For this year’s “Top Ten Tech Cars” we have a retrospective analysis of the feature’s past decade by Chen Liu and William B. Rouse of Stevens Institute of Technology. Liu is completing a doctorate in systems engineering. Rouse, an IEEE Life Fellow, holds the Alexander Crombie Humphreys Chair in Economics of Engineering in the School of Systems and Enterprises.

Every year IEEE Spectrum chooses 10 cars to highlight in its April “Top 10 Tech Cars” issue, and we have analyzed the 10 issues published through 2014 to discover what happened to the technologies those cars embody. We particularly wanted to measure the lag between Spectrum’s discussion of a technology and its success in the marketplace.

First, we considered the brand, model, and configuration of the 100 cars and also mined the text of the ten articles to determine technology-related term counts across cars. We considered that the more frequently occurring terms suggested that the associated technologies had captured the writer’s attention.

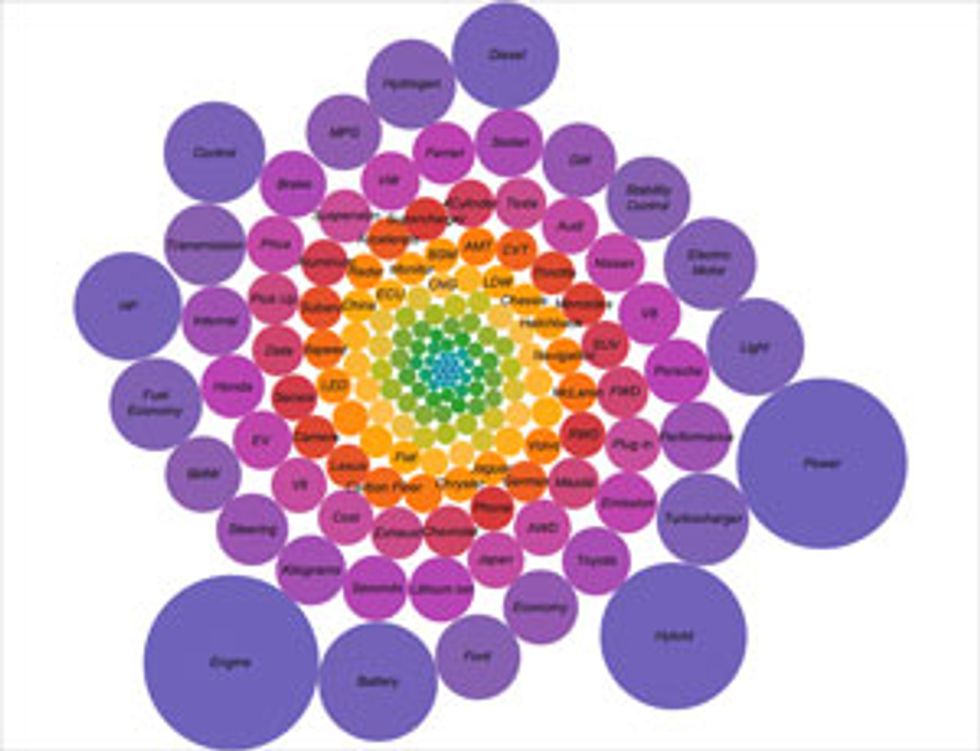

In the graphic at the top, the size of the bubble surrounding a term shows how frequently it showed up over the entire decade.

Second, we considered the global sales of each of the cars for each year following its appearance in the magazine, including sales for the year it appeared. From this data set, we could determine how many units were sold of the exact configuration that appeared in Spectrum. With these two data sets, we were in a position to answer the above questions.

Because consumers evaluate alternative car purchases using many more attributes than those emphasized by Spectrum (for instance, price), we decided to restrict our attention to the technologies. We identified the terms used to characterize these technologies, created a hierarchy of these terms, and then compiled a time series of the various word counts across the 10 years. Finally, we compared these times series to the times series of global sales of these models and configurations.

We identified 170 terms of potential interest. Some general terms had higher frequencies than more specific technology terms. Examples include engine (444 times), power (418 times), hybrid (310 times), battery (206 times), horsepower (169 times), diesel (165 times), control (149 times), light (137 times), fuel economy (123 times), and hydrogen (118).

It is not surprising that these terms frequently occurred. The engine is a most important subsystem for powertrain system, which many see as the heart of an automobile system. Horsepower also has a high frequency for similar reasons. It is also almost a necessity to mention power.

