Topaz Turns On 9 Million Solar Panels

With the completion of the world’s largest photovoltaic power plant, grid operators must figure out how to integrate more solar

Silence generally reigns across California’s Carrizo Plain, about 160 kilometers northwest of Los Angeles. But for much of the past three years, this expanse of grassland and farms was anything but silent, as up to 880 people trucked out each day to the plain’s sparsely inhabited northern end to build a hefty power plant. On a bright October afternoon, only a handful of construction workers remain, and the nearly completed plant is generating at close to full tilt. And yet it makes nary a click, buzz, or whir, even as it pumps hundreds of megawatts of electricity into California’s power grid.

The utter quiet is a facet of the technology. This is the world’s largest solar power plant, Topaz Solar Farms, where First Solar, based in Tempe, Ariz., has erected nearly 9 million of its cadmium-telluride thin-film photovoltaic panels across 19 square kilometers of former ranchland. This sea of panels and the associated inverters and transformers are designed to deliver 550 megawatts of low-carbon AC power, enough to service 180,000 homes. The site will reach its full design capacity early this year.

Topaz marks the pinnacle in a massive scale-up of grid-connected solar power across the United States. As recently as 2009, rooftop systems accounted for nearly 90 percent of U.S. solar capacity. While installation of rooftop PV continues to expand, utility-scale solar has come to dominate the market. This year, plants like Topaz will add more megawatts than the entire U.S. solar market did in 2013, according to projections by Boston-based green-tech consultancy GTM Research. Indeed, First Solar is also nearing the completion of another massive PV plant, its 550-MW Desert Sunlight Solar Farm, in Southern California.So far most grid operators are taking the “big solar” surge in stride, in part because PV plants like Topaz tend to produce the most electricity when demand is also high. But the commissioning of more plants, plus the proliferation of rooftop solar, could soon lead to days when generation exceeds demand, threatening to upset the grid’s delicate balance. According to models commissioned by the California Independent System Operator (CAISO), which oversees the state’s bulk electricity grid, some areas could suffer that very scenario by 2020 if current trends continue. This means that CAISO and other grid operators have just a few more years to figure out how to best integrate this new wealth of solar-generated power.

Solar’s scale-up in California has been a long time coming. One abortive start occurred right here in the Carrizo in 1983, when an oil company erected one of the first dedicated solar power stations. The 5.2-MW plant’s time in the sun was cut short, however, as deterioration of the panels soon sapped their output. By 1995, the panels were gone. That same period saw the construction of even bigger solar plants that use mirrors to concentrate sunlight, raise steam, and drive turbines. Nine such solar thermal plants generating about 40 MW each were installed in the Mojave Desert before expiring incentives stalled that technology, too.

Then, in 2006 California passed a law mandating that utilities include at least 20 percent renewable energy in their retail electricity supply by 2010; three years later, the state added a mandate for 33 percent renewables by 2020. Energy officials figured that much of this green power would come from big solar plants. The state’s best sites for wind turbines—that is, those having decent access to transmission lines—were already being maxed out, says Neil Millar, executive director for infrastructure development at CAISO. Top solar sites, in contrast, were largely untapped—including the Carrizo.

