This spring, construction is set to begin on the first projects coordinated through Power Africa, a multibillion-dollar Obama administration initiative that seeks to double access to electricity in sub-Saharan Africa within five years, and in some cases accelerate reforms in the governments of the nations involved. Among the initial projects are wind farms in Kenya and Tanzania, and a solar project in Tanzania.

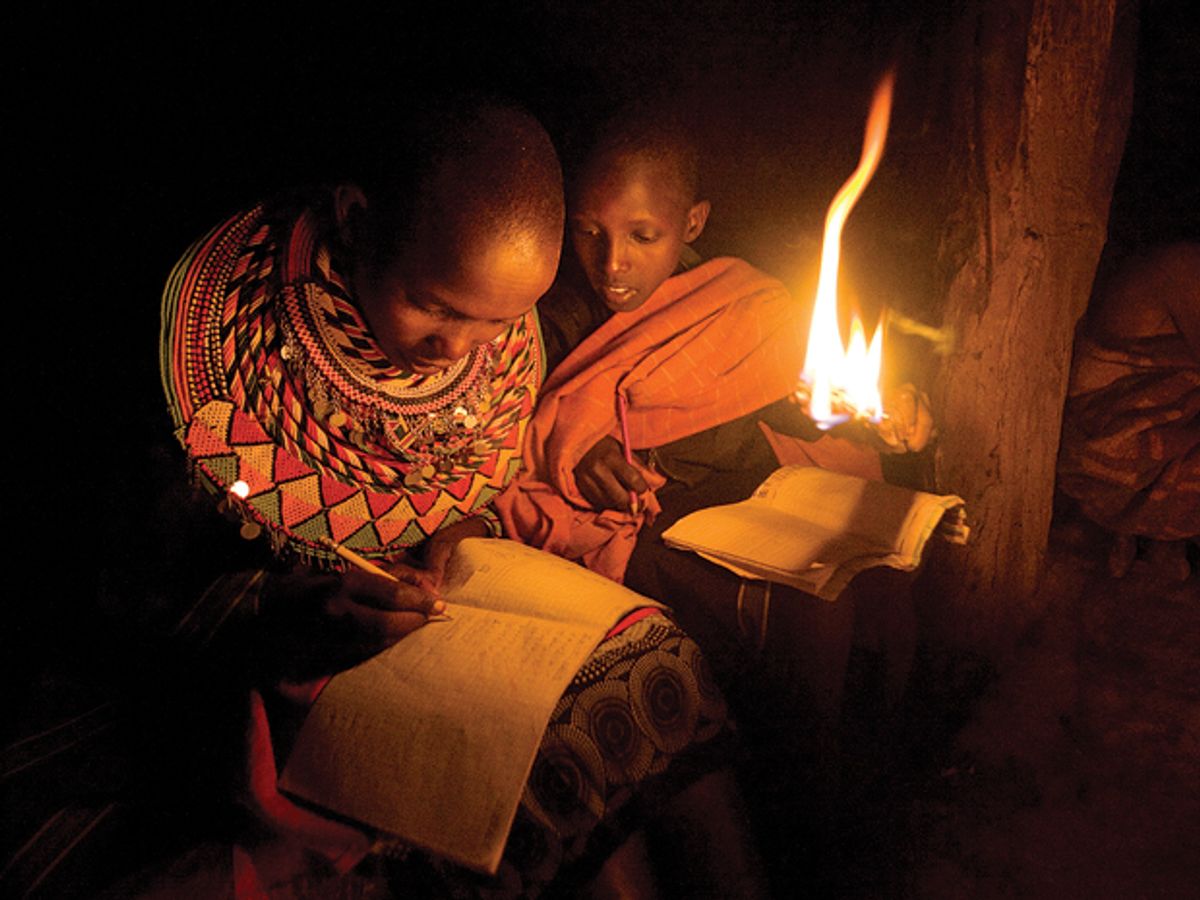

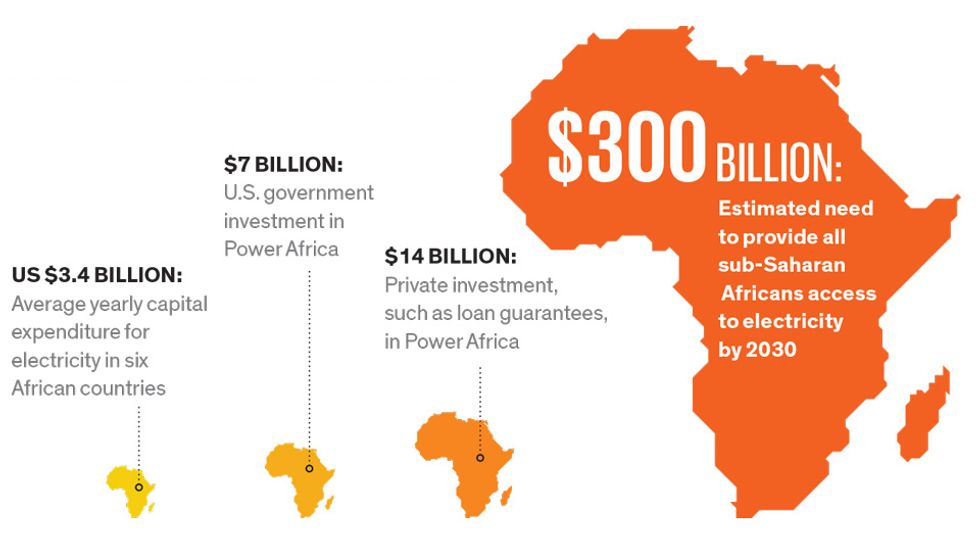

More than two-thirds of the 800 million people in sub-Saharan Africa have no access to electricity. Announced last summer, Power Africa is coordinating efforts among U.S. government agencies and private investors to try to reduce that number. The effort initially focuses on six countries: Ethiopia, Ghana, Kenya, Liberia, Nigeria, and Tanzania. The goal is to add 10 gigawatts of electricity generation capacity, which should increase electricity access by at least 20 million households. The U.S. government will provide more than US $7 billion in financial support and loan guarantees, as well as the support and expertise of 12 U.S. government agencies. Private investors have committed more than $14 billion in loans, loan guarantees, and equity investment, according to the White House.

The amount is small compared to developed-world standards: The U.S. electric power industry had capital spending of $90.5 billion in 2012, according to the Edison Electric Institute. And it is a drop in the bucket of what’s needed. “Power infrastructure in sub-Saharan Africa suffers from massive degrees of underinvestment as compared to the developed world,” says Andrew Herscowitz, coordinator for Power Africa. According to the International Energy Agency, sub-Saharan Africa will require more than $300 billion to achieve universal electricity access by 2030. Nevertheless, the investment would be a significant improvement. According to figures from the World Bank, the six countries have averaged a combined investment of just over $3 billion a year in their electricity infrastructure.

The White House touts the initiative as a new model of foreign aid. Rather than just giving grants and loans, Power Africa is aimed at fostering collaboration among U.S. government agencies and corporations in an effort to increase private investment that could lead to better access to electricity. “We’re taking all our tools and working together on common goals,” says Herscowitz. For example, Tanzania’s standard power purchasing agreement was for 15 years, but in order to obtain financing, one solar power deal needed a 20-year agreement. Power Africa helped convince the government to make a 25-year deal, he says.

“At the same time, we’re trying to use these [financial] transactions to push key reforms that will stimulate more private sector investment in these countries,” says Herscowitz.

What are the key reforms? It depends on the country, but few doubt that widespread corruption has inhibited investment in the past and could continue to do so. Herscowitz says that where corruption is a problem, Power Africa is pushing for greater transparency.

