The Lowballing of Kodak's Patent Portfolio

The bankrupt giant found that its huge trove of IP could fetch only pennies on the dollar

In January 2012, Kodak filed for Chapter 11 bankruptcy protection, having succumbed to a digital revolution in photography that it had helped to start. But the company’s managers still hoped to escape from bankruptcy and have another shot at greatness by selling part of a portfolio of patents that experts valued as high as US $4.5 billion.

Eleven months later, those roughly 1700 patents (together with 655 patent applications) sold for just $94 million—less than the licensing fees Kodak had collected in its worst-ever year in recent history. What’s more, the company licensed its remaining 20 000 patents to a dozen leading technology companies for only $433 million, severely restricting future earnings from them.

Without its anticipated multibillion-dollar payoff, the company was forced to hand over its iconic photographic film and paper businesses, as well as potentially lucrative new technologies like digital printing kiosks, to a spin-off owned by its U.K. pension fund. In September 2013, Kodak finally limped out of bankruptcy, a shadow of its former self. The following month, Standard & Poor’s Ratings Services assigned the slimmed-down Kodak a B– for corporate credit—a junk-grade rating.

So what exactly happened? Did the consortium of firms that bought the Kodak patents simply make a killer deal? Or were the patents overvalued to start with? In either case, how could such seemingly precious assets lose 95 percent of their value in under a year?

