In any business investment, price forecasting plays an important role in determining the viability of the project. Energy investing is no different, especially when it comes to fuel for a generating project. Quicker to construct than coal-fired power plants, natural-gas-fired projects offer environmental gains, but fuel prices are one key—if volatile—element to their success. Our role in the Full Cost of Electricity (FCe-) project by the University of Texas at Austin Energy Institute? Come up with a model that forecasts the long-term level of natural gas prices.

There are several approaches to developing long-term forecasts for commodity prices, including many types of econometric models, equilibrium models, and expert survey forecasts. We use an approach that is based upon calibrating some of the commonly used stochastic process models [PDF] with data from the commodities markets. (For an explanation of commodities markets, spot prices, futures, and other market modeling terms, see this article. For more on our specific model details, equations, and math, see our white paper [PDF].)

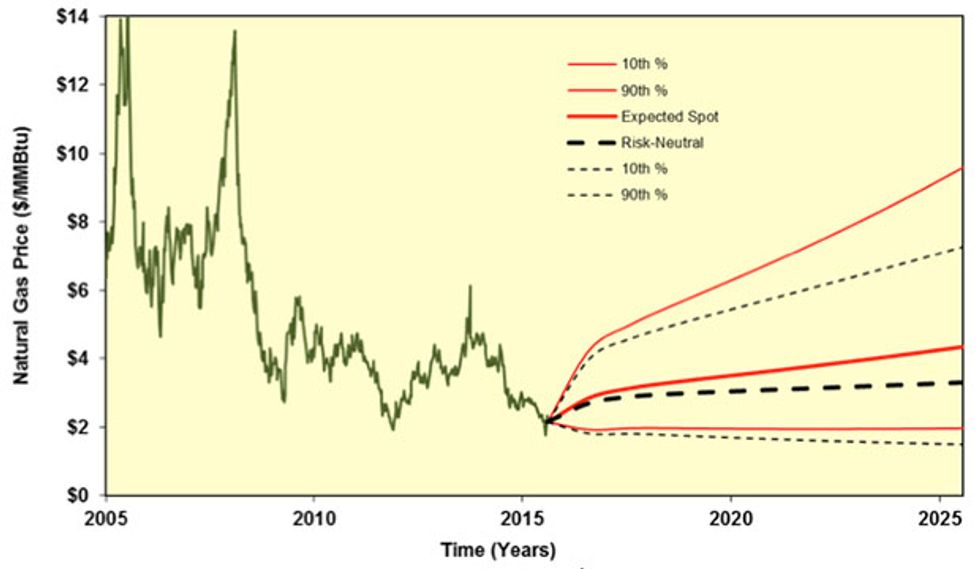

Data, equations, and models in hand, we used a two-factor economic model (two factors as causes of some event) to develop forecasts and confidence ratings for both the risk-neutral price (investor ignores risk completely in the decision-making process) and the expected spot price (current market price for a physical commodity). The risk-neutral version of the model yields a slightly lower forecast. The historical data shows that from 2009 through 2014, spot prices oscillated around a mean price just under US $4 per million Btu, and then prices dropped significantly and rapidly in 2015 [see graph above].

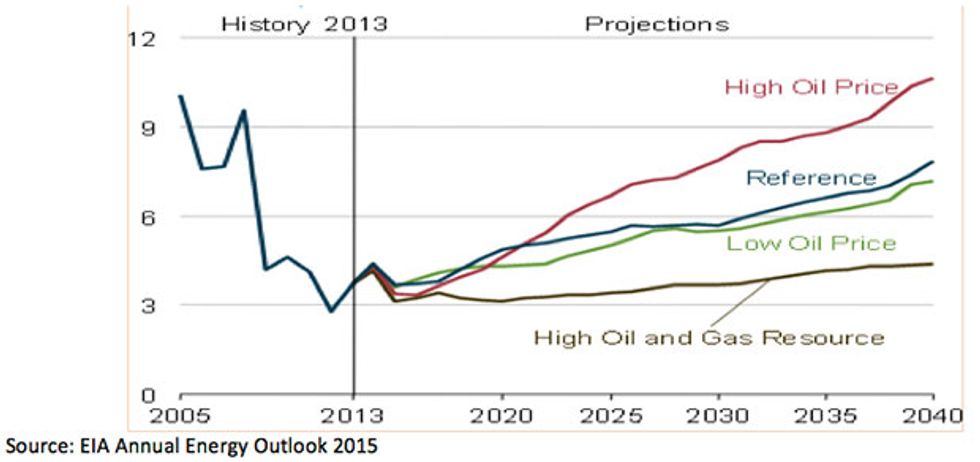

When the model is calibrated to shale gas era futures price data, leaving out the very high historical prices before 2009, the expected spot price is forecasted to recover to only about $3.00 per million Btu over the next two years, but then grow at a modest rate to a price of $4.35 per million Btu by the end of the forecast horizon, 2025 in our calculation. This forecast aligns with the Low Oil Price case projections from the Energy Information Administration 2015 Energy Outlook, slightly lower than their Reference case.

Our research shows that the choice of the data set has some effect on the two-factor model parameter estimates and the resulting forecast. The longer term data set yields a slightly lower forecast, thanks to the long-term downward trend from the high prices realized in the middle to latter part of the decade from 2000 to 2010. With either data set, however, forecasts roughly align with the High Oil and Gas Resource and Low Oil Price scenarios from the 2015 EIA Energy Outlook, two outcomes that seem increasingly likely as judged by market sentiment [see graph above]. This market-based forecasting model provides the added benefits of simple updating (as new futures data becomes available) and a statistical basis for uncertainty analysis, through the confidence envelope around the future expected spot prices.

For more information, read the full report, “Market-Calibrated Forecasts for Natural Gas Prices” [PDF] on the University of Texas Energy Institute’s page for The Full Cost of Electricity.

Warren J. Hahn& James S. Dyer are professors at the University of Texas at Austin, McCombs School of Business.