What began as a plaything among technology buffs in the United States has quietly evolved into the fastest-growing wireless data application in the world. All over, networks based on the IEEE's 802.11b wireless local-area networking standard, known also by the commercial trademark Wi-Fi, have been springing up--and not only in businesses and other self-contained organizations but in public places like waiting rooms and coffee shops as well. Now, increasingly, service companies are stringing these "hotspot" networks together to create what could soon be the world's largest wireless data network.

Wi-Fi communication cards for devices like laptops are selling at an estimated 1-1.5 million per month, and most city centers offer scores of opportunities for people carrying equipment outfitted with the cards to access IEEE 802.11b networks. In the central part of Manhattan alone, in just 90 minutes, participants at a recent hackers' convention were able to detect some 450 such networks. Picking up on a tradition once practiced by wandering hobos during the Great Depression, data-hungry itinerants have taken to marking sidewalks to flag opportunities to hitch a ride in nearby corporate 802.11 networks.

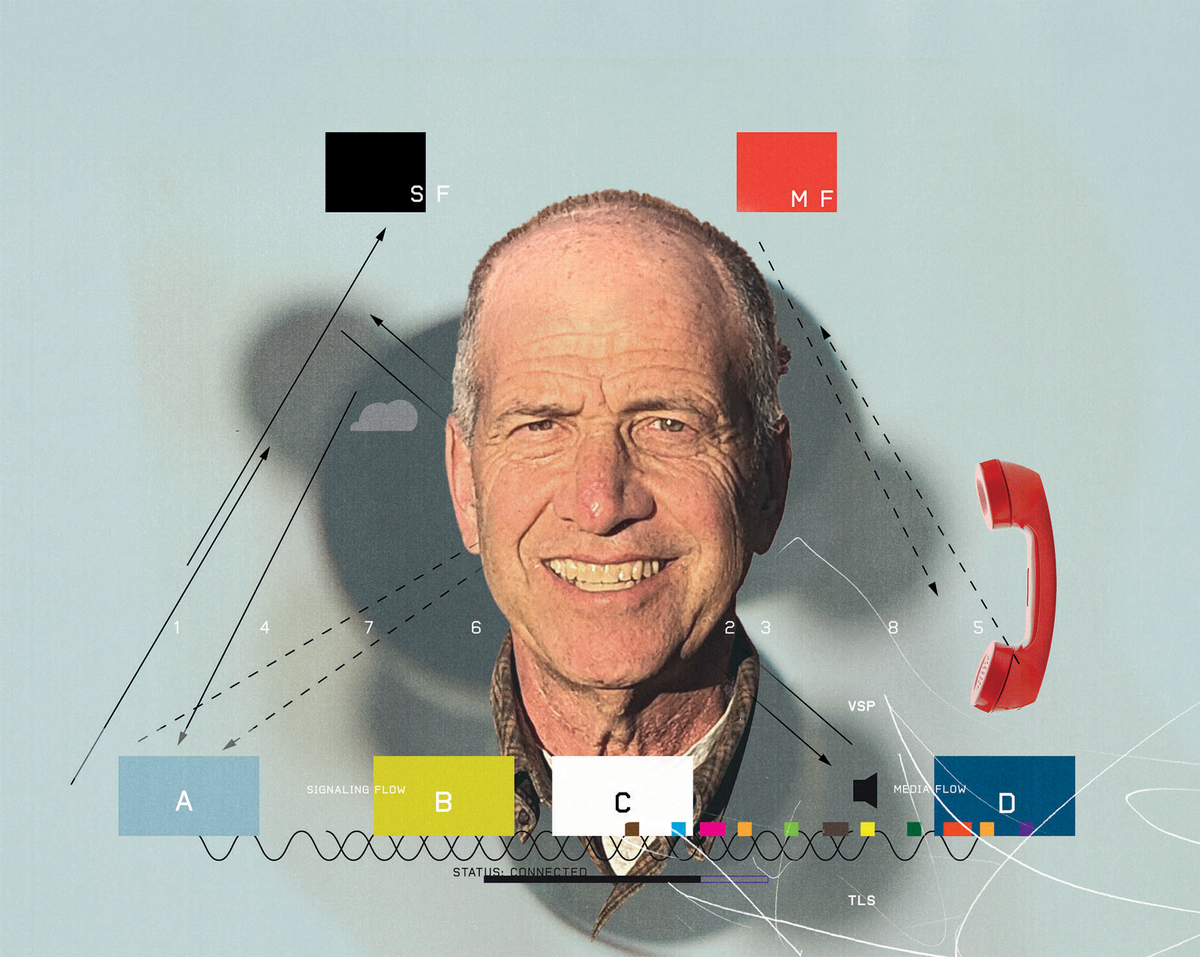

It's an annoyance for businesses attempting to secure already busy local networks against intruders, and one that's being addressed by evolving IEEE 802.11 standards [see , "The ABCs of IEEE 802.11"].But in an otherwise struggling communications sector, it also could be a gold mine--if only service providers can figure out ways of standardizing access to public local-area networks across wider areas and obtaining revenues for services offered over those networks.

With just such prospects in mind, U.S. industry heavyweights, including IBM, Intel, AT and T Wireless Services, and Verizon Communications, disclosed in June that they may soon launch a company--code-named Project Rainbow--to provide a national Wi-Fi service for business travelers.

While Rainbow may be the biggest project of its kind in the United States, it's just the latest of many. Boingo Wireless Inc., iPass Inc., and Sputnik Inc. are among the new wireless Internet providers selling services that let customers use wireless access points around the country.

Europe--the new frontier?

It is in Europe, however, where the creation of transregional Wi-Fi networks may be taking off the fastest and where opportunities and challenges are coming into sharpest relief. To be sure, IEEE 802.11b has prompted some serious concern about its potential impact on third-generation mobile technologies. The Europeans have championed 3G cellular telephony in global standards organizations, as a successor to its hugely successful Global System for Mobile Communications (GSM).