Nigeria is an example of both the progress and the challenges. In that country, “massive, widespread, and pervasive corruption affected all levels of government,” according to a report by the U.S. State Department. But the Nigerian government, now a democracy, has made progress in privatizing its power industry. Paul Hinks, CEO of U.S.-based Symbion Power, which is involved in several Power Africa projects, says Nigeria “is probably going to become a model for the rest of Africa” in that regard. In one Power Africa project, 15 companies plan to participate in this privatization program, according to the White House.

The “unique political environment” in some countries is one of the main challenges for private investors, says Bob Chestnutt, a project director with Aldwych International. This London-based boutique firm develops power projects focused on sub-Saharan Africa. In Kenya, for example, both President Uhuru Kenyatta and his deputy president, William Ruto, are charged with inciting violence that killed at least 1300 people in the wake of a disputed election in late 2007. If the trial in the International Criminal Court goes forward, it could destabilize the investment environment within Kenya, says Chestnutt.

Hinks, who is also chairman of the nonprofit Corporate Council on Africa, admits that corruption is a problem but asserts that’s no reason not to invest. “You can do business in Africa without getting involved in corruption,” he says. “A lot of U.S. companies say they don’t do business in Africa because of corruption. But those same companies do business in...other places where there is also corruption.”

The other big challenge for expanding electricity access in Africa is logistical, says Chestnutt. The places with the least access are in rural, remote areas. Aldwych is planning two wind farms under the Power Africa initiative—one in Tanzania and one in Kenya. The company hopes to start construction on a 300-megawatt installation at Lake Turkana, Kenya, in April. However, it’s located “in a barren desert wasteland. It’s 1200 kilometers from the nearest port, and the last 200 km of roads will need to be upgraded,” explains Chestnutt.

Such logistical problems are why Power Africa has a strong focus on off-grid and minigrid projects and on using renewable energy sources. For example, General Electric and the U.S. Africa Development Foundation launched a competition, called the Off-Grid Energy Challenge, to encourage African individuals and companies to come up with innovative approaches to generation and distribution. In the first contest, held last fall, three Kenyan and three Nigerian groups were awarded grants of up to $100 000 to develop their projects.

At this stage Power Africa is focused more on measuring the closing of financing deals than on the start of construction. As of February, 26 deals were in the works for projects that could provide 5.2 GW of electricity. Power Africa officials expect to have 4 GW reach “financial close” by the end of the year.

At the very least, Power Africa has served to stoke interest in the continent by U.S. companies and investors. “Power Africa has prompted a sea change in the attitude of U.S. institutions,” says Chestnutt. “There is much more focus and drive coming from the United States because of this initiative.”

This article originally appeared in print as “Africa Powers Up.”

This article was updated on 21 February 2014.