How the Free Market Rocked the Grid

It led to higher rates and rolling blackouts, but it also opened the door to greener forms of electricity generation

Most of us take for granted that the lights will work when we flip them on, without worrying too much about the staggeringly complex things needed to make that happen. Thank the engineers who designed and built the power grids for that—but don’t thank them too much. Their main goal was reliability; keeping the cost of electricity down was less of a concern. That’s in part why so many people in the United States complain about high electricity prices. Some armchair economists (and a quite a few real ones) have long argued that the solution is deregulation. After all, many other U.S. industries have been deregulated—take, for instance, oil, natural gas, or trucking—and greater competition in those sectors swiftly brought prices down. Why not electricity?

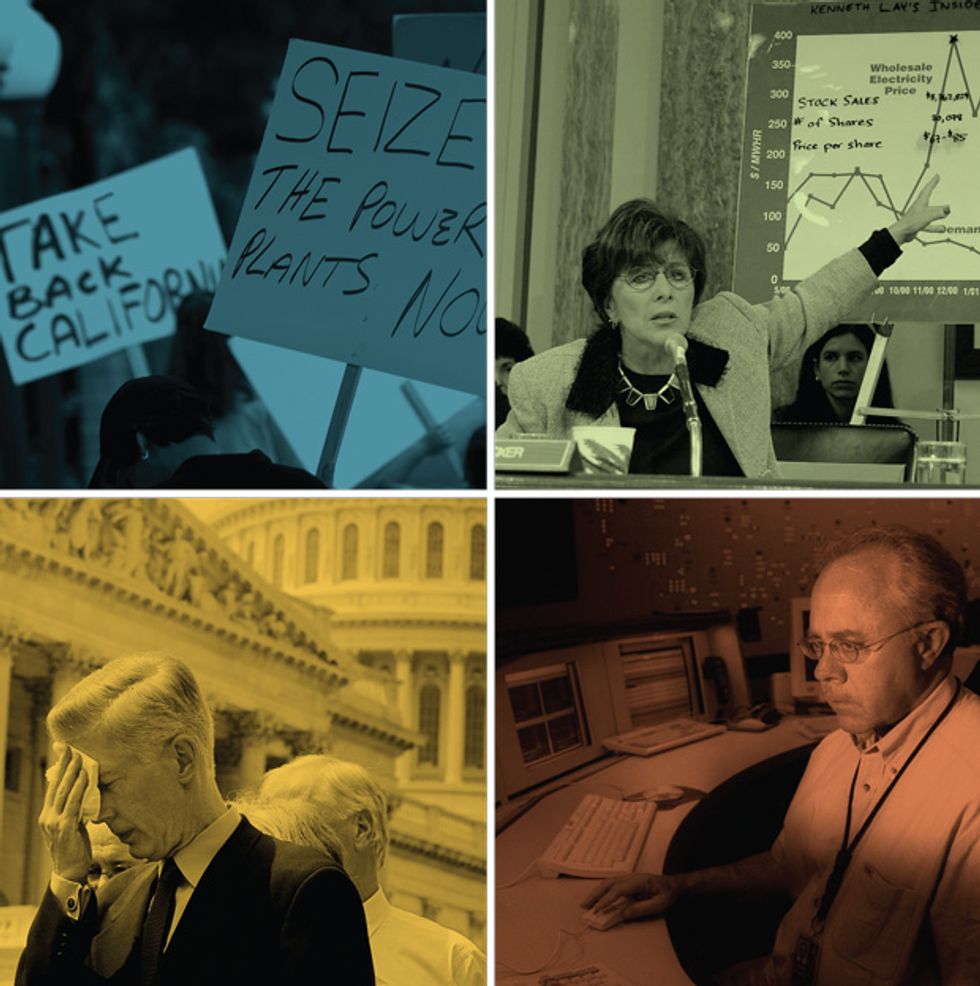

Such arguments were compelling enough to convince two dozen or so U.S. states to deregulate their electric industries. Most began in the mid-1990s, and problems emerged soon after, most famously in the rolling blackouts that Californians suffered through in the summer of 2000 and the months that followed. At the root of these troubles is the fact that free markets can be messy and volatile, something few took into account when deregulation began. But the consequences have since proved so chaotic that a quarter of these states have now suspended plans to revamp the way they manage their electric utilities, and few (if any) additional states are rushing to jump on the deregulation bandwagon.

The United States is far from being the only nation that has struggled with electricity deregulation. But the U.S. experience is worth exploring because it highlights many of the challenges that can arise when complex industries such as electric power generation and distribution are subject to competition.

