A device that turns light into sound has allowed researchers to capture lightning in a bottle, in a sense, slowing down the light beams enough so that they can be easily stored and manipulated.

Researchers at the University of Sydney in Australia, have figured out how to turn a light wave into a sound wave, creating an acoustic memory that they say will help data centers save energy by eliminating some electrical connections between processors. They reported their work in a recent issue of Nature Communications.

“Our vision is to replace the electronic interconnects between different processors and computing machines with photonic ‘wires,’’’ said Birgit Stiller, a postdoctoral researcher who led the project. “So light transmission will be used instead of electronic connections.”

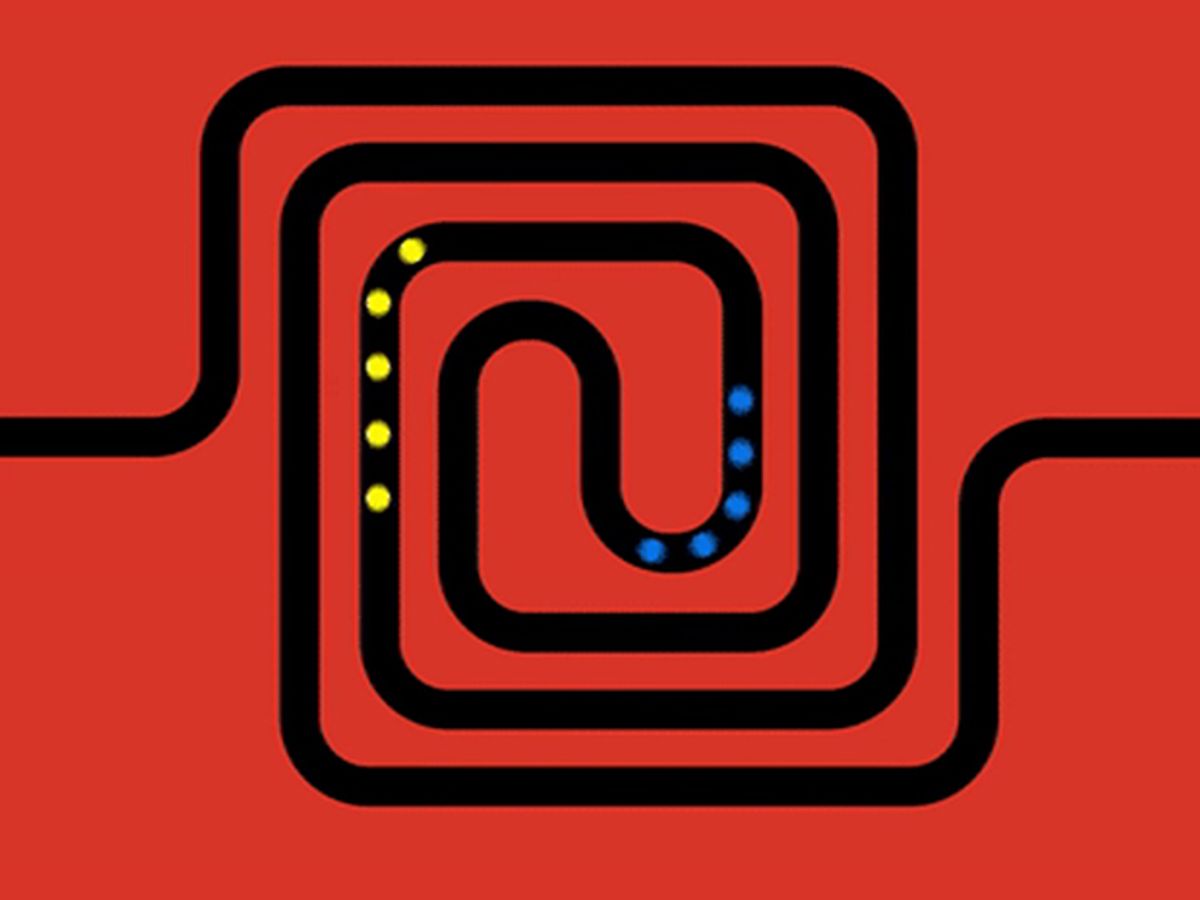

The team built a chip that consists of a spiral-shaped waveguide made from a soft glass called chalcogenide, sandwiched between two stiffer pieces of silica glass. As a light beam travels through the chip, it is met by another pulse of light that has a slightly different frequency. The difference between the frequencies of the two light beams is a “beat,” a wave with a frequency 100,000 times lower, thus turning the light wave into a sound wave.

The sound wave lives for a brief time—several nanoseconds—in the spiral chalcogenide waveguide. To read it out, the device reverses the process, adding the beat frequency to a light pulse to recreate the original light wave.

In standard optical fibers, light waves are prevented from leaking out of the fiber by a difference in refractive index between the core of the fiber and the cladding wrapped around it. In a similar way, the two types of glass keep the sound wave in place; the speed of sound is much slower in the chalcogenide than in the silica.

Slowing down the waves provides time to synchronize different signals coming from different processors. That eliminates the need to convert the optical signal to an electronic signal. Electronics can produce excess heat and require more energy, which are important issues in the big data centers owned by Google, Amazon, or Microsoft, Stiller says.

Further work with the design and materials might allow the sound waves to be stored longer, although the memory already lasts long enough for the use they envision. She and her team hope to refine the work further, with an eye to building a prototype of a manufacturable chip within the next few years.

Neil Savage is a freelance science and technology writer based in Lowell, Mass., and a frequent contributor to IEEE Spectrum. His topics of interest include photonics, physics, computing, materials science, and semiconductors. His most recent article, “Tiny Satellites Could Distribute Quantum Keys,” describes an experiment in which cryptographic keys were distributed from satellites released from the International Space Station. He serves on the steering committee of New England Science Writers.