The hybrid concept is a hot topic as the automobile industry strives to build a more environment-friendly vehicle and, more recently, improve the vehicle’s general performance. Batteries are the most important part for a hybrid system and naturally have a high frequency of occurrence. Hydrogen followed the hybrid as the next big thing for the auto-industry. Diesel also has a high frequency considering it has been an available alternative energy source for a long time and pretty popular in Europe.

Under the pressure of environmental regulations and higher oil prices, fuel economy has become frequently addressed, certainly compared to before the 1980s. More recently, the development of computer technologies and electronic controls for automobiles has resulted in dramatic improvements.

Lighting systems have become more and more popular during the past ten years as well. As a relatively isolated subsystem, new lighting technologies can be adopted quickly.

Several specific technology terms also have relatively high frequencies. For example, turbocharger (124 times) is a very popular technology to improve energy consumption and enhance high rpm performance. Four cylinder engines (34 times) combined with turbochargers, as well as direct fuel injection, have become popular ways to maintain performance and also decrease fuel consumption. Hybrid propulsion systems need electric motors (123 times) to drive the car or harvest excess kinetic energy. Lithium ion batteries (62 times) have become more widely used due to shorter recharging time, longer mile range and smaller packaging size. Other ways mentioned to improve a vehicle’s efficiency are regenerative braking (22 times) and engine start-stop (9 times).

We grouped these terms into six categories: energy, performance, lighting, HMI (human-machine interface), driving assistance, and body weight. Examples in these categories include:

- Energy: hybrid, diesel, lithium ion battery, turbocharger, engine start-stop, etc.

- Performance: supercharger, V8 engine, dual clutch transmission, magnetic suspension, etc.

- Lighting: LED headlights, automatic high beam, etc.

- HMI: stereo system, voice activated, Bluetooth, etc.

- Driver assistance: drive by wire, lane departure system, blind spot detection, adaptive cruise control, head up display, etc.

- Body weight: carbon fiber, aluminum, magnesium, etc.

We paid particular attention to energy terms, whose frequency came to more than 1800, easily four times greater than the second most common category, which was performance. Together these two categories accounted for more than 87 percent of the term count, and we have therefore focused on them.

From energy and performance categories, we picked five powertrain subsystems. They are hybrid, diesel, V8, V6 and AWD. As indicated earlier, the entire collection of “Top Ten Tech Cars” articles were treated as a dataset that captured the authors’ opinions on technology trends. Term counts across the decade were treated as a times series representing the dynamics of these opinions.

To find out how well this dataset predicted near-term technology trends, we performed a cross-correlation analysis between the term count time series and technology sales time series. We normalized sales, dividing by the overall sales for each year to remove the effects of economic fluctuations and, for each point in the series, calculated the percentage difference with the previous year.

The analysis indicated the extent to which Spectrum leads or lags the market. Leading here means that the authors’ opinions predicted market trends; lagging here means that market movements lead the authors’ opinions.

- Hybrid: Spectrum follows market with correlation 0.83.

- Diesel: Spectrum lags the market by 2 years with correlation 0.61.

- V8: Spectrum leads the market by 2 years with the correlation 0.40.

- V6: Spectrum leads the market by 2 years with correlation 0.44.

- AWD: Spectrum follows the market with correlation 0.36.

Generally speaking, the data series predicted market trends very well in term of these five subsystems.

