15 May 2012—From his airy offices on the 19th floor of a tower in downtown Tokyo, Hiroaki Ikebe can see the headquarters of the Tokyo Electric Power Co. (TEPCO) in the distance. It’s a little like David having an excellent view of Goliath’s house. Ikebe is president and CEO of Ennet Corp., an upstart energy company that is challenging Japan’s powerful utility companies—of which TEPCO is by far the biggest and most powerful. “We are against the power companies,” says Ikebe, who comes off as a fervent revolutionary despite his finely tailored suit and wire-rimmed glasses. “It is war!”

Before Japan’s earthquake, tsunami, and nuclear meltdowns last year, Ennet was a small company fighting for the very small piece of the Japanese energy market that was open for competition. But in the wake of the nuclear accident, Japan is having a national conversation about energy, and the government is considering a new wave of deregulation that could give Ennet and other independent companies like it a much bigger share of the market. For the moment, uncertainty reigns, and it may be years before the government takes action. But this state of flux doesn’t bother Ikebe. “I’m happy to put myself in this changing world,” says Ikebe. “I’m surfing on the waves of change.”

The status quo was set back in 1951, when the Japanese government created nine regional energy monopolies and granted them guaranteed profit margins—thus high electricity rates for customers. (A tenth regional utility was added later.) When globalization brought increased international competition in the latter decades of the 20th century, Japanese businesses asked for relief on electricity rates, and the government began to take tentative steps to deregulate the industry and allow for competition. In 1995, the government authorized small independent companies to produce power, and in 2000, it permitted the independents to take part in auctions to supply power to industrial and business customers.

But the very limited competition didn’t do much to bring down prices. In 2010, Japanese consumers still paid about twice as much per kilowatt-hour of energy as Americans did, according to the International Energy Agency. And the “Big 10” regional monopolies still controlled 98 percent of the market.

“Before March 11, electricity monopolies were not just a monopoly of the market. They pretty much controlled politics,” says Tetsunari Iida, who has studied Japan’s energy system as director of Japan’s Institute for Sustainable Energy Policies. “So most of the rules around the electricity market were very much biased toward the electricity monopolies.” For example, the Big 10 controlled the country’s transmission lines, and they set onerous terms for independent companies that needed to use them. If it hadn’t been for an earth-shaking disaster that altered the political equation, it seems likely that the situation wouldn’t have changed, says Iida.

Now, however, the Japanese people are furious with TEPCO for its perceived failure to prevent the meltdowns at Fukushima Dai-ichi and its lack of transparency throughout the disaster. Today, none of Japan’s 54 nuclear reactors are in operation; they are all shut down for maintenance and safety checks. This summer, when the heat sends electricity use soaring, the government will ask businesses and residents to voluntarily reduce consumption in an attempt to stave off blackouts. And TEPCO incurred the nation’s wrath with its request to raise electricity rates for corporate customers by 17 percent, to pay for the cleanup at Fukushima, to compensate evacuees, and to subsidize this year’s extra generation costs. (The utility had to buy fossil fuels to replace closed nuclear reactors.)

“After March 11, more and more voices are saying that the market should be restructured,” says Iida. Last week, the Japanese government announced that it’s taking a controlling stake in TEPCO and injecting 1 trillion yen (US $12.5 billion) into the company; the bailout may eventually total as much as 11 trillion yen (about $138 billion).“If the government owns TEPCO,” says Iida, “it could start by restructuring the electricity market in TEPCO areas. Then the [whole] electricity market could be restructured. So this is a very drastic change going on.”

