Eileen Tanghal, cofounder of the venture capital firm Black Opal Ventures, didn’t set out to be a venture capitalist. The electrical engineer left her job at a semiconductor startup to pursue an MBA so she could better understand the business side of technology. During a summer break, she was chosen for an internship with a venture-capital company that funded high-tech startups. Her engineering background got her the position. Tanghal went on to work for several tech-focused VCs before launching Black Opal in 2021.

“My cofounder, Tara Bishop, and I began as angel investors, investing our own money,” she says. “We invested primarily in early-stage startups, meaning they were still developing and validating their idea for a product and had raised little or no money yet.”

In 2022, Black Opal, based in New York City, expanded to managing a fund that invests other people’s and institutions’ money, primarily funding startups in health care and life sciences.

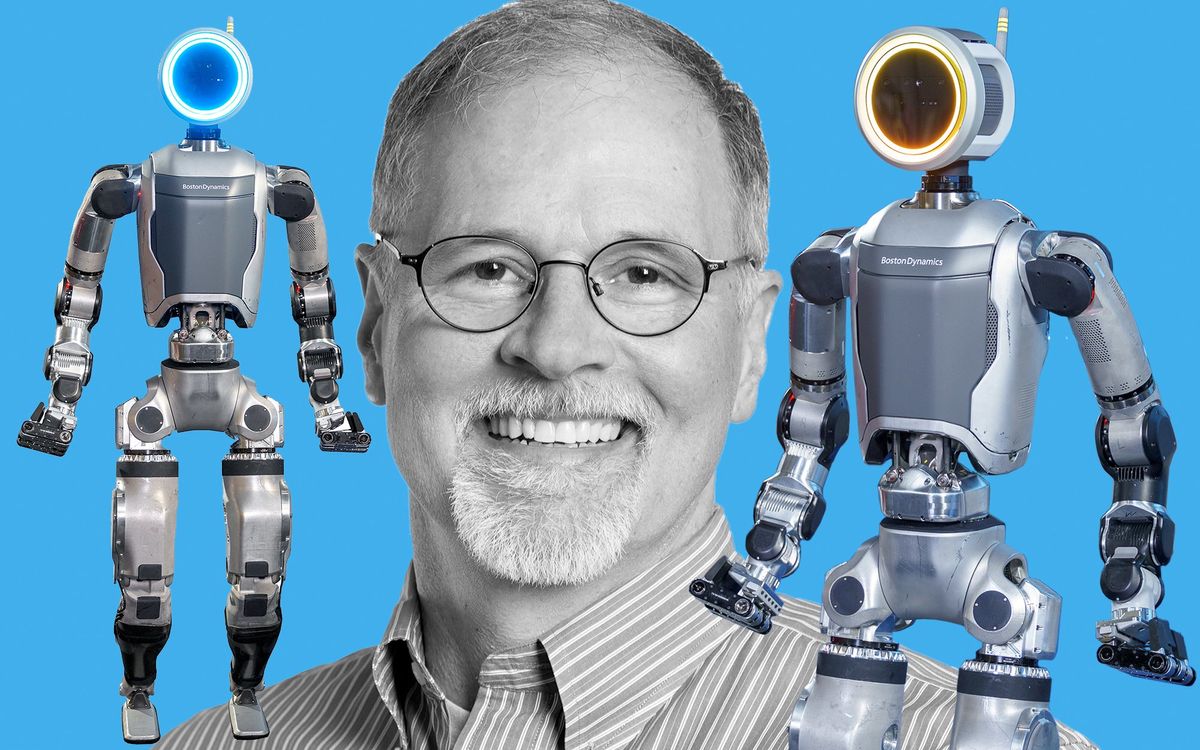

Eileen Tanghal

Employer:

Black Opal Ventures, New York City

Title:

Cofounder

Education:

MIT, London Business School

“We want to improve health care accessibility and affordability,” Tanghal says. “To do this, we look at companies working with emerging technologies and also those applying technologies that are well established in one industry but not yet leveraged in health care or life sciences.”

The IEEE member is also working to hire more women and underrepresented minorities within the Black Opal portfolio, including the recommendation of specific individuals for leadership positions within the companies it funds. A diverse workforce, says Tanghal, produces the most inclusive and most profitable products and services.

From engineer to investor

Tanghal earned a bachelor’s degree in electrical engineering and computer science, with a minor in economics from MIT in 1997. The classes she took on semiconductors led to her first job, at PDF Solutions, a startup semiconductor consultancy firm, in Santa Clara, Calif. She specialized in optimizing the process of making transistors and improving manufacturing yields.

“My experience at PDF included using digital twins—which are digital representations of real-world products and processes—to improve development, testing, and support of our products,” she says. “I also did advanced data analytics to help semiconductor manufacturers improve their fabrication yield.”

After PDF, she spent nearly a year as product manager at AllAdvantage, a short-lived Internet advertising company. Tanghal then decided to pursue an MBA from the London Business School.