Yet Wi-Fi also stands to benefit from the fact that GSM systems are found everywhere in Europe, which creates opportunities for synergies, and from the various kinds of cards Europeans are accustomed to using to make their phone systems work to best effect. With wireless connections and cards for user authentication and billing, European providers are in a position to offer secure IEEE 802.11 roaming on a continental scale.

In July, TDC Mobile, the mobile arm of Danish incumbent telephone company Tele Danmark, signed a contract with Erics-son to deploy a Wi-Fi system to link with GSM. The Danish operator plans to integrate an IEEE 802.11 service into its GSM network, using mobile phones and their subscriber identification module (SIM) cards to deliver passwords that control access. (All GSM phones contain SIM cards, which include the user's phone number, account information, phone directories, and so on.)

In the central part of Manhattan alone, in just 90 minutes, participants at a recent hackers' convention were able to detect some 450 IEEE 802.11b (Wi-Fi) networks

The integrated TDC-Ericsson system "will give the company a lower-cost solution that shares back-office functions and provides added security for customers," says Michael Ransom, a senior analyst at the consulting firm Current Analysis Inc. (Sterling, Va.). For example, when a user logs into a Wi-Fi network, the hub can send a message to a GSM server, which in turn can generate a short message back to the user's cellphone, providing a one-time password to access a specially encrypted Wi-Fi link.

Spotting the same opportunity, Finland's Nokia Corp., the world's largest maker of handsets, has developed an integratedWi-Fi/SIM card, which also uses the GSM network for authentication. And local GSM mobile operator Sonera Corp. (Helsinki) is offering a roaming service between its public local-area networks, also relying on SIM cards for authenticated access. Sonera argues that SIM authentication is far more secure than relying on user names and passwords.

T-Mobile USA (Bellevue, Wash.), a subsidiary of Deutsche Telekom AG, and the group's U.S. wireless subsidiary VoiceStream Wireless Inc., are collaborating closely on a transatlantic Wi-Fi/GSM system. T-Mobile has begun deploying public hotspots in Germany and in some European airports in cooperation with the German airline Lufthansa AG. Since acquiring MobileStar Networks Corp., the wireless Internet service provider that had a service contract with Starbucks, VoiceStream now plans to expand Wi-Fi service to more than 70 percent of the chain's ubiquitous U.S. coffee shops.