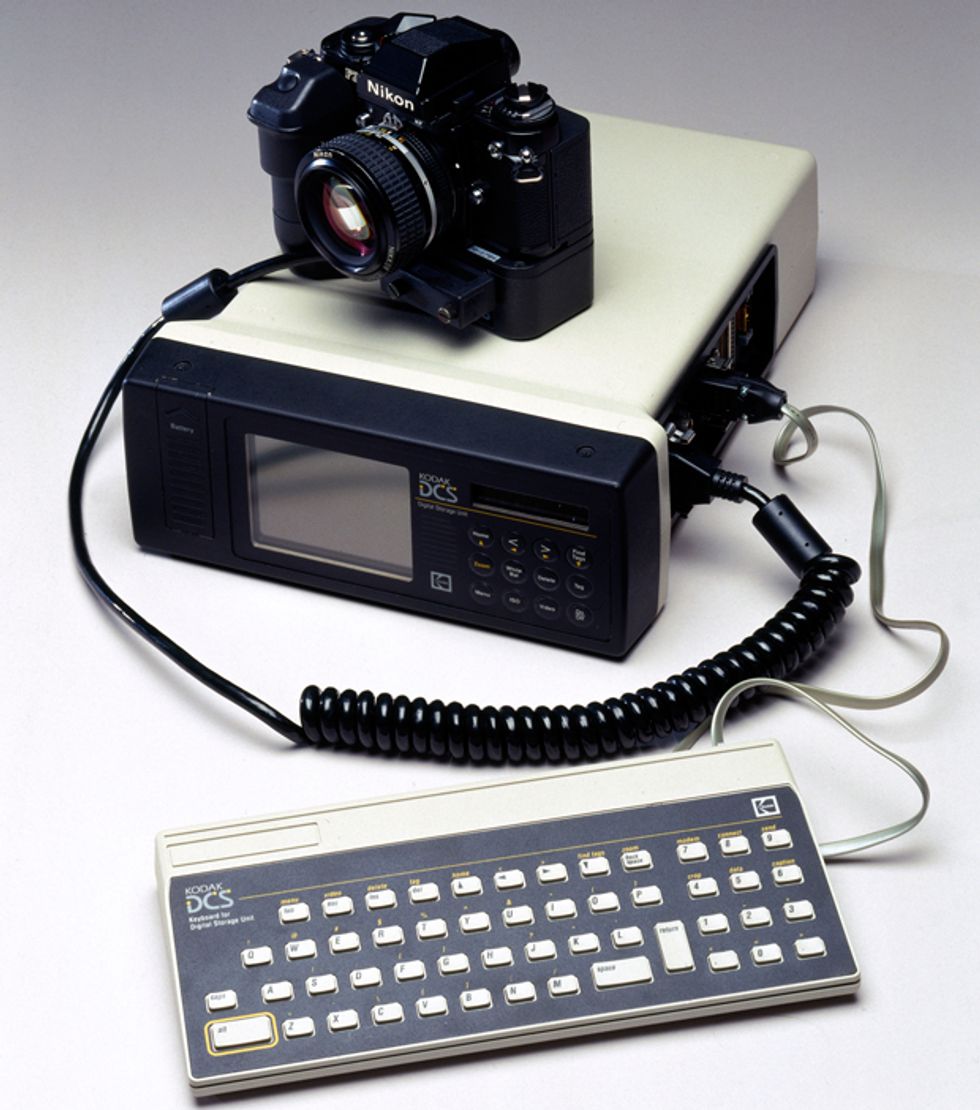

For virtually all of the 20th century, Eastman Kodak Co. dominated photography. It produced the inexpensive Brownie camera, made 9 out of 10 rolls of film bought in America, and gave the world billions of colorful “Kodak moments.” In 1969, Kodak built a stereoscopic camera for the Apollo 11 astronauts, and six years later Kodak engineer Steven Sasson invented the world’s first digital camera.

But there was something wrong with this picture. Kodak executives saw digital as a threat to its film business. And its chief intellectual property officer, Timothy Lynch, says, “[we] basically told Sasson to take that box and go away; we don’t ever want to see you again.” A complacent Kodak also underestimated competition from Fuji’s color films. In the 2000s, digital cameras flooded in from Asia, and first camera phones and then smartphones decimated Kodak’s point-and-shoot business. By the time it filed for Chapter 11 in 2012, Kodak had reorganized and shed tens of thousands of jobs.

Even then, Kodak hoped that by selling some patents it could recover from bankruptcy and get on with reinventing itself as a commercial and packaging printing company. Throughout decades of turmoil, Kodak had continued to innovate, spending up to $500 million annually on R&D. The company developed the first megapixel image sensor, which went into Apple’s groundbreaking QuickTake digital camera, and it came out with the first cameras with OLED screens and built-in Wi-Fi. By 2012, Kodak had accumulated 22 000 patents and other intellectual property covering 160 countries. From 2003 to 2011, licensing that IP to other companies had earned Kodak over $3 billion.

