The United Arab Emirates’ Nuclear Power Gambit

The oil state readies the Arabian Peninsula’s first nuclear power plant

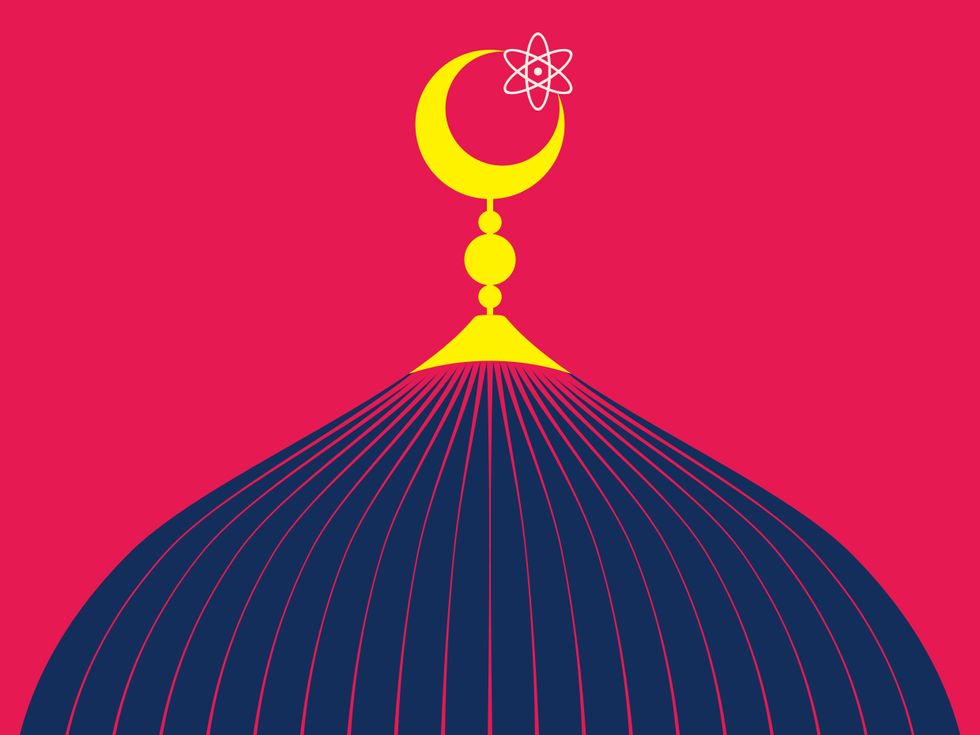

The National, an Abu Dhabi–based English-language daily newspaper, recently likened the domes erected at the United Arab Emirates’ first nuclear reactor complex to “an industrialised version of a mosque.” The US $30 billion Barakah Nuclear Energy Plant, located on the coast some 300 kilometers west of Abu Dhabi, is a source of national pride as well as a strategic investment in energy diversification and climate action. At least one of the plant’s four reactors is slated to start up this year. When fully completed, the plant, jointly owned by Emirates Nuclear Energy Corp. (ENEC) and Korea Electric Power Corp. (KEPCO), will produce more than 5 gigawatts of low-carbon power in a region best known for filling megatankers with oil and liquefied natural gas.

The Barakah project uses pressurized water reactors built by a KEPCO-led consortium and based on a design from Toshiba-owned Westinghouse. The APR1400 reactors offer extensive safety features. Nevertheless, the design had a troubled birth: The first APR1400 reactors in South Korea entered commercial operation more than two years behind schedule, after the discovery of substandard safety-related control cabling.

KEPCO’s setback in South Korea had a knock-on effect at Barakah, because the latter’s technicians were supposed to first observe operations of the new reactors. The problems with the cabling also contributed to the loss of public support for nuclear construction in South Korea and the election of an antinuclear president—changes that have dimmed that country’s prospects for further nuclear exports.

The Barakah project hasn’t been troubled by antinuclear sentiments. But it still must contend with harsh conditions—perhaps including missiles fired by Yemen’s Houthi rebels. The real challenge, though, is that the Persian Gulf, the source of cooling water, is naturally hot and could get hotter with climate change.

In 2013, South Korean nuclear experts Byung Koo Kim and Yong Hoon Jeong noted that the Gulf’s temperature can exceed 35 °C and called it “one of the most thermally stressed bodies of water on earth.” Barakah thus needs extra cooling water to condense the steam driving the turbines so that it can be cycled back to the reactors—about 100 metric tons per second for each reactor, versus 65 metric tons per second in South Korea. Extra cooling water means larger seawater-intake structures, bigger circulation pumps, and more powerful backup generators. Running all that equipment will lower Barakah’s performance. An APR1400 delivers about 1,450 megawatts in South Korea, but the same reactor may yield only 1,360 MW at Barakah, according to Kim and Jeong’s analysis.

Robin Mills, CEO of Dubai-based energy consultancy Qamar Energy, has projected that Barakah will supply energy at a cost of roughly 11 U.S. cents per kilowatt-hour, assuming the startup delays are not substantial. (All four reactors are scheduled to be operating by 2021.) Mills regards that as inexpensive for low-carbon power that can be ramped up as demand increases. But solar is now even cheaper in the Gulf region, where the same intense sun that keeps the seawater hot puts solar power plants on steroids. “Solar has become the lowest-cost source of electricity compared to pretty much anything,” says Mills.

A 1,170-MW photovoltaic project under construction near Abu Dhabi, for example, will be selling its output for just 2.42 cents per kilowatt-hour. And a 700-MW Dubai solar thermal plant promises to provide electricity year-round from 4 p.m. to 10 a.m. for 7.3 cents per kilowatt-hour.

Unsurprisingly, energy experts in the region predict that solar may have already eclipsed nuclear. Hassan Arafat, a professor of water and environmental engineering at Khalifa University of Science and Technology’s Masdar Institute, in Abu Dhabi, says solar is already the cheapest option for powering desalination plants connected to the region’s power grids. He predicts that further price reductions in solar will widen its advantage over nuclear. “[Photovoltaic] prices are at record lows now, but probably we’ll see a bit lower, and we’re going to see a significant drop in the cost of storing energy. But there are no breakthroughs coming for nuclear,” says Arafat.

What’s more, the UAE’s ambitious $163 billion plan for slashing its carbon emissions 70 percent by 2050 includes no further investment in nuclear energy. The plan, announced in early 2017, calls for a boost in renewable energy to 44 percent of power generation as well as a 40 percent increase in energy efficiency. Nuclear’s share would shrink from nearly one-quarter of the power supply right after Barakah is fully commissioned to just 6 percent by midcentury.

Other countries in the region could still make a nuclear push, notably Saudi Arabia, which could award contracts for two nuclear reactors this year. But the economic logic of cheap solar might win out there, too. “The Saudis are serious about their nuclear program,” says Mills. “But will they see it through to completion? That’s still a question.”

This article appears in the January 2018 print issue as “An Oil State’s Nuclear Power Gambit.”