The future of the U.S. cryptocurrency industry hangs in the balance after the Securities and Exchange Commission (SEC) sued cryptocurrency exchanges Binance and Coinbase. The cases hinge on the technology’s ambiguous legal status, but if the SEC wins the outcome may well not be ambiguous at all. Some outcomes could even wind up posing an “existential risk” to exchanges, cryptocurrencies, and no small portion of the “Web3“ decentralized finance world.

At the heart of both lawsuits is whether any of the crypto tokens listed on the company’s exchanges count as securities, a class of tradable financial asset that includes stocks and bonds. Any entity handling securities falls under the SEC’s jurisdiction and has to register with the regulator. Neither Binance and Coinbase has done so, arguing that the tokens they list are not securities.

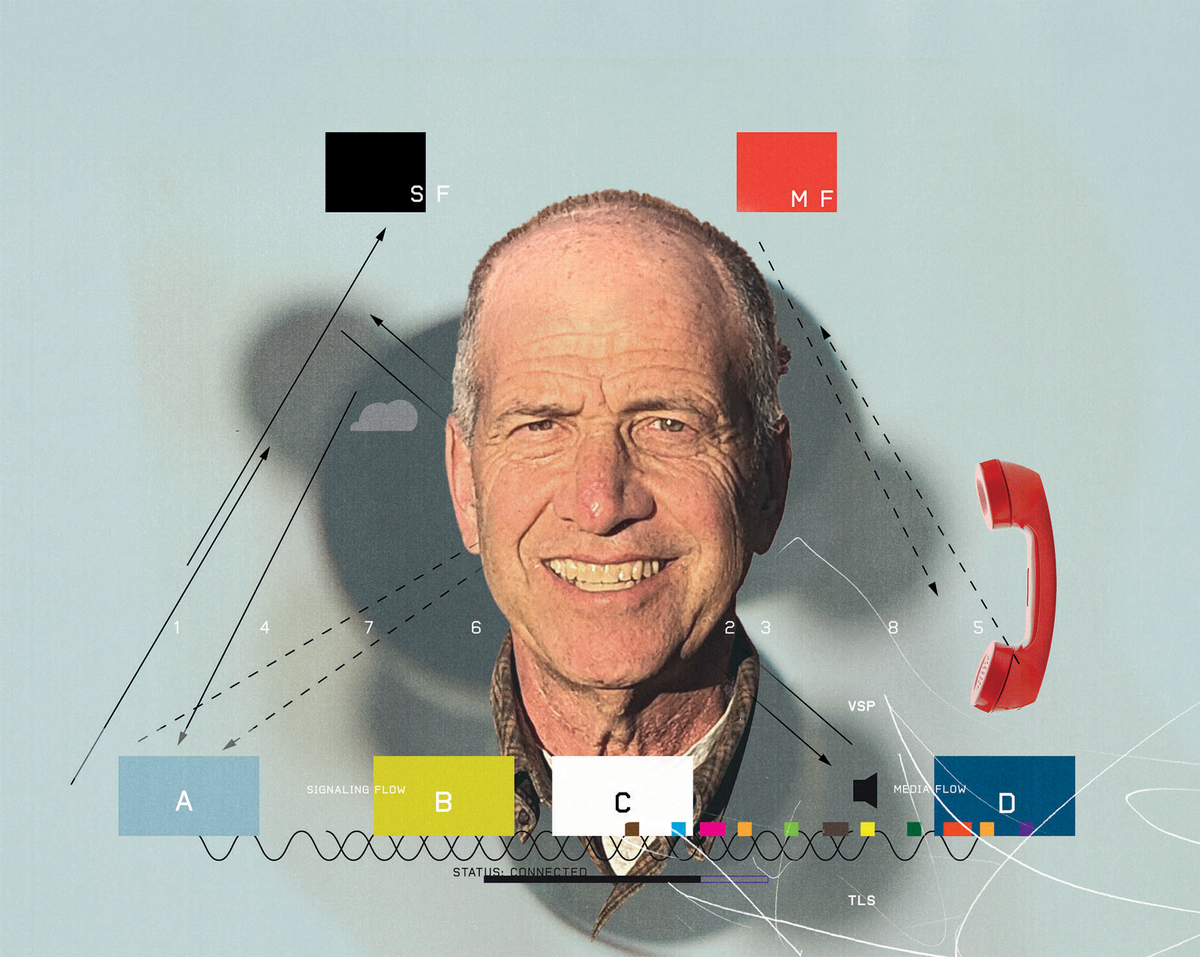

“The reach of this would be dramatic. This gives a much broader way of getting at crypto generally, and I think that that’s a strategic decision by the SEC.”

—Marc Fagel, Stanford University Law School

But the SEC disagrees, and last week it sued both companies for failing to register, naming several of the cryptocurrencies it believes are securities, including Solana, Cardano and Polygon. Binance, the world’s largest crypto exchange, is also facing more serious allegations that it misled investors, concealed who was in control of its U.S. subsidiary, and misused customer funds, and the SEC has applied to freeze some of its assets.

The implications of these cases go far beyond the companies themselves, though, says Marc Fagel, a lecturer at Stanford Law School and former regional director of the SEC’s San Francisco office. So far, the agency has been playing whack-a-mole going after issuers of individual cryptocurrencies, he says. But by targeting the exchanges at the heart of the industry, the SEC could impact the way all cryptocurrencies operate.

“The reach of this would be dramatic,” says Fagel. “This gives a much broader way of getting at crypto generally, and I think that that’s a strategic decision by the SEC.”

Why did the SEC sue Coinbase and Binance?

