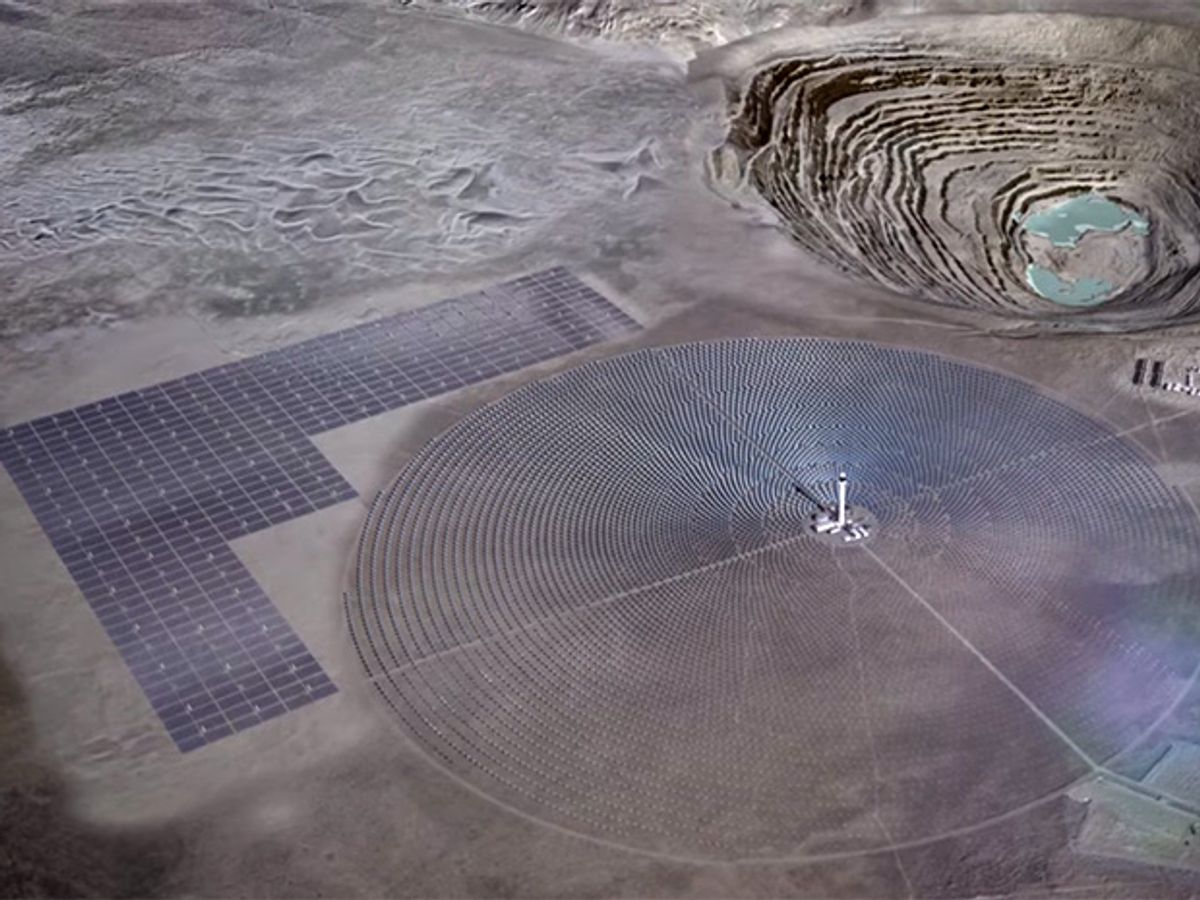

SolarReserve, the technology developer behind the world’s biggest solar thermal power tower project optimized for energy storage, says its Crescent Dunes plant in Nevada recently delivered power to the grid for the first time and should reach its full 110-megawatt rating by the end of 2015. While SolarReserve has a similar plant starting construction in South Africa, much of its development activity—like that of a key rival, Spanish engineering firm Abengoa—is focused on a novel solar technology twist destined for Chile’s power hungry energy market.

