At first glance, North Devon, an expanse of rolling hills and gentle seaside cliffs deep in the English countryside, may not seem like a place to find the future.

But if a company called Xlinks can realize its plan, North Devon will be a conduit for one of the most ambitious renewable-energy dreams to date. By 2029, Xlinks hopes, the North Devon coastline will host the landing site for two electric cables providing as much as 8 percent of the United Kingdom’s electricity needs. At the other end of those cables, there will be a vast complex of yet-unbuilt solar panels and wind turbines in the Moroccan desert thousands of miles away.

This is the goal of Xlinks’s Morocco-U.K. Power Project. If successful, the project may be a model for an entirely new global grid in which long-distance cables carry clean electricity between continents. But Xlinks and its backers must overcome a significant gauntlet of political, logistical, and financial hurdles before their their own project can switch on, let alone inspire others.

“It seems to me that the level of seriousness of these projects is certainly increasing,” says Will Todman, deputy director and senior fellow in the Middle East Program at the Center for Strategic and International Studies in Washington, D.C. “But I don’t think they have truly been proven yet.”

A record-setting power-cable plan

Xlinks’s plan rests on the simple premise that Morocco can generate renewable energy when the U.K. cannot—for example, the infamously dreary North Sea winters prevent solar power. The company plans to install 11.5 gigawatts of solar panels and wind turbines at an unannounced site in Morocco’s largely arid Guelmim-Oued Noun region. Notably, the region straddles the internationally recognized border with the occupied Western Sahara, although Xlinks told the nongovernmental organization Western Sahara Resource Watch that the company would not build in “contested territory.”

Xlinks plans to build 200 square kilometers of solar photovoltaic panels. Bolstering the solar panels will be a wind farm, harnessing breezes that Xlinks claims are at their strongest in the late afternoon and early evening—peak hours in the U.K., which shares a time zone with Morocco during the summer. The plans also call for a 5-GW battery facility in Morocco capable of producing 22.5 gigawatt-hours of energy storage.

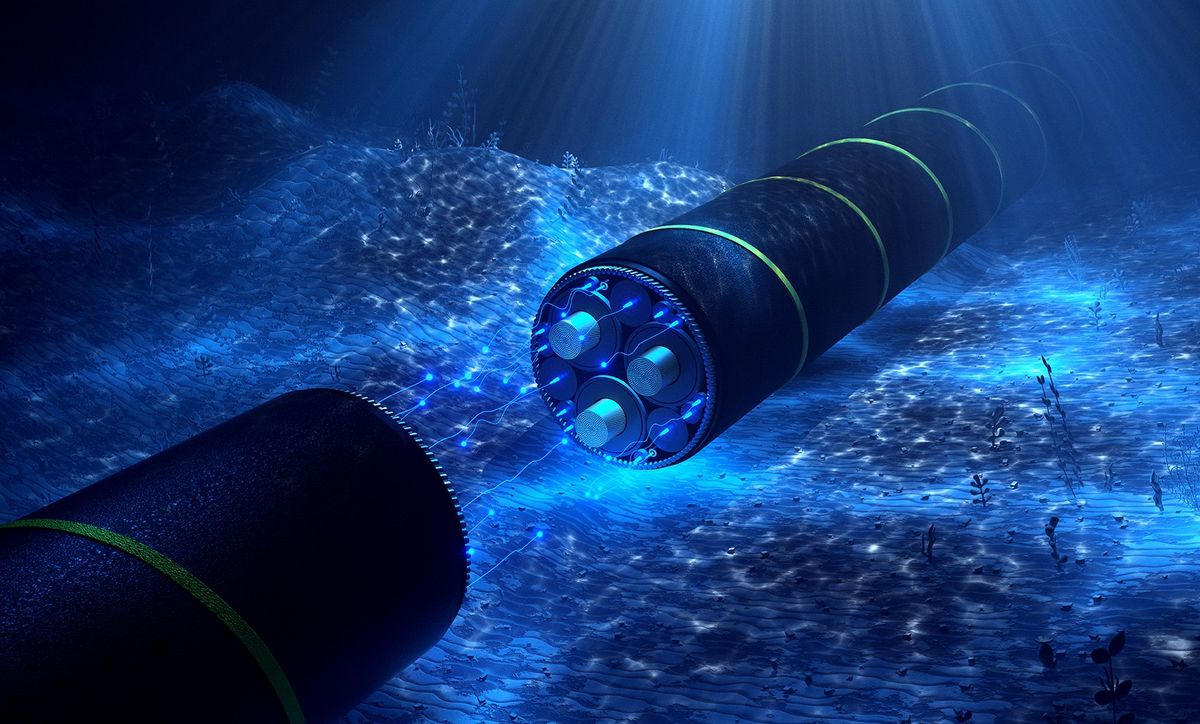

But Morocco’s grid will not see any of that electricity. Instead, a pair of high-voltage direct current (HVDC) cables will transfer the electricity to Britain. The 3,800 km-long cables will shadow the coasts of Portugal, northern Spain, and southwestern France, jut out to sea in a wide arc around Brittany and Cornwall, and then make landfall in North Devon. The twin cables will deliver 3.6 GW of power to the British grid on average, which would be more than the under-construction, repeatedly delayed Hinkley Point C nuclear power station.

“The sheer distance that they’ll have to handle makes it a very, very, very complicated project.” —Harish Sarma Krishnamoorthy, University of Houston

Xlinks’s project is ambitious, and making it materialize will be a heavy lift, both financially and politically.