Unlike many other nations grappling with electricity deregulation, the United States has never had one government-owned electric utility running the whole country. Instead, a patchwork of for-profit utilities, publicly owned municipal utilities, and electric cooperatives keeps the nation’s lights on. The story of how that mixture has evolved over the last 128 years helps to explain why deregulation hasn’t made electric power as cheap and plentiful as many had hoped.

The 1882 opening of Thomas Edison’s Pearl Street generation station in New York City marks the birth of the American electric utility industry. That station produced low-voltage direct current, which had to be consumed close to the point of production, because sending it farther would have squandered most of the power as heat in the connecting wires.

Edison’s approach prevailed for a while, with different companies scrambling to build neighborhood power stations. They were regulated only to the extent that their owners had to obtain licenses from local officials. Municipalities handed these licenses out freely, showing the prevailing laissez-faire attitude toward competition. Also, politicians wanted to see the cost of electricity drop. (A kilowatt-hour in the late 1800s cost about US $5.00 in today’s dollars; now it averages just 12 cents.)

It didn’t take long, though, before Samuel Insull, a former Edison employee who became a utility entrepreneur in the Midwest, realized that the technology George Westinghouse was advocating—large steam or hydroelectric turbines linked to long-distance AC transmission lines—could provide electricity at lower cost. Using such equipment, his company soon drove its competitors out of business. Other big utilities followed Insull’s lead and came to monopolize the electricity markets in New York, New Jersey, and the Southeast. But the rise of these companies was ultimately a bane to consumers, who had to pay exorbitant prices after the competition had been quashed.

Angered by the steep rates, consumers formed electricity cooperatives and municipal utilities. That in turn led Insull and his counterparts to plead with state officials for protection from this “ruinous” competition. Politicians complied, passing laws that granted the large electric power companies exclusive franchises in their areas in exchange for regulation of their prices and profits. The municipal utilities and electricity cooperatives continued to operate but in most cases never grew as large as the regulated for-profit (investor-owned) utilities.

This basic structure remained in place until the oil shocks of the 1970s. Real electricity prices rose by almost 50 percent during that troubled decade, despite having fallen virtually every year since the opening of Edison’s Pearl Street station. One culprit was the widespread use of imported oil. The United States then generated almost 20 percent of its electricity using fuel oil; today that figure is less than 1 percent. And many utilities had made some poor investments—primarily in nuclear power—which their customers had to pay for.

The 1970s also exposed problems in how the electric power industry was regulated. Power grids were growing in complexity as different utilities began interconnecting, and many regulators—particularly those whose appointments were political favors—didn’t understand the technical implications of their decisions. The combination of rising prices and obvious mismanagement led many large industrial consumers of electricity to push for deregulation.

The Public Utility Regulatory Policies Act of 1978 was the first shot fired in the ensuing battle. The new federal law allowed nonutility companies to generate electricity from “alternative” fuel sources (mostly natural gas), and it required utilities to sign long-term supply contracts with these new generating companies. The Energy Policy Act of 1992 expanded the pool of players in the wholesale electricity market by allowing financial institutions—Morgan Stanley being the first—to buy and sell bulk electric power. Yet neither act was effective in curbing electricity prices.

Two states, California and Pennsylvania, then decided to take more drastic measures. They established centralized spot markets for electricity and allowed individual customers to choose their electricity suppliers. While Pennsylvania’s experiment has largely run smoothly, California’s experience was quite different. After two years of reasonably stable operation, wholesale prices exploded in 2000, from a few cents per kilowatt-hour to more than a dollar per kilowatt-hour. One reason for those astronomical prices was that power-trading companies like Enron Corp. had figured out how to game the system. With retail prices capped by law at 6.7 cents per kilowatt-hour, two of the state’s three investor-owned utilities, Pacific Gas & Electric and Southern California Edison, ran out of money to pay for electricity. That triggered a second power crisis the following year, which forced the state to buy electricity from producers. The long-term contracts signed during that period of panic buying saddled California taxpayers with a debt of some $40 billion.

For Californians, at least, deregulation had lost its gloss. This turned out to be temporary: The state recently reintroduced centralized wholesale markets modeled after Pennsylvania’s. But has deregulation on the whole made things better or worse? Dozens of studies have attempted to answer that question. But you can’t simply compare states that have aggressively deregulated with ones that haven’t. That would ignore the fact that some states have built-in advantages that keep prices low: proximity to natural resources, a large base of generation capacity, and so forth. It also ignores what utilities and regulators would have done if deregulation had never happened.