SolarReserve’s and Abengoa's Chilean projects both seek to unite solar power’s hitherto competing technology wings: solid-state photovoltaics and steam-raising thermal solar. The aim is to deliver cheap round-the-clock power for Chile's big mines. Their PV component will keep the power on during the day. Solar thermal installations akin to Crescent Dunes—with mirrors or 'heliostats' that concentrate sunlight to directly heat molten salt— will take care of the rest, efficiently storing heat to provide competitive generation overnight.

Chile, which is the world’s top producer of fine copper and second leading gold producer, is also the source of half of the world’s lithium, according to a 2014 report on Chile’s mining sector by consulting firm KPMG. As a result, Chile's mining sector is the country’s largest power user, consuming about 85 percent of capacity on the northern grid (the Sistema Interconectado del Norte Grande). Demand is growing: power use by copper mines is projected to double by 2025.

Imported natural gas is pricey, so Chile has met new demand with a mix of coal-fired generation, wind power, and PV farms. Utility-scale PV, much of which exploits the intense sun that bathes northern Chile's Atacama Desert, is surging this year. Chile will have installed 1 gigawatt of solar PV this year alone, according to PV-TECH, up from 493 megawatts in 2014.

While PV is a good deal—it costs as little as $70 per megawatt-hour (before subsidies), which is well below the heavily-discounted bulk rate of $100 per MWh that Chilean mining firms pay for grid power—it is a glass-half-empty electricity source. As the flat line across the power chart on the Sistema Interconectado del Norte Grande homepage shows, Chile's mines don't stop gobbling power when the sun sets and PV shuts down.

In fact, as a result of the surging PV development, Chilean power prices are now higher at night than during the day, according to Kevin Smith, SolarReserve’s CEO.

Hybrid PV-thermal solar plants promise a nearly complete 24-hour-a-day power solution. The first, which Abengoa began building last year in the Atamaca Desert city of Calama, combines a 100-MW PV farm with a 110-MW molten salt power tower designed to run 18 hours without sunlight. The PV plant is to be completed this year, while the salt tower (Abengoa’s first) is to begin operation in 2017.

Abengoa entered the Calama plant’s solar thermal component into a government-mandated auction for renewable power supplies in 2014 and was approved to earn $115/MWh. SolarReserve, in contrast, is offering power from its Chilean hybrid PV-thermal solar projects as a bundle, which CEO Kevin Smith promises will sell for “well under” $100/MWh.

Smith says SolarReserve’s first proposed Chilean hybrid plant, near Copiapó at the southern end of the Atacama, would combine a pair of 130-MW salt towers—each 18 percent more powerful than the tower at Crescent Dunes—with 150 MW of PV output.

In August, environmental regulators approved the project (a critical hurdle, particularly since documentation of high avian mortality at the triple-tower Ivanpah installation in California’s Mohave Desert appeared). Smith says SolarReserve is seeking industrial buyers for its hybrid power, but may also bid it into a grid power auction in April 2016.

Both solar thermal developers have big plans for additional hybrid plants in Chile. SolarReserve’s Smith says they have over 1,000 MW of solar projects in “advanced development” in Chile. Abengoa has filed for environmental permits for two follow-on projects, including a twin of its hybrid 110-MW plant approved by environmental regulators for the northern Atacama and a triple-tower, 315-MW project near Copiapó.

Abengoa’s challenge will be raising the capital required. The company is struggling with a heavy debt load, and its financial valuation slid last week after an audit by KPMG, driven by Abengoa creditors, detected a larger than expected cashflow deficit.

Analysis this weekend by OilPrice.com notes similar stock slides at other renewable energy firms. Among them is the one suffered by PV giant SunEdison, whose stock is down by about 70 percent from its valuation in July 2015. The report suggests this is due both to the financial structure some renewable firms have adopted, and to fallout from sliding oil prices that has hurt the competitiveness of their renewable energy.

Peter Fairley has been tracking energy technologies and their environmental implications globally for over two decades, charting engineering and policy innovations that could slash dependence on fossil fuels and the political forces fighting them. He has been a Contributing Editor with IEEE Spectrum since 2003.