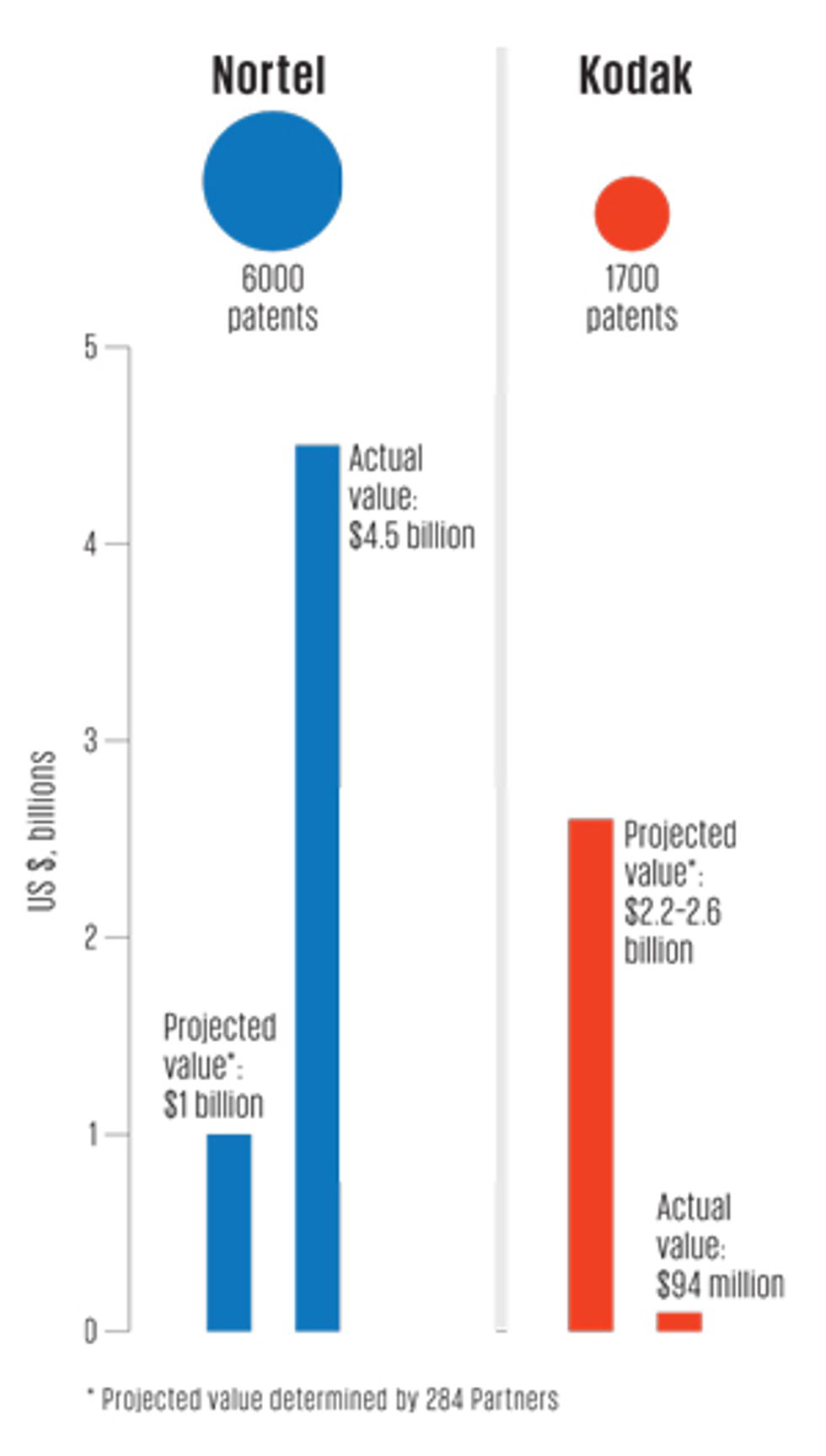

The signs for a sale looked good. The market for IP was sky high. Record-breaking deals in 2011 included Apple, Microsoft, and Research in Motion paying $4.5 billion for Nortel’s portfolio of 6000 wireless communication patents, and Google’s purchase of Motorola Mobility’s cellphone IP (and the company along with it) for $12.5 billion. The consultants behind the Nortel deal, 284 Partners, reckoned that a set of 1700 Kodak imaging and printing patents could fetch up to $2.6 billion on the open market; three other firms valued them at between $1.8 billion and $4.5 billion. Kodak officials had every reason to believe their plan was the right one.

In the United States, trading in patents goes back more than two centuries, to when America’s founding fathers’ system made it straightforward to register, sell, and buy intellectual property.

Two-thirds of the most famous U.S. inventors of the early 19th century sold or licensed their patents, and legal disputes were common, according to research by the economists Kenneth L. Sokoloff and B. Zorina Khan. The “sewing machine wars” of the 1850s saw up to twice as much litigation, proportionally, as the modern struggle for smartphone supremacy. Dozens of individuals and companies struggled to perfect automated sewing technology, with the result that hundreds of overlapping patents were granted. And when Isaac Singer settled a high-profile patent suit with rival inventor Elias Howe, litigation threatened to rip the nascent industry apart at the seams. Large manufacturers were sued by individuals exercising key patents—what some people today call patent trolls. (More-polite terms include patent assertion entities (PAEs) and non-practicing entities (NPEs), so called because they do not produce goods or services subject to countersuits or injunctions.)

Although the rough and tumble of patent trading is nothing new, the stakes have risen considerably. Damage awards from IP infringement suits have spiraled upward; in 2012, for instance, Samsung and chipmaker Marvell each faced judgments of over $1 billion. “Massive awards are new,” says Robin Feldman, a law professor at the University of California Hastings College of Law. “The patent system is allowing rights holders to bargain for compensation far above the value of the right. It’s become a gold rush, and there is an extraordinary level of speculation in the market.”

Some experts link that speculation to the arrival of patent aggregators, and specifically Intellectual Ventures. Founded in 2000 by ex–Microsoft CTO Nathan Myhrvold, Intellectual Ventures has used over $6 billion of its investors’ money to acquire tens of thousands of patents. The firm then either licenses the IP or sues companies that it claims are infringing on those patents—a process known as monetization.

“We were early and helped create the ecosystem around patent buying,” says Jeremy Salesin, vice president of acquisitions at Intellectual Ventures. “There has since grown up a network of buyers and brokers. The result is that the flow of patents is stronger and more constant than years ago.”

