attempt by the Chinese government to assert tighter control over what it sees as a strategically important technology.

The waters have been further muddied since then after Tencent, another leading Chinese tech company, outlined its vision for how quantum computing will soon converge with cloud and high-performance computing. And just days later, the government released a document outlining strategic priorities that included the deployment of quantum cloud platforms and efforts to develop industrial applications for the technology.

Trying to divine the motivations behind these divergent strategies is tricky, given the opaque nature of much decision making in the country, says Sam Howell, a research associate at the Washington, D.C.–based think tank the Center for a New American Security. But given that the bulk of China’s cutting-edge quantum research is already carried out in government-funded universities, the loss of two major private sector players in short order is notable.

“It’s pretty expensive to run a quantum-computing program, and they probably just said we need to cut our losses now.” —Edward Parker, Rand Corp.

“It’s hard to get any real concrete information about what China’s doing in quantum and what its priorities are,” she says. “The reason why it’s so significant, though, is because there are so few private-sector players involved in China’s quantum ecosystem, and those were two of the biggest.”

Where Beijing stands on quantum computing

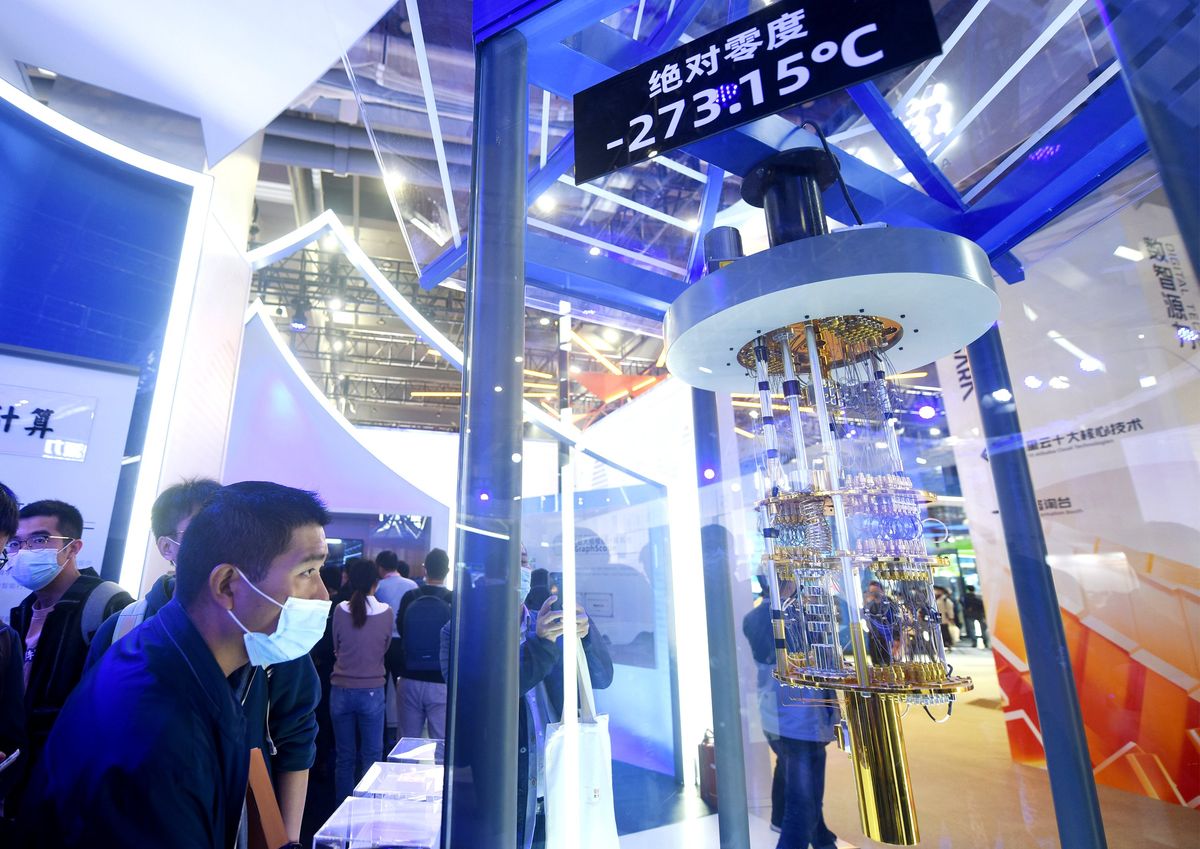

China is a world leader in quantum-communications technology, but was slower to get in the game when it came to quantum computing. However, that changed when Chinese scientists announced two new quantum computers in the space of just a few months that were “close to the global state of the art,” says Edward Parker, a physical scientist at the Santa Monica, Calif.–based Rand Corp. In December 2020, researchers at the University of Science and Technology of China, in Hefei, unveiled a photonic quantum computer that could solve an obscure physics problem 100 trillion times as fast as a supercomputer. Then, in June, the same lab showed off a 56-qubit superconducting quantum computer that could also outpace the fastest of supercomputers.