To answer the question properly, you’d need to figure out what things would have been like in the absence of deregulation. And that’s well-nigh impossible. Of the various studies that have attempted to assess the impacts of deregulation, most have come from groups with a stake in the outcome of the regulatory reform process. So they tend to be either strongly for deregulation or strongly against it. In reality, deregulation has had both good and bad effects.

Consider a simple variable like the price of electricity. That competition will lead to lower prices is about as close to a universal truth as economics gets. But electricity seems to be an exception.

Here’s why: Under regulation, each generating plant is paid for its electricity based on its average cost plus some prescribed rate of return. In a competitive market, supply and demand set the price. That means that the last plant coming online to handle the load determines the wholesale price of electricity. All generators in the system are then paid that same amount for each kilowatt-hour they inject into the grid.

That might seem only fair, but you have to remember that not all electricity generators are created equal. In most places, coal and nuclear plants, which can’t be ramped up and down easily, produce the roughly constant base-load power feeding the grid. If more is needed, natural gas turbines then kick in. So in deregulated markets, the price of gas, which has historically been higher than that of coal or nuclear fuel, ends up controlling the wholesale price of electricity—allowing the owners of nuclear plants and efficient coal plants to earn much higher profits than they did under regulation. That’s why electricity prices in many places rose so sharply when natural gas prices skyrocketed at the turn of the millennium.

Other strange dynamics also come into play. For example, state political leaders realize that escalating or erratic electricity prices are bad for economic development (and their own chances of reelection). So they’ve fought hard to keep them low and stable by imposing rate caps and freezes. But many of these same states also compelled their electric utilities to divest themselves of generating capacity in an attempt to spur competition. And when electricity demand is high and the utilities don’t have enough of their own generating capacity, they’re forced to buy more on the spot market, where prices are volatile. The results have not been pretty. In 2000, one of California’s two largest utilities went bankrupt, and the other nearly did. And when regulators in Maryland finally allowed retail electricity rates in Baltimore to float with wholesale electricity prices, the local utility immediately announced a rate increase of 72 percent, leading to consumer outrage and eventually to the summary firing of the entire public utility commission.

Clearly, deregulation hasn’t been at all successful in bringing prices down. But has it made the companies that provide electricity more efficient? Very probably. Their labor costs have fallen, mostly through reductions in staff, while the reliability of their power plants has improved. The champions in this regard are the nuclear power stations, whose uptimes have risen from around 65 percent in the 1980s to over 90 percent today. This shouldn’t be a surprise. Because the construction costs of most of these plants have been paid off and because nuclear generators have very low operating expenses, the plants have become extraordinarily profitable. So their owners strive to have them online as much as possible, investing as needed to keep them well maintained.

Maintaining some other parts of the grid infrastructure has, however, proved to be more of a struggle. In the old days, investments in transmission lines and generating stations were determined by consensus between each utility and its regulator. Deregulation’s architects envisioned a different scenario—that entrepreneurial firms would automatically make the needed investments in hopes of profiting from them. That didn’t exactly happen. One thing deregulation definitely did do, though, was to change the mix of fuels in the U.S. generation fleet, shifting it away from coal and nuclear power toward natural gas. That’s because gas units are quick to build, and many are flexible enough to operate only when prices are high enough to warrant throwing their switches on. It helps, too, that natural gas is a cleaner fuel than coal and less controversial than nuclear power, which helps with public approval. Also, because companies generating electricity in a free market need to demonstrate a return on investment within 5 to 10 years, building big nuclear and coal plants, which usually take over a decade to complete, just isn’t an option. So more and more of the grid’s power comes from gas turbines, despite the high fuel costs.

The changing investment environment has also inflated the cost of building new infrastructure. The reason is obvious once you think about it. Regulated utilities can spread the burden of investment among all their customers, and the government guarantees that these companies can charge enough to recover their initial outlay and make a decent profit on it. So there’s little financial risk in building a new plant or transmission line, allowing the companies to attract low-priced capital. Not so with unregulated utilities, whose fortunes depend on an uncertain market. The greater risk they face means they must offer higher returns to attract investors, and these increased financing costs make capital projects more expensive.

Depending on market-based investment in transmission lines has proved especially problematic. Deregulation’s proponents believed that for-profit companies would recover the money they invested in transmission lines through “congestion pricing”—charging more when demand for these lines is high. Instead, lucrative congestion revenues have only given the owners of existing transmission lines an incentive not to build more capacity. And the general aversion people have to high-tension cables nearby—the “not in my backyard” effect—has made it almost impossible to construct new lines.