Where once patents were traded between companies largely as a hedge against litigation, 50 to 60 percent of portfolios are now sold to PAEs. Some PAEs, like Intellectual Ventures, go after big manufacturers for large sums of money. Others target smaller companies like podcasters with a deluge of threatening (and sometimes misleading) demand letters; small business owners anxious to avoid expensive litigation will often settle. One such campaign sent over 8000 letters. A very few, like patent aggregator RPX, claim to use their patents only defensively, creating a pool of intellectual property for operating companies to dip into when sued. (A pool like this, called the Sewing Machine Combination, finally brought the sewing machine wars to a close in 1856.)

IP experts thought it unlikely that a portfolio as extensive and lucrative as Kodak’s would end up with a PAE, even one as well funded as Intellectual Ventures. Putting an exact value on it, however, was a tricky business. “Patents are unique and idiosyncratic assets,” says Robert Heath, senior vice president for corporate development at RPX. For example, companies wishing to enter an established market or boost their market share are often willing to pay a premium, as Google and Apple did with smartphone patents in 2011. Manufacturers or aggregators already sitting on a healthy portfolio, on the other hand, might pass up otherwise attractive patents.

Michael Lasinski’s firm, 284 Partners, was hired by Kodak in July 2011 to value 1730 of its patents. With so many variables to consider, he favored a purely financial approach. “You roll up your sleeves and create a business plan around the IP,” he says.

Specifically, 284 Partners used what investors call a discounted cash-flow analysis, which estimated the expected income from monetizing Kodak’s patents through licensing and, if necessary, legal action. Just as it had done for the Nortel portfolio, 284 Partners interviewed Kodak managers, read claims and court filings, reviewed previous licenses and projections, checked royalty rates, and examined key patents. Lasinski says his company also adjusted revenue expectations to reflect the risks inherent in licensing the IP.

Ultimately, it projected cash flows from the patents of $3.07 billion from 2012 to 2020, giving the portfolio a present value of $2.2 billion to $2.6 billion. Lasinski thought that estimate “very conservative” given Kodak’s existing licensing and future plans.

With the estimate from 284 Partners in hand, Kodak began shopping its patents. Just days before it filed for Chapter 11, it also filed a flurry of lawsuits, alleging patent infringement against Apple, Fujifilm, HTC, and Samsung. Kodak already had an outstanding complaint at the United States International Trade Commission (USITC) against Apple and RIM. Both actions should have helped to move the Kodak IP: Selling patents to alleged infringers is a quick way to make such lawsuits disappear.

But the technology companies didn’t bite. Instead, Apple swiftly countersued Kodak for infringement. It also tried to halt the sale of 13 Kodak patents that had been filed during the two companies’ joint development of the QuickTake camera, alleging they belonged to Apple and a spin-off company called FlashPoint. Kodak complained to the court, “Apple and FlashPoint are seeking to benefit from Kodak’s difficult financial position, which will be exacerbated if [we] cannot obtain fair value for the patents.”

The truth was that Kodak now desperately needed money. Securing a restructuring loan of nearly $1 billion depended on the patent sale, and anything hindering that would put the future of the company in jeopardy. Fortunately, the bankruptcy court sided with Kodak against Apple and allowed the sale to continue. By early July 2012, Kodak had lined up around 20 potential bidders for an auction of the patents.

Then disaster struck. In late July, barely two weeks before the auction was due to commence, the USITC made its final ruling in Kodak’s case against Apple and RIM. It found the Kodak patent in question, covering a way of capturing still photos while previewing motion images, to be invalid. That one patent, nicknamed “218” for the last three digits of its assignment number, had previously been used to secure licensing deals with LG and Samsung for a reported $414 million and $550 million, respectively. (Annoyingly for LG and Samsung, such deals are usually final, with no recourse should the patent later be thrown out.) The USITC decision would not necessarily affect 218’s value in domestic litigation, but untangling the mess would take time that Kodak did not have.

“We were floored by that decision,” says Kodak’s Lynch. “Weeks earlier, the same patent had survived re-exam and came out with absolutely no changes. If we’d had the resources and the financial stability, we would have taken this to the Federal Circuit and gotten it righted…but that’s just not the way it works in bankruptcy. You start to lose control of the process and timing and you just have to drive forward. It’s a freight train.”

Lasinski of 284 Partners still has a nondisclosure agreement in place for the Kodak deal and so can’t comment on the particulars. “Speaking generally,” he says, “when cash is required quickly and you have to switch a strategy from a certain patent to other patents, that can impact their value.” Envision IP, an IP research firm not directly involved in the case, duly reduced its valuation of Kodak’s portfolio by around $1 billion, to $1.4 billion at most.