The list of hotspot providers doesn't end there, and there's no saying where it will end. Among the incumbent European telephone companies to have announced plans to install public Wi-Fi hubs in recent weeks are Britain's BT Group PLC (BT), Spain's Telefonica SA, and Sweden's Telia AB. For example, a Wi-Fi service called HomeRun, launched two years ago by Telia Mobile AB (Stockholm), is already available at 450 locations in the Nordic region and at several airports elsewhere. And in June, Telia Mobile and the Italian unit of Megabeam Networks Ltd. (London) signed what both companies claim to be Europe's first cross-border roaming agreement for Wi-Fi. The companies were running a test phase of the service until31 August, allowing customers to roam for free. After the trial, the companies will introduce a prepaid tariff for roaming, said Ryan Jarvis, CEO of Megabeam.

Megabeam already operates IEEE 802.11b networks in Belgium, Germany, the Netherlands, and the UK. It plans to have networks--mostly in key airports, train stations, and hotels--in all major European markets, except for the Nordic region, where it will cooperate with Telia, according to Jarvis.

Overcoming resistance

Few will dispute that some of Wi-Fi's growth will be at the expense of 3G cellular systems, designed to provide Internet access and data transfer, and the General Packet Radio Service (GPRS), which was visualized as a transition to 3G. As it is, GPRS has been off to a slow start in Europe, and 3G's introduction is way behind schedule.

In July, Spain's Telefonica--after spending around

6.5 billion (about the same in U.S. dollars) to acquire 3G spectrum--decided to drop plans to build 3G networks in Germany, Italy, Austria, and Switzerland. Other operators are expected to follow.

The British consulting firm Analysys Consulting Ltd. (Cambridge) reckons that mobile operators providing GPRS and 3G services will lose 3 or 10 percent, respectively, of their total data revenue to public wireless LAN services in 2006. One reason is IEEE 802.11's superior speed. Another, perhaps of even more importance, is price. According to Analysys, the current cost of transferring 1 Mb over a public network is between 0.2 and 0.4 eurocent, compared with between 3 and 38 eurocents for GPRS networks.

Yet Wi-Fi and 3G may still prove more complementary than competitive. "Cellular-based data services will give users seamless coverage and mobility, while local-area services will give them high speeds in select areas," comments Ross Pow, managing director of research at Analysys.

Under the circumstances, Europe's spectrum regulators have begun to open doors for IEEE 802.11. So far, networks have for the most part been built around Wi-Fi, which operates in the unregulated 2.4-GHz band. But IEEE 802.11a, providing higher data rates and greater security, depends on the 5-GHz band, which is restricted in several European countries.

The French and the British governments agreed in June to drop their bans on using the 5-GHz band for IEEE 802.11a, and German spectrum authorities have made concessions, too.

Vendors, including Intel Corp. and Proxim Inc., say they're shipping IEEE 802.11a equipment to several European countries, including Belgium, Denmark, France, Sweden, and the Netherlands. It's still not clear, however, if the 5-GHz band will be available all across Europe, or anywhere else in the world, for that matter.

Provision of seamless service between IEEE 802.11 and GPRS/3G networks could take years to achieve, says Declan Lonergan, an analyst at the London office of the Yankee Group. "Technological solutions for authentication, billing, and quality of service management must be provided before internetwork roaming becomes a commercial reality," he noted.

Following the money

Payment schemes are still fluid in the nascent Wi-Fi market. While some operators, such as Norway's Telenor AS (Oslo), favor a volume-based model, others believe in an "all-you-can-eat" flat rate. Still others favor prepaid cards.

As long as users stay in one hotspot, billing isn't a big issue. Once they move, it becomes one. Operators will need to agree on revenue-sharing models. Interconnection fees are a tricky issue in any market, but they could trip up many of the smaller, less experienced players in the Wild West environment that Wi-Fi has created.