China is notorious for its accelerating consumption of coal, which will soon push it past the United States as a leading producer of greenhouse-gas emissions. But China is also rapidly becoming a world leader in wind power. Its fleet of wind turbines more than doubled in generating capacity in 2007, surging by over 3 gigawatts, according to the Global Wind Energy Council. That's less power capacity than China's coal sector adds per week, but it's enough to make China the third-fastest-growing wind market worldwide (behind the United States and Spain) and propel it to fifth place in the Global Wind Energy Council's annual capacity rankings (ahead of even wind-energy pioneer Denmark).

Sebastian Meyer, director of research for Beijing consultancy Azure International Technology & Development, predicts that China will add another 4 to 5 GW's worth of wind turbines in 2008, thanks in part to new standards announced late last year that mandate a greater reliance on renewable energy. If Meyer is right, China will close out 2008 with at least 10 GW of installed wind capacity--twice the country's target for 2010. Meyer says that wind farms are going up faster than China's grid operators can connect them to regional transmission lines. ”Incredibly, up to 2 GW of the capacity out there at the end of 2007 was installed but not yet commissioned,” says Meyer. He expects those wind farms to be connected soon.

What's truly unbelievable about China's dramatic investment in wind power is its endurance in the face of below-cost pricing. The government's primary mechanism for supporting the wind industry has been the awarding of wind-power concessions--agreements whereby the government purchases set amounts of wind energy from project developers. Bidding for the wind concessions--totaling 2.45 GW so far--has yielded an average price of 0.45 yuan (about 6 U.S. cents) per kilowatt-hour. That's break-even at best, according to industry experts. Many Chinese wind projects stay afloat by selling international carbon credits generated under the Kyoto Protocol's Clean Development Mechanism, earning roughly another cent per kilowatt-hour.

A sweeping renewable-energy law enacted in 2005 failed to put China's wind industry on steadier financial ground. Regulations finalized last year by China's National Development and Reform Commission (NDRC) require large power-generating companies to incorporate at least 3 percent wind energy in their power portfolios by 2010 and 8 percent by 2020. However, the NDRC dashed hopes for a generous ”feedâ''in” tariff akin to Germany's price premium, which fueled that country's world-leading wind sector by guaranteeing many years of fixed prices for any electricity sold into the grid. Instead, the NDRC opted to continue setting tariffs for wind projects on a case-by-case basis, guided by the pricing of nearby concession projects.

Policy analysts view China's rock-bottom pricing as a deliberate, though seemingly paradoxical, strategy to nurture local wind power developers. Li Jungfeng, secretary general of the Chinese Renewable Energy Industries Association, and Eric Martinot, a visiting professor at Beijing's Tsinghua University, wrote a report on the subject in November 2007 for the World Watch Institute. In Powering China's Development: The Role of Renewable Energy , they say that according to anecdotal evidence domestic developers have proved more willing to accept the low prices than foreign companies have.

On one hand, the price scheme has worked. Azure's Meyer notes that state-owned companies account for 88 percent of the wind power installed to date. And they are buying an increasing share of their turbines from domestic manufacturers. Meyer says that the top three Chinese wind-turbine manufacturers--Xinjiang Goldwind, Sinovel, and Dongfang--supplied over half of 2007's megawatts.

But the Chinese Wind Energy Association is worried about the industry's sustainability under relentless pricing pressure. As a result, the association may be the only renewable-energy trade group in the world calling for slower growth. Haiyan Qin, secretary general of the Beijing association, has no doubt that his industry will meet China's goal of installing 30 GW of wind power by 2020. In fact, he thinks the industry can do at least twice that. But first it needs to get its house in order. As Qin put it in an eâ''mail to IEEE Spectrum : ”It is necessary to slow down the pace in order to guarantee the sound development of the industry.”

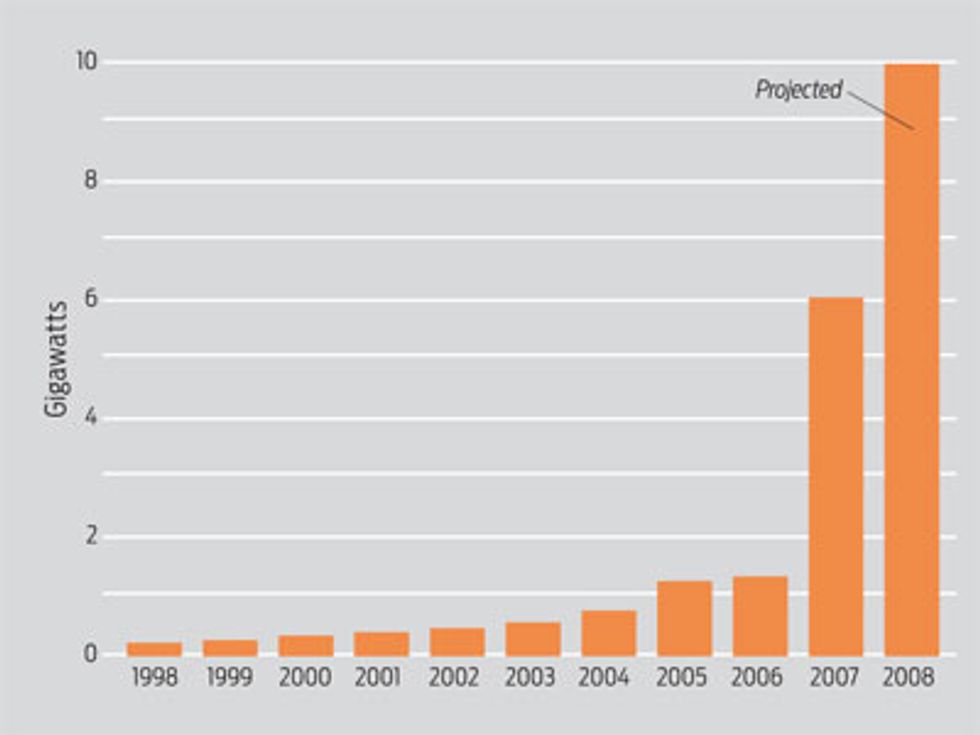

WIND POWER IN CHINA

The country’s capacity is expected to surge by at least 4 GW this year.