“I knew I needed to pick up more skills in order to advance my career in product management,” she says. “It turned out I was one of a handful of students with a technology background and startup experience. Many classmates came from investment-banking or consulting companies.”

“There’s strong evidence that female-managed U.S. funds outperform all-male managed funds. Increasing the number of female leaders isn’t just the right thing to do but also the smart thing to do.”

A turning point came when she applied for a summer internship with Amadeus Capital Partners, a London-based firm that invests in European high-tech companies.

One of Amadeus’s cofounders was Hermann Hauser. Earlier in his career, he had cofounded Acorn Computers, which developed one of the first reduced-instruction-set personal computers and had spun off the chip-design company Arm. During Tanghal’s interview, Hauser talked about a plastic semiconductor company he had invested in. Drawing on her experiences at PDF, she asked him about the electron mobility in plastic versus silicon, which is a measure of semiconductor behavior.

She later learned her question made her stand out and got her the internship, one of just seven MBA students out of around 100 to get an offer from Amadeus. After receiving her MBA in 2003, the company hired her as a junior member of its investment team, and Hauser became one of her mentors. She went on to work for other VCs, where she invested in startups working on semiconductors, communications, imaging, and artificial intelligence.

Many of the technologies Tanghal is currently investing in are ones she learned about through her previous job as managing director at In-Q-Tel, a not-for-profit venture capital firm in Menlo Park, Calif., that funds information technology for U.S. and international defense and intelligence agencies.

Tech knowledge with industry experience

Successful technology investing calls for knowledge of a market’s needs as well as the technologies that are or aren’t yet being fully embraced, Tanghal says.

“Based on my experience of being a member of the board of directors for 40 companies, many of today’s technology vendors want to get into health and life sciences, but few have the knowledge of what these industries need,” she says. “And companies already in these fields often don’t know what technology is available, or what’s already on the market.”

For example, as an investor, she looks at pharmaceutical companies’ initiatives and how they can be improved upon, such as through drug discovery, the use of new messenger RNA for vaccines, and other therapeutics.

A focus on diversity, equity, and inclusion

Tanghal believes it’s the responsibility of Black Opal and the companies it works with to help increase the number of women and those from underrepresented groups in high-level investment positions.

“Less than 6 percent of VC firms based in the United States are led by women,” she notes. “There’s strong evidence that female-managed U.S. funds outperform all-male managed funds. Increasing the number of female leaders isn’t just the right thing to do but also the smart thing to do.”

Black Opal has invested in these startups:

- Conceivable Life Sciences (New York City) is applying semiconductor manufacturing techniques such as advanced micrometer-level robotic automation to help reduce the high cost of in vitro fertilization at fertility clinics.

- Empatica(Boston) is developing AI algorithms and wearable sensors to remotely monitor patients for medical conditions. The company’s Embrace2 wearable detects possible epileptic seizures and immediately alerts caregivers. The wearable is so far the only such consumer device cleared by the U.S. Food and Drug Administration for adults and children ages 6 years old and and up.

- Optellum (Oxford, England) creates AIs for the earlier diagnosis of lung cancer. Most cases currently aren’t diagnosed until they are already in stage III or IV, contributing to lung cancer being the leading cause of cancer deaths in the world.

Through its Fellows Program, Black Opal hires MBA students to work part time and teaches them about investing.

Most of the recruiting for the program is done by Tanghal and cofounder Tara Bishop. The company has six employees and an advisory board of seven.

“In the 20 years I have been recruiting associates, this year is the first time that almost 70 percent of the applicants were women,” Tanghal says. She suspects that many of the women candidates applied because “they saw two women heading the firm.”

Another reason for promoting DEI, she says, is to make health care more equitable. “If women and minorities aren’t properly represented at the board level, the company’s products may not address their health issues and other concerns.”

Advice for becoming an investor

Historically, high-tech venture-capital firms tended to hire people who had an MBA. That’s no longer the case, Tanghal says.

“Nowadays you don’t have to have an MBA to become an investor,” she says, “because now there’s more opportunities to learn about investing. I prefer candidates who can dig deeper into the target-market sector and understand the potential technologies being developed.”

Another way investors can improve their understanding of a prospective company, she says, is to seek out opportunities to “sit next to the chief technical officer at a meeting and talk to them about what they are working on.” She also recommends doing online research and taking advantage of IEEE member resources and its networking events. For Tanghal, combining tech savvy with business focus is the perfect fit.

“My passion—and Black Opal’s focus—is to find or make new matches between technologies and health-care applications, and to make money for our investors while improving health care for all.

- How This Startup Cut Production Costs of Millimeter Wave Power Amplifiers ›

- A Young Professional on the Power of Mentorship ›

- This VC Is Betting Big on Flying Taxis and Scooters ›

Daniel P. Dern is a freelance journalist. He writes about the careers of engineers as well as a variety of technology topics.