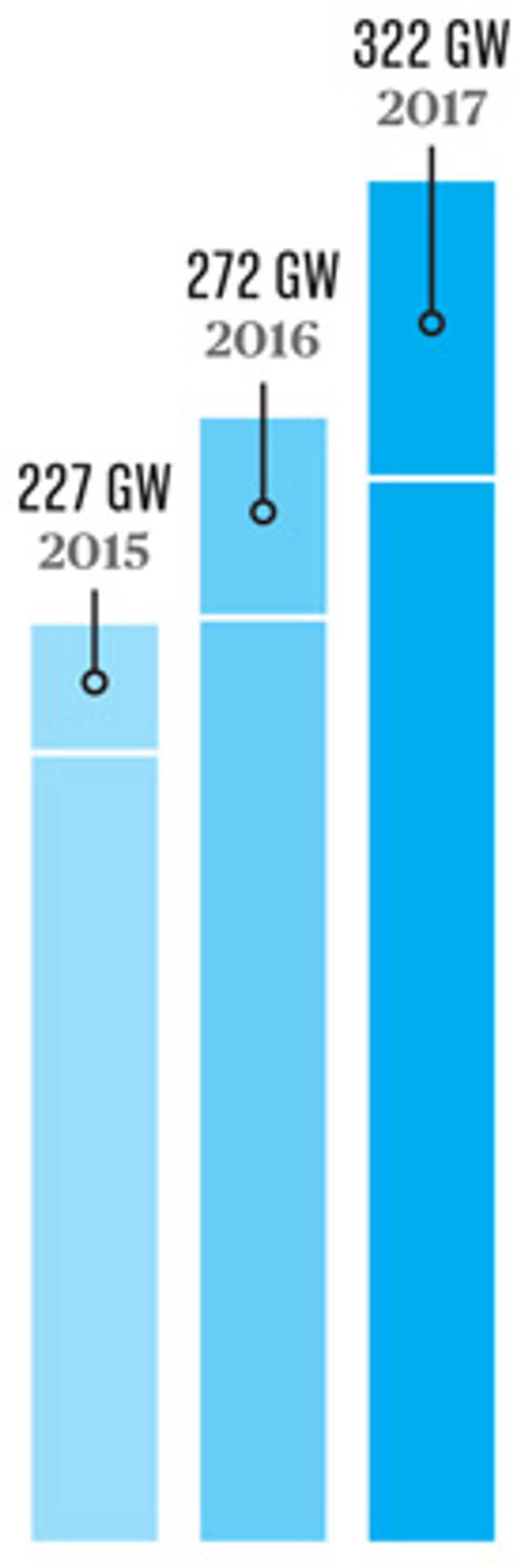

Estimated Global Photo-voltaic Capacity, 2015–17

The Carrizo Plain, with 315 sunny days a year, offers some of the state’s best sun, and it is conveniently bisected by an existing 230-kilovolt transmission line. In 2008, when the Topaz project was first proposed, San Francisco–based Pacific Gas and Electric Co. signed up to take the site’s power at a guaranteed price of roughly 20 U.S. cents per kilowatt-hour for 25 years. By the time First Solar was ready to build Topaz in 2011, the alternative-energy investment arm of billionaire Warren Buffet’s empire, known as MidAmerican Renewables, had bought the project and financed its construction. “All of the stars lined up for Topaz,” says Gary Hood, MidAmerican’s Topaz project manager.

Aligned stars or not, Topaz has taken many years to come together. Ironically, what held it up—and what has posed a challenge for many solar megastations—is its environmental footprint. Topaz lies within a critical habitat for several dozen protected species, including the longhorn fairy shrimp, the giant kangaroo rat, and the San Joaquin kit fox, one of California’s most imperiled animals. “It’s this great vast open area with very little growing over a foot tall, but there are some remarkable species out there,” says Bruce Gibson, chairman of the San Luis Obispo County Board of Supervisors.

To win government approvals and avoid litigation, First Solar purchased another 70 square kilometers nearby to be conserved in perpetuity. The company also designed the Topaz site itself to function as wildlife habitat, both during construction and throughout its 35-year projected lifetime.

So far, no kit foxes have been harmed during construction. And Brian Cypher, an expert on these foxes at California State University’s nearby Stanislaus campus, says that Topaz may even be improving the foxes’ lot by providing refuge from predators. Small gaps in the fencing around the site let the house-cat-size foxes slip through while excluding the coyotes that hunt them.

Even if Topaz now passes environmental muster, other big-solar sites in California have not. Topaz’s twin, Desert Sunlight, is one of several solar plants where endangered waterbirds have turned up dead. Ileene Anderson, a senior scientist for the Center for Biological Diversity who specializes in desert conservation, speculates that the birds are mistaking the polarized light reflecting off the panels for lakes. They may be injured when landing, she says, and may then be unable to take off. Anderson’s group is reportedly planning a lawsuit over the dead birds.

Facing even greater scrutiny are solar thermal power plants. Altogether, California’s three recently completed projects—plus two more in Arizona and Nevada—have more than doubled the country’s solar thermal capacity since 2012. But further development has all but stalled amid alarming reports of birds igniting as they fly through the plants’ concentrated solar flux. “That market is at a standstill,” says Mark Bolinger, a renewables expert at Lawrence Berkeley National Laboratory and coauthor of a recent analysis of utility-scale solar.

Environmental concerns aside, solar PV continues to benefit from a virtuous cycle in which new installations beget cost reductions that drive further adoption. In the process, the price of solar-generated electricity has plummeted. While PG&E is obligated by its 2008 agreement to pay about US $0.20/kWh for Topaz’s electricity, recent PV projects are earning just $0.05/kWh to $0.06/kWh. The price drop reflects both mass production and technology upgrades, the latter of which is visible at Topaz. When First Solar installed the first panels there in 2012, each was rated to produce 77.5 watts of direct current. The last panels to be installed, by contrast, are rated for 97.5 W DC—a 26 percent increase in output—thereby cutting the per-megawatt cost of installing new capacity.