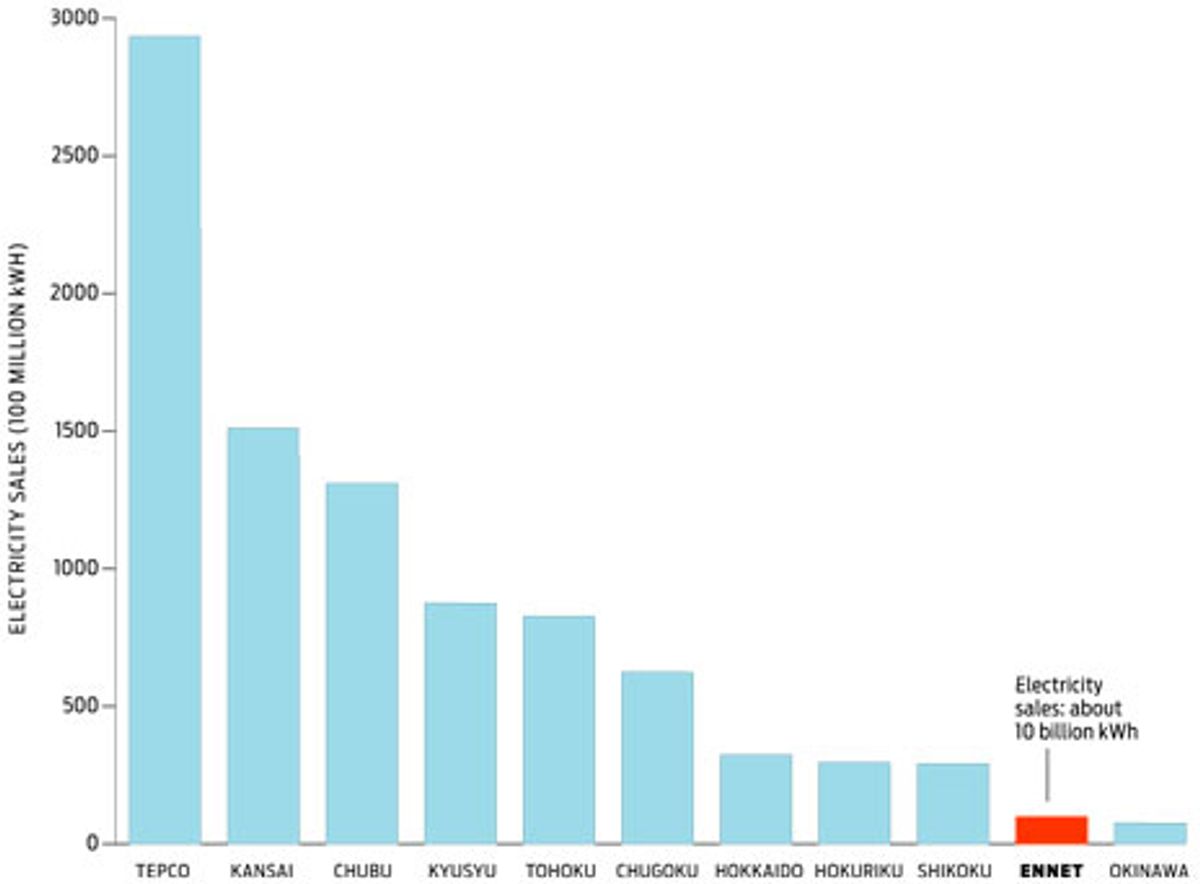

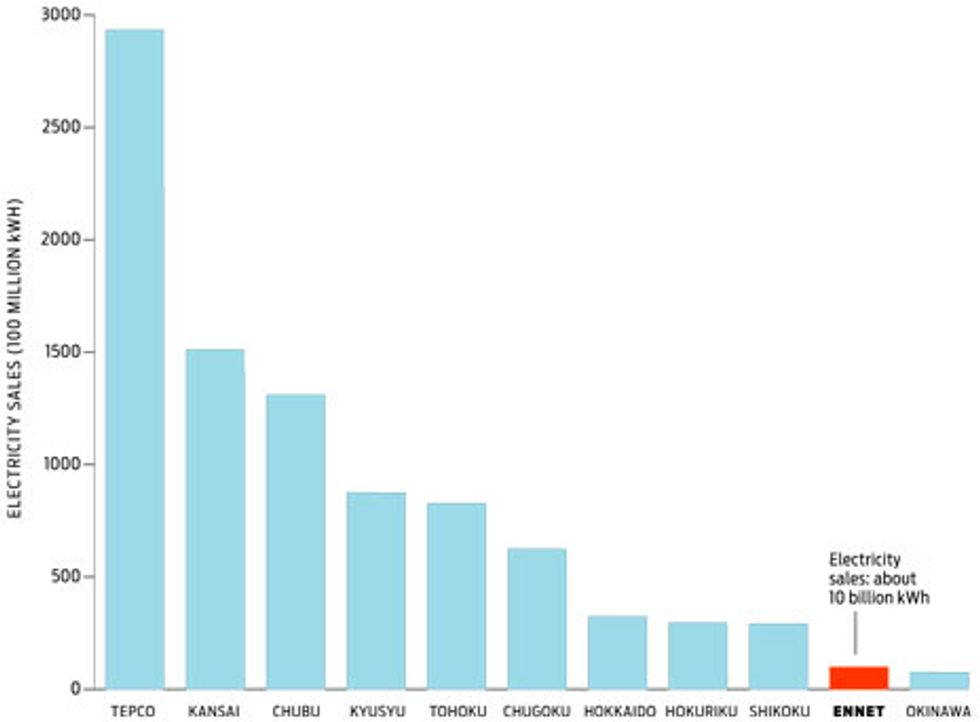

Top 10: Ennet's electricity sales in fiscal 2010 exceeded that of "Big 10" utility Okinawa Electric Power Co. Click on image to enlarge.