While the pace of breakthroughs has slowed since then, Parker says the country is now probably the second most capable in the world behind the United States when it comes to quantum computing. Meanwhile, President Xi Jinping has made it clear the technology is a priority. However, the bulk of this progress has been made in government-funded universities. Plus, the country’s private quantum sector is relatively meager. Parker says that when Rand tallied up total investment in mid-2021 it was in the region of tens of millions of dollars, compared to billions in the United States.

“There’s still wide recognition [in China] that maintaining quantum capability is really strategically important, and there is still a desire to move it forward.” —Sam Howell, Center for a New American Security

Parker says he suspects the reasons for the Alibaba and Baidu closures are fairly prosaic. With China’s economy in the doldrums, he says the companies may have decided to divert resources away from an experimental technology with little prospect of near-term returns. “If I had to guess, they were not succeeding very much technically,” he says. “It’s pretty expensive to run a quantum computing program, and they probably just said we need to cut our losses now.”

Was it a shutdown or a handoff?

Simple loss-cutting could explain the companies’ actions, says Howell, although some details do lend credence to the idea that Chinese authorities could have also played a role. After all, the two companies’ closures were only about a month apart; both companies donated their equipment to public institutions; and neither explained their moves. All of which could indicate government intervention. “It could have been an effort by the Chinese government to gain more control over quantum-computing development, to get more resources for state-linked entities and just kind of streamline the innovation pipeline,” Howell says.

And, given the report and public statements noted above, the technology is undeniably recognized as a crucial asset by Chinese authorities. “There’s still wide recognition that maintaining quantum capability is really strategically important, and there is still a desire to move it forward,” she says.

However, even if it is the case that the closures were due to government intervention, says Parker, it may not be particularly consequential. Decision making in China’s upper echelons is not always particularly technically informed, he says, and Baidu and Alibaba’s efforts were far from the cutting edge, he says.

“The businesses in China are more short-term.... They are looking for easy money, that’s the culture.” —Olivier Ezratty, quantum computing consultant

“Maybe a fairly senior person decided this is a strategic technology, we need to have government control over it,” Parker says. “But they may not have even known which were the leading companies within China.” Companies like Hefei-based Origin Quantum and SpinQ in Shenzen are much more technically advanced than either of the tech giants in this area, he says, and are already selling quantum chips to customers.

Quantum technology consultant Olivier Ezratty thinks the idea that China’s government was involved makes little sense. Alibaba’s financial troubles are well publicized, and he thinks this was a clear case of cost cutting. That’s a shame, he says, because the Alibaba team were reportedly doing cutting-edge work on fluxonium qubits, a promising alternative to the transmon qubits used by companies like IBM and Google. But for a company that primarily makes money from e-commerce, quantum computing was far from a core part of their business, he adds, so it would be an obvious place to trim fat.

Keeping a foot in the quantum race made much more sense for Baidu, says Ezratty, which is essentially China’s equivalent of Google. But he says the results coming out of its quantum-computing lab were fairly lackluster, which may have driven the decision to give up on the technology.

The divergent strategies between the tech giants and the government, which has pumped billions into quantum technologies, are indicative of a broader trend in China, says Ezratty. “It’s a weird country, because I’d say that the politburo, the big engineers that you have in government, they have a long-term view on many industry dimensions,” he says. “But the businesses in China are more short-term.... They are looking for easy money, that’s the culture.”

On the other hand, he says, he’s also unconvinced that these big companies’ quantum-computing pullbacks might serve as any sort of canary in the coal mine for the country’s—or, for that matter, the world’s—quantum industry. For one thing, Ezratty says, the companies’ investments were too small to impact the broader quantum ecosystem.

Rand’s Parker agrees. The quantum-computing industry has already experienced a mild correction in the last couple of years, he says, as some of the wilder claims and timelines for the technology have been debunked, and companies have reassessed their expectations. He thinks the retreat of companies like Alibaba and Baidu, which had only small stakes in the quantum race, are just a symptom of the latest corrections rather than a harbinger of further retraction. “I wouldn’t necessarily see it as a foreshadowing of more dramatic industry collapses coming in the future,” he says.

Baidu and Tencent declined to comment for this story, and Alibaba did not respond to an interview request.

Edd Gent is a freelance science and technology writer based in Bengaluru, India. His writing focuses on emerging technologies across computing, engineering, energy and bioscience. He's on Twitter at @EddytheGent and email at edd dot gent at outlook dot com. His PGP fingerprint is ABB8 6BB3 3E69 C4A7 EC91 611B 5C12 193D 5DFC C01B. His public key is here. DM for Signal info.