Such advances in PV technology have turned utility-scale solar into a mainstream option for utilities looking to meet midday power demand. According to the financial firm Lazard, new grid-scale solar plants now deliver at $0.072/ kWh to $0.086/kWh when subsidies are excluded. That stacks up well against electricity from even the most efficient natural-gas-fired plants, which costs $0.061/kWh to $0.127/kWh (with the higher end including the cost of CO2 capture). Between June 2013 and July 2014, U.S. utilities announced plans to buy 3,000 MW of utility-scale solar power without or ahead of state mandates, according to the Solar Energy Industries Association, a Washington, D.C.–based trade group. Bolinger says that utility-scale solar is also advancing in South America and Asia.

And while solar-generated electricity does come with some variability—from passing clouds, rain, and such—plants such as Topaz may actually be in a position to help balance the grid, says First Solar vice president and interconnection expert Mahesh Morjaria. For one thing, the plants’ control systems and power electronics are designed to maintain output during any faults on a transmission line and can be programmed to support the line voltage as required or requested by grid operators. And unlike wind power, solar output tends to look much the same from day to day, especially in sunny places like the U.S. Southwest. “The solar panels have very predictable curves for when they’ll be ramping up and down,” says Millar of CAISO.

Millar adds, though, that as solar deployments continue, things will get more complicated. CAISO modeling [PDF] of conditions in 2020 suggests that some areas will suffer from excess midday generation on low-demand days or be starved for electricity in the late afternoon as the sun sets. To continue to balance demand and supply as solar grows, CAISO is already pushing for investment in fast-acting resources, including conventional power plants, battery storage, and demand-response programs (which give customers incentives to curtail their electricity consumption at peak hours).

The modeling looked to the future, says Millar, but “the reality is actually showing up now.”

Fast Forward

Big Solar Slims Down

Although photovoltaic generation will grow, individual installations will get smaller over time

By 2020: More grid-scale solar will continue to come on line over the next five years, but some “rightsizing” is already in the works. Many experts expect utility-scale plants in 2020 to be a lot smaller than the 550-megawatt Topaz Solar Farms. “We’re looking at 20 to 80 MW as the sweet spot,” says Mark Bolinger of Lawrence Berkeley National Laboratory.

That’s because the economies of scale for gas, coal, and nuclear power plants don’t apply to solar, Bolinger says. Instead, building bigger tends to complicate solar installations. While small photovoltaic plants can be easily slipped into unused tracts, such as abandoned farmland, larger parcels—like Topaz’s 19 square kilometers—are harder to come by. Smaller projects can also connect with the power grid more quickly and cheaply. To hook up Topaz and another nearby solar farm, Pacific Gas and Electric Co. had to upgrade high-voltage transmission wires at a cost of US $35 million to $45 million.

By 2025: Expect the trend toward smaller sizes to continue, with rooftop installations eventually retaking the lead. Electricity from rooftop solar systems may be pricier than that from utility-scale plants, but it already makes economic sense in an increasing number of states and countries that enjoy great sun and suffer from high grid-power prices. California is among them, with nearly a quarter of a million PV systems providing about 1 percent of the state’s power. By 2025 the rooftop share could be 10 times as great, according to distributed-energy proponents.

James Fine, a San Francisco–based senior economist for the Environmental Defense Fund, says the rise of rooftop solar will come from consumers’ desire for self-sufficiency as well as the growing number of third-party providers that lease PV systems to homeowners and businesses for no money down.

California may need that extra power by 2025. By then, the licenses are set to expire for its last nuclear power plant: PG&E’s 2,200-MW Diablo Canyon facility, which lies on a seismically active stretch of coastline just 80 kilometers west of the Topaz solar plant. —P.F.

About the Author

Contributing editor Peter Fairley often covers conflicts between energy use and the environment. But while visiting Topaz Solar Farms, in California, he was struck by their coexistence. Construction crews noticed that one of the endangered San Joaquin kit foxes would watch them work, and they gave it a wide berth. After the fox got trapped in a 5.5-meter-deep auger-drilled hole, the workers named it Auggie. “The fox came out unscathed and went right back to making his living on the Topaz site,” Fairley says.

This article originally appeared in print as “Big Solar’s Big Surge.”

Make Your Own Tech Predictions

How clear is your crystal ball? IEEE Spectrum has teamed up with the SciCast project, based at George Mason University, to bring its “Bayesian combinatorial prediction market” to Spectrum readers with one thing in mind: predict the future of technology. To that end, we’ve selected articles from the January Top Tech 2015 issue to give you the opportunity to match wits with the experts by making your own tech forecasts at IEEE SciCast. Registration is free, but required to set up a trading account. Select “IEEE Spectrum” under “Topics” in the registration menu. Get a feel for the tech-specific SciCast queries with this sample:

Question 327: Will California's solar thermal facilities reach an overall capacity of 1.5 GW before the end of 2015?

Question 332: Will a 500 MW capacity solar thermal power station be completed and in operation in the US before the end of 2016?

Question 450: Will either the US or China have 10 GW in utility-scale PV solar power capacity installed by the end of 2015?