Such reversals of fortune are commonplace in IP litigation. Billion-dollar judgments are regularly overturned on appeal, and even a patent that has held up in court multiple times, like Kodak’s 218, can be judged worthless at new proceedings. Part of the problem is that while patent attorneys must hold an engineering or science degree, there are no such requirements for judges or juries, leading to some technically dubious decisions.

A bigger issue, though, goes to the heart of the patent system. “You can’t tell at the time of a patent grant precisely what it covers,” says Feldman of the University of California. “You’re using language that’s going to be compared to something that doesn’t exist at the time you write it.” By the time an industry grows up around a patent, a decade or more down the road, its text may seem obsolete, absurdly irrelevant, or excessively broad.

Nokia estimates that as many as 250 000 existing patents could apply to smartphones. If each patent added just one cent to the cost of a handset in licensing, the dumbest smartphone would be liable for $2500 in fees. That doesn’t happen, in part because of cross licensing of IP between manufacturers but also because most patents are virtually worthless. An estimated 90 percent of patents never earn a direct return, and three-quarters of U.S. patents are abandoned seven years after being issued, when extra fees to keep them in force become due.

Even without 218, Kodak had a wide-ranging and substantial portfolio. And so when the auction opened on 8 August 2012, the company still expected multiple bids above a billion dollars. But when the envelopes were opened, it had received just two offers, the highest of which was reportedly a mere $250 million.

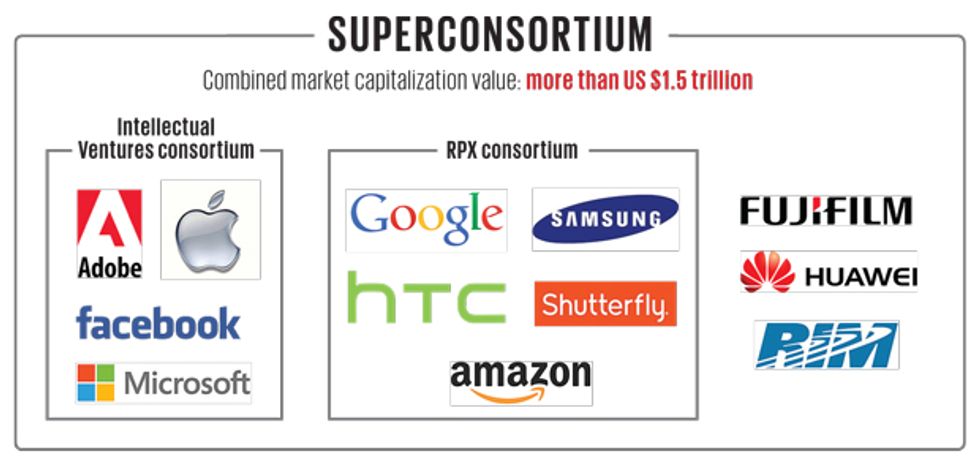

The potential bidders, it turned out, had organized into two camps. In one, Adobe, Apple, Facebook, and Microsoft formed a consortium led by Intellectual Ventures. In the other, RPX mustered Amazon, Google, HTC, Samsung, and the photo-printing website Shutterfly. Each participant in such a consortium gets to keep a share of the patents and a license for the rest. The cost to each is relatively low, and all gain the protective power of the entire portfolio.

“We knew this would be one of the largest deals ever done,” says Kenneth Lustig, head of strategic acquisitions at Intellectual Ventures. “It was our conclusion that it was likely a consortium buy, and as a leader in the invention business we felt it was something we should lead.”

Kodak balked at the offers. A few hundred million dollars would not be enough to secure the loans it required and might devalue its remaining IP by association. The company extended the auction and then threatened to abandon it altogether. “They did not get the spontaneous bidding war they wanted,” says RPX’s Heath. “I imagine it was a splash of cold water.” The earlier licensing deals with LG and Samsung, he adds, “had reduced the strategic value of the portfolio and…dampened people’s enthusiasm.”

Negotiations with potential buyers continued into October, but time was running out. If Kodak couldn’t complete a deal, its plan to emerge from Chapter 11 would fall through and the company might be split up or shut down. Simply put, Kodak needed more money to survive than either consortium was prepared to pay.