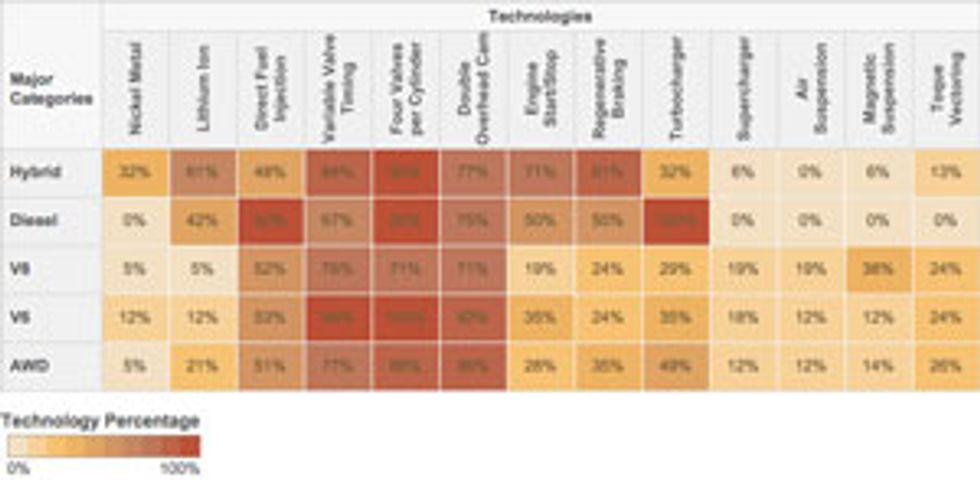

We chose some interesting technologies and determined the patterns of technology adoption for each of the powertrain categories. This chart summarizes the frequency with which each technology appeared for each of the powertrain platforms.

More specifically, we identified the following general patterns.

1. 61 percent of hybrid models have lithium-ion batteries. Only 32 percent of hybrid models have nickel metal batteries. This suggests that market is adopting lithium-ion batteries due to their high performance for recharging time, mile range, size and decreasing price.

2. Most of hybrid models are equipped with engine start/stop systems (71 percent) and regenerative braking (81 percent). While regenerative braking is especially important for hybrid cars, it is also a good option for regular non-hybrids.

3. Normally, hybrid models will have 4-cylinder engine. These engines employ some fuel-conserving technologies, like variable valve timing (84 percent), four valves per cylinder (90 percent), and double overhead cam (77 percent).

4. Diesel models normally include direct fuel Injection (92 percent) and four valves per cylinder (92 percent). Diesel engines usually include a turbo to blow more air into chamber to enable more sufficient combustion.

5. Variable valve timing (67 percent) and double overhead cam (75 percent) are gaining their way in diesel engines due to improved fuel consumption and reduced emissions.

6. As most hybrid and diesel models are in the economy segments of the market, they do not normally include high performance technologies, like supercharger, air suspension, magnetic suspension, or torque vectoring.

7. V8 models have the highest adoption rate (67 percent) for all-wheel drive compared to the other three propulsion subsystems. AWD is a good option to improve vehicle controllability.

8. V8 models rarely include additional environment-friendly technologies, like engine start/stop system (19 percent) and regenerative braking (24 percent). Perhaps from a customer view, those systems are seen as influencing the performance of a vehicle. However, it seems reasonable to expect to see a growth of adoption for these eco-friendly technologies in the future.

9. Some high engine-related technologies are in an early adoption phase for high performance segments, such as variable valve timing (76 percent), four valves per cylinder (71 percent), double overhead cam (71 percent), turbocharger (29 percent) and supercharger (19 percent).

10. Comparing across the four propulsion systems, higher suspension technologies are used in V8 models, including air suspension (19 percent), magnetic suspension (38 percent), and torque vectoring (24 percent).

11. V6 models also have a relatively high adoption rate for all-wheel drive technology (53 percent).

12. Compared with V8 models, V6 models have a higher adoption rate for engine start/stop system (35 percent) and regenerative braking (24 percent). That phenomenon can be easily understood; along with decreasing engine displacement manufacturers need to offer more economy-focused technologies.

13. For V6 engines, technologies more widely included are direct fuel injection (94 percent) -- 18 percent more than V8 engines; four valves per cylinder (100 percent) -- 29 percent more; double overhead cam (82 percent) -- 11 percent more; and turbocharger (35 percent) -- 6 percent more.

14. Compared with V8 engines, some high performance technologies in V6 engines have lower adoption rates due to their normally lower price market segments, including supercharger (18 percent) -- 1 percent less; air suspension (12 percent) -- 7 percent less; magnetic suspension (12 percent) -- 26 percent less; and torque vectoring (24 percent) -- same as V8 models.

15. While there is no direct relationship between AWD and engine technologies, we still can see AWD models have a pretty high adoption rate for high-tech engine-related technologies, including direct fuel injection (51 percent), variable valve timing (77 percent), four valves per cylinder (86 percent), double overhead cam (86 percent) and turbocharger (49 percent).

Spectrum’s “Top Ten Tech Cars” is a highly regarded and often ardently debated compilation. Automobile aficionados, including ourselves, enjoy discussing what is hot now, and perhaps what will be hot next. And in fact, our analysis indicates that Spectrum accurately reports what is happening in the market and often provides a good prognostication of what will happen.