No great wonder, then, that investment in transmission lines and equipment has mostly been falling since the 1970s. Many people paid little notice to that fact, but the Northeast blackout of 2003 was a wake-up call. It began on a hot August afternoon with several seemingly trivial outages of transmission lines in Ohio, but by nighttime a series of cascading failures grew to plunge more than 50 million people in the Midwest, the Northeast, and Ontario into darkness. This episode convinced even skeptics that investment in the nation’s electricity grid was lagging.

Given deregulation’s checkered record, you have to wonder how well competitive electricity markets will handle upcoming challenges. In particular, how will they reconcile the need for reliable, low-cost power with the environmental costs of producing it?

One much discussed way to use markets to benefit the environment is to put a price on emissions of carbon dioxide and other greenhouse gases. Many countries have already done this. But unless the price is set a lot higher than in Europe, U.S. utilities and generating companies aren’t going to be abandoning their carbon-spewing coal plants anytime soon—they’re just too profitable. Putting a dollar value on greenhouse gases might encourage some generators to invest in less carbon-intensive power sources where they can, but only if proper laws and regulations are in place to lower the risk. And that won’t happen overnight.

In the meantime, 32 of the 50 U.S. states are trying to boost the use of renewables by mandating “renewable portfolio standards.” These standards force utilities to buy considerable quantities of wind and solar power but also give them the freedom to shop for the least expensive sources. Also, the U.S. Department of Energy wants 20 percent of the nation’s electricity to come from wind power by 2030 [PDF, 9.5 MB]. Government bodies are taking these actions because consumer demand alone hasn’t sparked much renewable generation. That’s not surprising. The wind and sun are notoriously fickle, which forces system operators to maintain plants that can fill in when necessary. Those backup generators are expensive, as are the transmission lines needed to link most renewable resources, which are located in sparsely populated areas, to the people using electricity. So the cost of generating “green” electricity is generally higher than the price it can command.

Renewable portfolio standards create a not-so-free market (but a market nevertheless) for wind and solar power while also pressuring these producers to keep their prices down. Policymakers in both regulated and deregulated states are also hoping to harness other market-based approaches to reducing electricity consumption. Using less electricity not only helps the environment, it can be just as effective as increasing supply in maintaining the reliability of the grid. And it’s less expensive to boot.

The most straightforward way to discourage electricity use is, of course, to charge a lot for it. But U.S. consumers, and the lawmakers who represent them, are never too keen on that. Another strategy now being explored—one that’s less of a political hot potato—is to have utility operators offer their customers compensation for reducing their demand for electricity during times of peak use. A reduction in demand allows utilities to avoid having to buy so much electricity when wholesale costs are at their highest. This approach provides an enticement to consumers to react to market signals, even if they are not yet ready to face them squarely in the form of higher prices.

Another advance that probably wouldn’t have come about without deregulation is the emergence of small-scale, distributed generation, particularly from renewable sources such as rooftop solar panels. What’s happening in many places is that customers are producing some electricity on their own while still attached to the grid. So they can offset some of the electricity they would otherwise consume, perhaps even spinning their meters backward at times. Although this practice competes with the electricity that the utility sells, more and more utilities are nevertheless allowing it to a greater or lesser degree.

In hindsight, the electricity crisis in California and the myriad problems with deregulation in other parts of the country could have been anticipated. Given the complex market rules, concentrated supply, and largely inelastic demand, it’s really no wonder that Enron, other energy-trading companies, and the electricity suppliers themselves found clever ways to manipulate markets.

Would U.S. consumers have been better off if the industry had remained strictly regulated? It all depends. If your goal is low electricity rates, maybe the answer is yes—but don’t forget that bad regulatory decisions helped drive up electricity prices in the first place. If, however, you want the ability to feed power from your rooftop solar panels into the grid, the answer is probably no.

The real question facing the United States now is whether it can maintain reliable electricity grids without building lots of new transmission lines and big power plants. The only realistic alternative to such massive construction projects is for the generation of electricity to become more widely distributed, coupled with substantial efforts in energy efficiency. Electricity markets will surely have to become more expansive and open to accommodate that inevitable evolution. And they will also require new technical standards and, yes, some new forms of regulation.

About the Author

Seth Blumsack, an economist in the College of Engineering at Pennsylvania State University, says of his colleagues, “Engineers have this idea that economics is about money.” But he warns them “not to depend on him for stock tips.” He does have lots to say, though, on electricity economics (as a part of the Penn State Electricity Markets Initiative), which he shares in “How the Free Market Rocked the Grid.”