The key issue in both cases will be whether any of the cryptocurrencies listed by Binance or Coinbase are securities. Traditionally, this has been decided by the Howey test, named after a landmark case heard by the Supreme Court in 1946. The test defines a security as an investment in a common enterprise with the expectation of profits derived solely from the efforts of others. The archetypal security is shares in a company.

The unusual nature of cryptocurrencies make applying the test difficult, though, says Katherine Snow, head of legal at crypto analysts Messari. The blockchains on which cryptocurrencies run are decentralized by design, and therefore their fate is, in theory, determined by the joint efforts of all holders. And while there is typically a development team behind a coin at its launch, their role and influence often diminishes with time. “Digital assets, while sometimes issued in the first instance by a centralized entity, can morph into nonsecurities once the network on which the token functions is ‘sufficiently decentralized,’” she says.

To further complicate things, many crypto tokens are, at least nominally, more than just investments, says Nelson Rosario, a technology lawyer and adjunct professor at Chicago-Kent College of Law. They can be used to make purchases, encode smart contracts, or even confer voting rights. “You can have tokens that look like securities and commodities and money and property all at once,” says Rosario. “There aren’t a lot of assets out there that are as dynamic as these things.”

Even if the industry accepted the SEC’s assertion that most tokens are securities, there is also currently no viable path for most crypto companies to register with the SEC, says Jason Gottlieb, partner at the New York law firm Morrison Cohen. The SEC has called for firms to “come in and register,” he says, but many of the provisions are simply incompatible with the nature of the technology.

“It’s clear that the SEC is doing its best to ensure American investors lose access to the digital asset markets.”

—Katherine Snow, Messari

For instance, issuers of a security are supposed to make regular disclosures to investors. But when it comes to a decentralized token governed by a software protocol, it’s unclear who is expected to make these disclosures. Similarly, rules that require brokers to take physical possession of a security’s paperwork don’t make sense for assets that are stored on a blockchain, says Gottlieb.

“Crypto companies try an extremely expensive and time-consuming process and then get rejected because they literally can’t follow the rules as written,” he adds. “So people stopped trying.”

Last year, Coinbase sent a formal petition to the SEC asking it to set new rules. In a response to a March notice from the SEC warning of impending enforcement action, the company said it had met with the agency numerous times to discuss how regulations could be adapted to allow crypto exchanges to register before discussions were abruptly called off. Coinbase’s chief legal officer, Paul Grewal, said the company does not list securities but would like to do so in the future. “We continue to welcome a registration process for crypto securities activities, but the current rules don’t map onto the basic realities of our industry,” he says.

Part of the problem though, says Lee Reiners, a lecturing fellow of economics at Duke University, lies in the underlying business model of these exchanges. In its complaint, the SEC notes that both Binance and Coinbase are simultaneously acting as exchanges, brokers, and clearing agencies, functions that are typically separated in traditional finance to avoid conflicts of interest.

The crypto industry has laid out arguments for why combining these functions is beneficial, says Reiners, such as instantaneous settlements of trades. And the SEC already permits some mingling of these roles for organizations known as Alternative Trading Systems. But the SEC’s case against Binance provides a clear example of why the fire gaps exist, adds Reiners. The SEC alleges the exchange permitted a trading firm called Sigma Chain, owned by Binance CEO Changpeng Zhao, to carry out transactions with itself, known as “wash trading,” to inflate trading volumes on the platform and deceive investors. Binance didn’t respond to a request for comment.

Speaking at a conference in New York last week, SEC Chair Gary Gensler said that crypto intermediaries may need to separate out these lines of business to comply with securities law. “The fact that they didn’t build their platforms with these things in mind shouldn’t be a free pass to put investors at risk,” he said.

That’s something the exchanges are likely to “fight tooth and nail” though, says Reiners, because in all likelihood they would no longer have a viable business model. “The only way that they can make money over the long term is to perform all of these functions,” he says. “This is an existential risk for them.”

Many in the industry think the SEC’s zealous enforcement and unwillingness to set new rules for cryptocurrencies is less about bringing the industry to heel, and more about effectively banning crypto trading in the United States. “It’s clear that the SEC is doing its best to ensure American investors lose access to the digital asset markets,” says Snow.

Whether that’s a bad thing or not ultimately depends on one’s opinion of crypto though, says Fagel. He suspects the SEC sees the industry as fundamentally problematic and rife with scams, particularly following the collapse of the cryptocurrency exchange FTX last year, which saw investors lose billions of dollars. “Do you, as the SEC, need to ferret through 1,000 filings to try to figure out which is the one out of 1,000 that’s actually legitimate?” he says. “Or do you just say, look, none of these are complying, we’re going to sue them, we’re going to make it difficult?”

Either way, the dispute is unlikely to be resolved anytime soon, says Reiners. The court cases are likely to drag on for years, and the current Congress has shown little appetite for passing new crypto regulations. The only thing likely to shift the needle in the near term, says Reiners, is if a crypto-friendly Republican administration wins the presidency in 2024.

- The Highs and Hazards of Bitcoin - IEEE Spectrum - IEEE Spectrum ›

- The Crazy Security Behind the Birth of Zcash, the Inside Story ›

Edd Gent is a freelance science and technology writer based in Bengaluru, India. His writing focuses on emerging technologies across computing, engineering, energy and bioscience. He's on Twitter at @EddytheGent and email at edd dot gent at outlook dot com. His PGP fingerprint is ABB8 6BB3 3E69 C4A7 EC91 611B 5C12 193D 5DFC C01B. His public key is here. DM for Signal info.