Solar power projects intended to turn solar heat into steam to generate electricity have struggled to compete amid tumbling prices for solar energy from solid-state photovoltaic (PV) panels. But the first commercial-scale implementation of an innovative solar thermal design could turn the tide. Engineered from the ground up to store some of its solar energy, the 110-megawatt plant is nearing completion in the Crescent Dunes near Tonopah, Nev. It aims to simultaneously produce the cheapest solar thermal power and to dispatch that power for up to 10 hours after the setting sun has idled photovoltaics.

“When the grid wants 110 MW, we’ll provide 110 MW. There will be no variability,” says Kevin Smith, CEO for SolarReserve, the plant’s developer, based in Santa Monica, Calif.

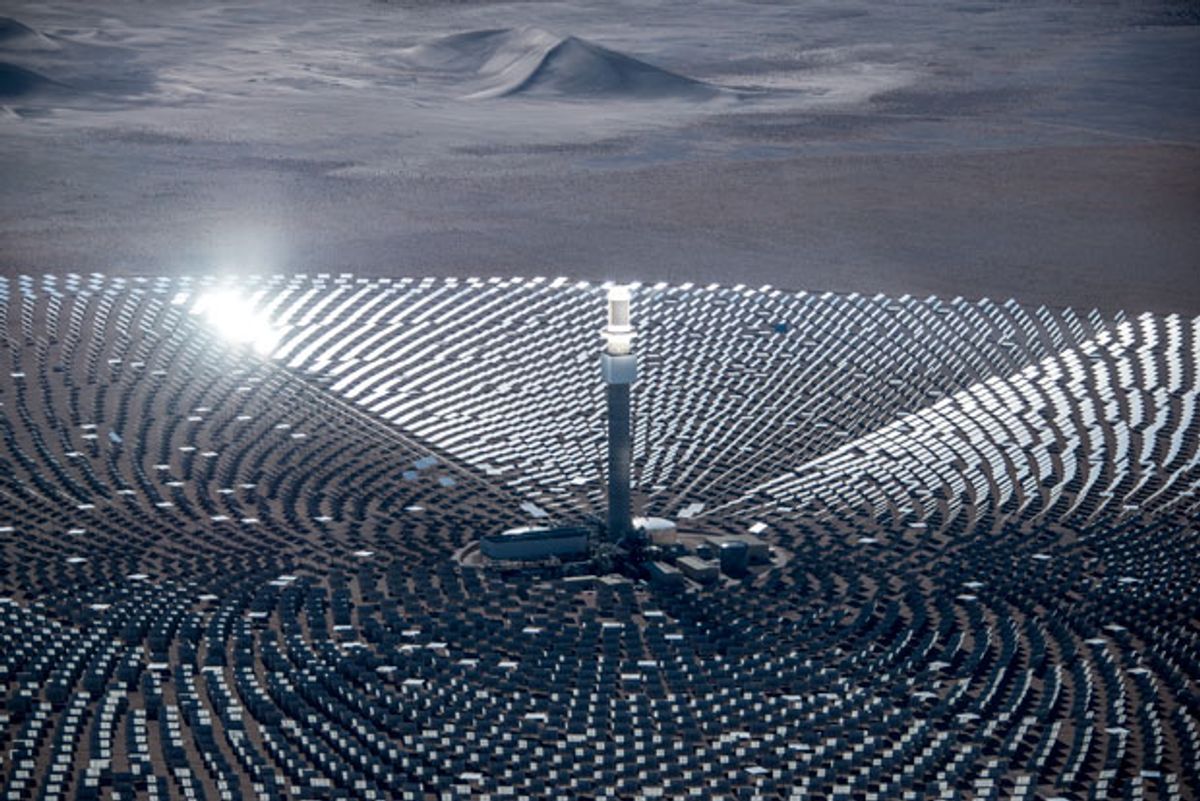

Crescent Dunes, due to come on line by the end of this year, uses over 10,000 mirrors to focus sunlight on a heat receiver atop a 165-meter-high tower—a layout resembling California’s massive Ivanpah solar power tower. However, while Ivanpah’s receiver heats steam and pipes it directly to turbine generators, SolarReserve’s heats a molten mixture of nitrate salts that can be stored in insulated tanks and withdrawn on demand to run the plant’s steam generators and turbine when electricity is most valuable. Smith expects that NV Energy, the Las Vegas–based utility contracted to buy Crescent Dunes’ output, will want it mostly during the utility’s unusually late demand peak, which the Vegas Strip’s nightlife routinely stretches toward midnight.

Mark Mehos, thermal systems group manager at the National Renewable Energy Laboratory (NREL), says molten salt towers akin to SolarReserve’s are “the next-generation technology” for solar thermal power. Plants without storage may never be able to compete with PV, says Mehos. And while molten salt storage is often added to trough-style plants, which use hectares of parabolic mirrors to heat synthetic oil flowing through pipes suspended above them, salt towers are cheaper and more efficient, he says.

Eliminating the heat exchange between oil and salts trims energy storage losses from about 7 percent to just 2 percent. The tower also heats its molten salt to 566 °C, whereas oil-based plants top out at 400 °C. That temperature boost squeezes 5 to 6 percent more power from the plant’s steam turbines and enables a tank of salt to hold two to three times as much energy. The temperature advantage could grow: In September, SolarReserve won a US $2.4 million grant from the U.S. Department of Energy to develop a ceramic receiver that can withstand 732 °C.

Now the company just needs to make Crescent Dunes run. SolarReserve finished its construction early this year and was targeting first power generation at press time in early October. Smith says that one of the biggest complexities to master is the repositioning of the mirrors—more than 1 million square meters of reflective glass—every 60 seconds to keep their beams focused on the receiver. A 20-MW demonstration-scale plant completed in 2011 by Spanish solar thermal developer Sener Grupo de Ingeniería is running well, according to Mehos, but it must coordinate about one-sixth the number of mirrors as the new Nevada plant.

Crescent Dunes promises to be the first of many big molten salt towers. Sener and fellow Spanish solar thermal developer Abengoa have large towers under construction in Morocco and Chile, respectively. SolarReserve expects to break ground this year in South Africa on its second plant. With the first plant completed, costs are coming down. Crescent Dunes’ generation earns about $190 per megawatt-hour, including the value of federal subsidies, whereas Smith says the company’s South Africa plant will get $125/MWh with no subsidies.

At present, solar thermal makes the most sense in markets where, unlike the United States, natural gas is pricey enough to make gas-fired plants less attractive for managing peak demand. But stronger growth is projected in the United States as well, because climate protections there threaten to restrict the use of natural gas to balance power generated by increasing levels of intermittent renewable power. NREL has predicted that solar thermal plants could be doing as much grid balancing in California as gas-fired and hydro plants combined by 2030, when that state’s utilities are mandated to use 50 percent renewable electricity.

That is, unless declining battery costs make storing PV power more economical. James Nelson, a California-based energy modeler with the Union of Concerned Scientists, says this intrasolar race will be good for the environment: “I’m glad we have multiple technologies that can help the transition from gas power plants.”

This article originally appeared in print as “Molten Salt Tower Reboots Solar Thermal Power.”

A correction to this article was made on 27 October 2015.