The politics, at least, are in Xlinks’s favor. Morocco’s National Office of Electricity and Drinking Water backs the plan; the British government designated it a nationally significant infrastructure project, which reduces the ability of local authorities to throw up barriers in the project’s way. Plus, one advantage of Xlinks’s chosen route is that the company won’t need to seek approval from any of the continental European countries along the cable route.

The finances are less certain. As of October, Xlinks estimated the project would cost at least £20 billion (US $25 billion)—for a point of comparison, Hinkley Point C now costs an estimated $40 billion—and gave no indication of where that much money might come from. Furthermore, no one knows what Xlinks’s electricity will actually cost energy suppliers or U.K. consumers once it starts flowing. (Xlinks did not respond to a request for comment.)

“I think it’s only once this has actually been constructed that we will really know how expensive it is, and if it’s financially feasible and beneficial to invest in transporting electricity from more than 2,000 miles away,” Todman says.

Europe does host some international HVDC cables of considerable length. The 720-km-long North Sea Link, the current record-holder for HVDC cable length, connects the U.K. to Norway’s grid. In 2023, builders finished laying the 765-km-long Viking Link between the U.K. and Denmark, which is expected to switch on in January 2024. Another effort hopes to take the record: the European Union–backed Euro-Asia Interconnector‘s planned 898-km link connecting Greece, Cyprus, and Israel.

At 3,800 km, Xlinks’s cables will be more than quadruple the Viking Link’s length. Four-digit lengths are unprecedented in the HVDC world. “The sheer distance that they’ll have to handle makes it a very, very, very complicated project,” says Harish Sarma Krishnamoorthy, an electrical engineer at the University of Houston who studies offshore electrical infrastructure.

Compounding the challenge is the project’s depth. Xlinks plans to bury its cables under the European continental shelf, about 700 meters beneath the seafloor. Cable-builders will need to reinforce their cable to withstand 70 atmospheres of pressure. Short HVDC cables do exist at that depth, often linking offshore energy facilities with their respective mainlands. “The distance is the main thing,” says Krishnamoorthy. “The time that will be needed to install everything, the sheer cost of the project.”

For their part, Xlinks has defended the route choice. “It’s not the shortest route to the U.K., but it has the lowest technical challenges,” CEO Simon Morrish told the BBC.

Who will benefit from Xlinks’s cable?

If Xlinks’s plans come to fruition, power will start flowing through the cables in 2029—though the complexity means that the project’s commissioning could easily be delayed into the 2030s. After that, the U.K. could conceivably be pulling 5 to 8 percent of its electricity from clean sources in Morocco.

Britons may celebrate their renewable rewards, but Moroccans may find that number contentious. It is true that the project may spur economic activity and investment in the latter country, but Moroccans may wonder why billions of dollars have been invested in a project that doesn’t actually add anything into their own grid.

“The question for the Moroccan government is: Can it sell this project in a way that Moroccans really believe that they will be benefiting from it and then feel those benefits?” —Will Todman, Center for Strategic and International Studies

“Not only is it that Morocco won’t benefit from the electricity, but it will also use quite a lot of water to keep this infrastructure operating,” Todman said. Solar farms need water to clean and cool their panels, and water use is a delicate matter in a country whose farmers already face a worsening water shortage.

Moreover, the disparity threatens to exacerbate difficulties that even Moroccan renewable projects for the country’s citizens already create. For example, southeast Morocco is home to the Noor Solar Complex, a 580-MW solar complex that includes the world’s largest concentrated solar power plant. When a Moroccan-government-backed company built the complex in the late 2010s, the largely Amazigh inhabitants of the region expected the solar plant would bring jobs and cheaper electricity. Instead, the region saw few boons, and most of the jobs went to outsiders with more technical know-how.

Mirroring Noor’s promise, Xlinks says that the project will create 10,000 jobs in Morocco. “I think there is a real question about who exactly is going to be getting those jobs,” Todman says. “I think there could be the potential for some real discontent from local populations here.”

“I’m not trying to say that Morocco won’t benefit at all—clearly it will—but it’s not going to be without controversy,” Todman adds. “I suppose the question for the Moroccan government is: Can it sell this project in a way that Moroccans really believe that they will be benefiting from it and then feel those benefits?”

Many Europeans dream of importing renewable energy from North Africa. In the overbearing darkness of a northern winter solstice, the idea of drawing solar power from a land of sunshine is certainly tempting. But if the Morocco-U.K. Power Project is to become a template, then its followers will face hard questions.

The idea of intercontinental renewable energy is not limited to Europe. On the other side of the world, a company called SunCable has charted a path for an 4,300-km-long undersea cable that would deliver solar power from Australia’s Northern Territory to Singapore, dodging the islands of Indonesia along the way. SunCable’s experience has been rocky; the company entered and exited administration this year over a dispute between its financial backers.

The inevitable choppy waters have not stopped engineers from envisioning an even more ambitious project: a “global intergrid” of ocean-spanning interconnectors tied together into a truly planet-spanning grid.

Krishnamoorthy is optimistic that Xlinks’s cables could become the first bone in that global intergrid’s skeleton: “This can really encourage engineers and legislators to look at this as a viable option going forward.”

- ABB & Siemens Test Subsea Power Grids for Underwater Factories ›

- Norway Wants to Be Europe’s Battery ›