Whether you pay for a bag of groceries by cash, check, credit card, or debit card may seem to be just a matter of convenience. But the cost to you is nothing like the cost to the seller, says Allan Shampine, senior vice president of the Chicago financial consulting firm Compass Lexecon. “If it’s a mom-and-pop store and you get out your credit card, the merchant is probably groaning inside: ‘He comes here all the time. I really wish he’d pay with cash!’ ”

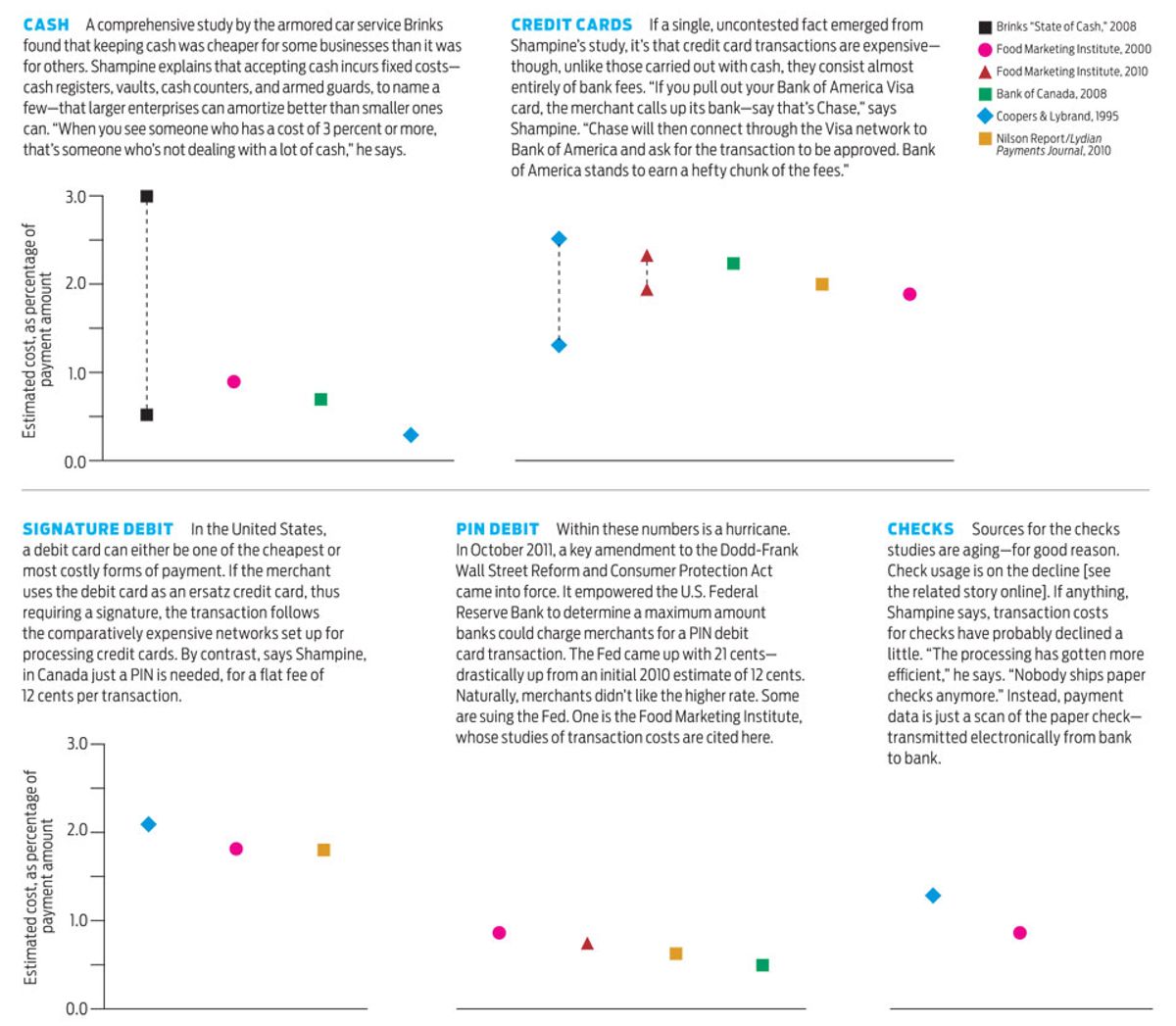

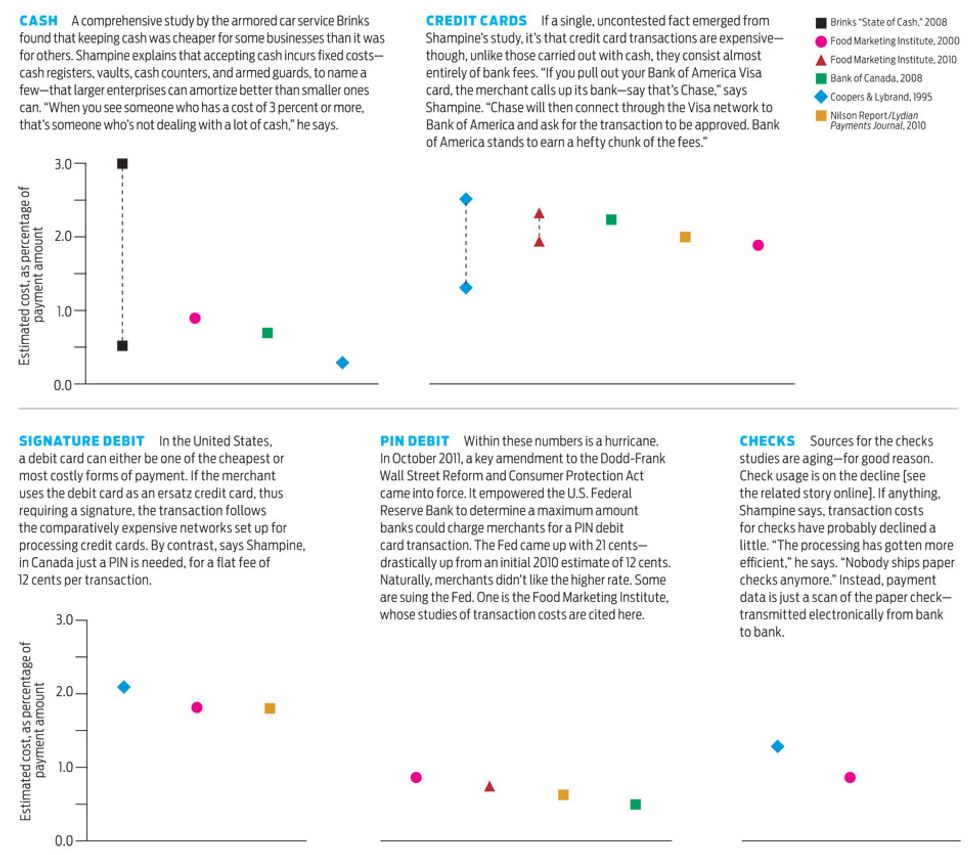

In January, Shampine published a survey of 11 studies from the past 21 years of the actual costs of various payment methods. Shampine was surprised to discover that estimated costs of cash versus credit cards versus debit cards or checks vary so widely that only a fuzzy picture emerges.

Below are some sample findings—along with Shampine’s commentary on parts of the story that the data might not be telling.

This article originally appeared in print as "The High Cost of Money."