Inside Ennet’s offices, a modern set of rooms filled with plants and light, monitors show graphs of the company’s electricity supply and demand, updated every half hour. Ennet says it purchases energy from more than 100 power plants and renewable power sites throughout Japan and sells it to more than 10 000 customers. The company makes money by bidding on electricity supply contracts in those cases where it can provide energy more cheaply than the big utilities can.

Ennet’s customers include businesses like offices, schools, and stadiums, as well as government facilities. The company can supply only the industrial and business sectors, however, because only the high-voltage electricity market has been opened for competition. The more profitable residential power market, most of which uses low-voltage electricity, hasn’t been deregulated; Ennet is limited to certain large residential complexes that take in high-voltage power and step it down for individual residences.

Because Ennet moves its power through transmission lines owned by the energy monopolies, Ikebe says, the company is at their mercy. And the Big 10 have set very favorable terms for themselves. Ikebe explains that Ennet has a margin of error of only 3 percent. “If supply is 3 percent more than demand, TEPCO takes the excess for free,” he says. “If supply is 3 percent less, we pay a big penalty.”

The utilities’ control over transmission lines also caused trouble for Ennet in the immediate aftermath of the 2011 earthquake and nuclear disaster, when the loss of nuclear power forced blackouts around Japan. Ennet could have kept supplying power to its customers, Ikebe explains: “Our power plants were healthy after the earthquake, but we use TEPCO’s transmission network,” he says. “TEPCO was having outages on their network, so they forced outages for our customers too. We had many customer complaints. They said, ‘We are not TEPCO’s customers. Why should we suffer?’ ”

In the months following the nuclear disaster, Ennet’s website and call centers were flooded with citizens asking if they could sign up with Ennet; they didn’t want to be reliant on the big utilities and their nuclear plants. “There were many TEPCO customers’ voices saying, ‘I would like more green power. I would like to change to Ennet,’ ” says Ikebe. Some businesses, like Tokyo’s Johnan Shinkin Bank, did make the switch. Residential customers also wrote in, but Ikebe says the company couldn’t help them. “They asked, ‘How many houses must I gather together so you can supply us with power?’ When I heard that, tears!” he says.

Ennet was founded in 2000 by NTT Facilities (an offshoot of Japan’s largest telecom company, NTT) in cooperation with two regional gas companies. Ikebe was transferred from NTT Facilities to run Ennet and now finds himself in a surprising situation. During the 38 years he worked at NTT, he watched with dismay as Japan’s telecom market was deregulated, reducing the importance of his company. “I was on the other side, looking at our new competitors,” he says. Now, he notes approvingly, telephone long-distance rates have gone down 80 percent since deregulation. “In telecom, there are now rules to encourage competition and help smaller companies,” he says, “but not in the power world!”

In the 2010 fiscal year, Ennet’s electrical sales ranked it as the 10th largest power company in Japan—meaning that it surpassed the smallest of the Big 10 utilities. But it still has a long way to go before it poses a serious challenge to TEPCO. In 2010, Ennet sold about 10 billion kilowatt-hours of electricity, while TEPCO sold 293 billion kWh.

Yet if Japan restructures its energy system, Ennet could be a trailblazer and a major beneficiary. And there are strong signals that change is coming. Japan’s powerful Ministry of Economy, Trade, and Industry is considering an overhaul of the connections between the country’s oddly estranged power grids in the east and west and could work to improve connections between regions in general. This could allow renewable energy, which is variable depending on sunshine and wind, to be moved more easily throughout the country. Japan’s post-Fukushima energy policies are expected to emphasize renewables, but progress has so far been slow.

Mika Ohbayashi, the director for advocacy at Japan’s Renewable Energy Foundation, says more grid connections would help Japan gradually phase out nuclear power (a move that 80 percent of respondents to a recent poll endorsed). “The big companies didn’t want to invest in the grid for what they think is unstable energy sources,” Ohbayashi says. But the government could force the issue, and she thinks it will do that over the next five years.

“I think the government is thinking, ‘[Let’s] take control of TEPCO [and] stabilize the grid so it’s easy to transfer energy from east to west, and then start looking at [the] larger question of opening up access to the grid,’ ” Ohbayashi says. “The energy system is still a dinosaur, but that’s how we can grab the monster by the neck.”