The logical solution was for Intellectual Ventures and RPX to form a superconsortium. And so they did. With the two aggregators at the helm, the consortiums merged and acquired three new members: Fujifilm, Huawei, and RIM. The superconsortium now featured a dozen of the world’s biggest technology multinationals, with a combined market capitalization of more than $1.5 trillion (the size of Australia’s GDP). Its members reach almost every human being who is online, have software running on 98 percent of all computing devices, and sell half of the world’s smartphones.

Back at the negotiating table, the pressure ratcheted up again. In November, Kodak announced that it had secured $793 million in funding from banks and investment funds, on the condition that its patents raised at least $500 million. But that figure was still higher than both previous bids combined. The new, more powerful superconsortium was hardly going to make a worse deal than before. Its members offered an alternative. They would help Kodak cross the magic $500 million barrier, but only in return for the company’s family silver: the tens of thousands of Kodak patents that had previously not been on the table. Kodak would also have to agree to drop all legal cases against consortium members and vice versa.

Kodak was up against a wall, its single possible buyer a consortium that included almost everyone who might want what it was selling. Inevitably, a deal was struck. In mid-December, Kodak sold its imaging and printing portfolio and a license to all of its remaining patents to the superconsortium for a total of $527 million. The portfolio itself earned the company just $94 million—about 4 percent of 284 Partners’ initial valuation. Although the financial breakdown of the deal is subject to a nondisclosure agreement, the 12 superconsortium members each received licenses to more than 20 000 Kodak patents for an average of $44 million. That’s less than one-tenth of what Samsung paid to license just two Kodak patents, including 218, back in 2009.

“Things never play out the way you expect them to,” says Kodak’s Lynch. “The rights that the consortium wanted, they got. We got what we got because of all the dynamics in that period, which really were quite negative for us.”

There’s a word for deals like this: “ monopsony.” It’s when a single powerful buyer dictates terms to sellers. Although rarer than a monopoly (where a single seller sets prices), it can lead to outcomes just as inequitable. “From an antitrust perspective, there is always a concern when competitors get together,” says Feldman. “There is a temptation to bash everybody who is not in the room with them. At the moment, there are virtually no constraints if parties in the patent market…wish to collude, to divide up the market, to manipulate that market in various ways.”

Changes in the U.S. patent system are afoot, with the White House announcing in June 2013 moves to improve the quality of newly issued patents, boost transparency, protect small businesses, and reduce nuisance lawsuits. These moves are unlikely to curb the influence of superconsortiums, aggregators, or PAEs, however. More useful, thinks Feldman, is the Federal Trade Commission’s promise to investigate the entire industry of patent monetization. “The FTC can subpoena things shrouded in nondisclosure agreements and require companies to report on what they are doing,” Feldman says. “Lack of information is a key issue for regulators and legislators in figuring out what they could do.”

RPX for its part insists that the Kodak deal was consistent with antitrust laws. “In bringing this consortium together, we did efficiently what a licensor would have done painstakingly over the next four or five years,” says Heath. The winning parties note that the Kodak sale has had little effect on the patent market generally. In fact, Intellectual Ventures, which ended up owning all of Kodak’s digital imaging patents, is already licensing them to other companies. “Some would say the Kodak portfolio is heavily licensed, but we really know how to pull it apart and look more closely,” says Loria Yeadon, executive vice president of Intellectual Ventures’ Invention Investment Fund. “For us, there’s significant value remaining in the patents. Kodak also had a lot of [patent] applications it was continuing to file. We have future value in those as well.”

Kodak’s fire sale shifted decades of intellectual capital, at pennies on the dollar. “There’s the concept of people like Kodak, like IBM, like Bell Labs, who invested billions and billions of dollars in R&D and now these new guys come along that haven’t done any of that,” says Lynch. “It’s almost like your kids. At some point you’re going to transfer your wealth to your kids. We’re in the process of transferring our intellectual property wealth to the new entrants.”

There is at least one benefit arising from the Kodak deal. The “patent peace” imposed by the superconsortium should discourage expensive, high-profile courtroom battles in the years ahead—at least in the area of digital imaging.

This article originally appeared in print as “Snapping Up Kodak.”

- Digital Photography: The Power of Pixels - IEEE Spectrum ›

- September 1888: George Eastman Patents His Kodak Camera ... ›

- Ten on Tech: Spotlight on Steven J. Sasson - IEEE Spectrum ›

- How the Digital Camera Transformed Our Concept of History - IEEE ... ›