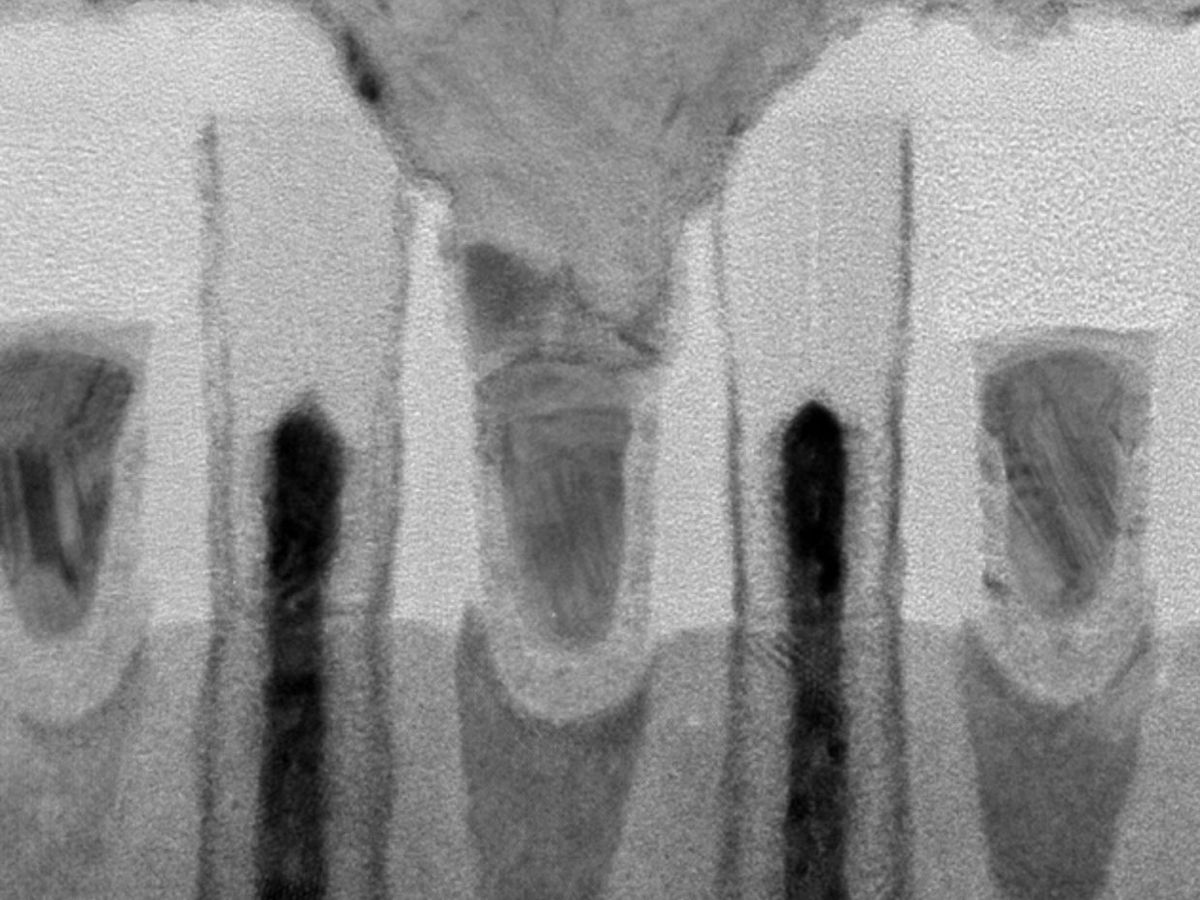

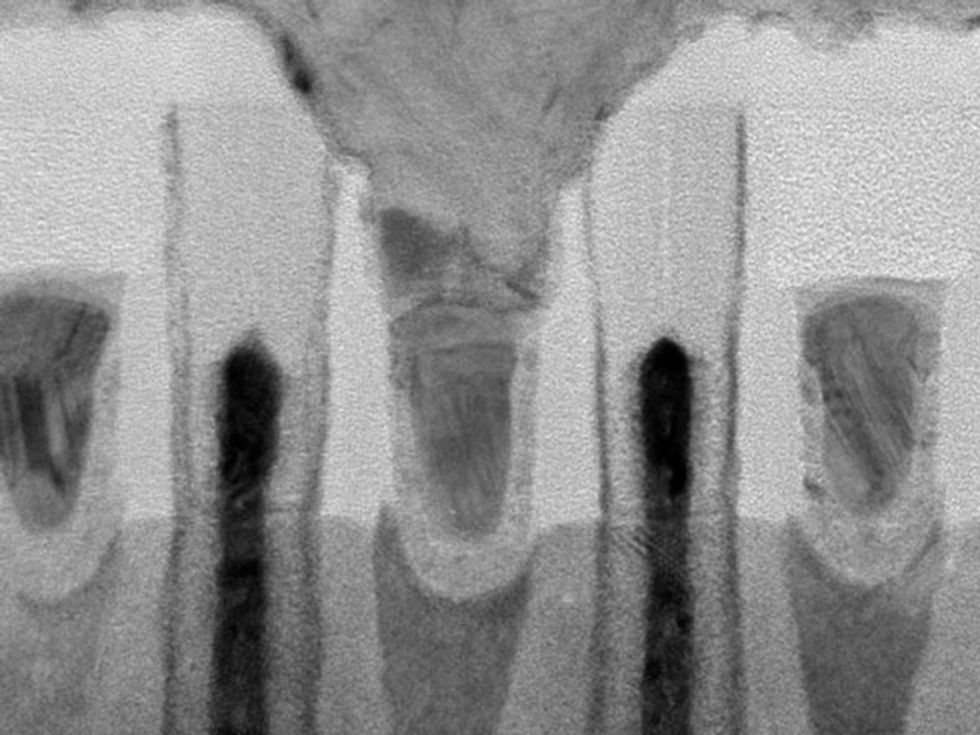

Today’s computer chips contain tens of kilometers of copper wiring, built up in 15 or so layers. As the semiconductor industry has shrunk the size of transistors, it has also had to make these interconnects thinner. Today, some wiring layers are so fine that electrical current can actually damage them. And chipmakers are running out of new ways to deal with this problem.

Companies are now eyeing other materials, such as cobalt, ruthenium, even graphene, to replace copper for on-chip wiring. In December at the IEEE International Electron Devices Meeting (IEDM), in San Francisco, some seemed ready to anoint cobalt as the chosen metal. Intel described adopting the metal in its 10-nanometer chips’ finest interconnects; Intel and GlobalFoundries both presented details about the performance of devices that rely on cobalt as a replacement for other electrical contacts currently made of tungsten.

The problem they’re trying to solve stems from basic physics: The narrower a wire (and the longer it is), the higher its electrical resistance. “Scaling is always bad for wires,” says Daniel Edelstein, a research fellow at the IBM Thomas J. Watson Research Center, in Yorktown Heights, N.Y. One of the chief architects of the technology that allowed IBM to switch from aluminum to copper in 1997, Edelstein knows his interconnects.

Copper boasts lower resistivity than aluminum, tungsten, and even cobalt. However, copper is particularly vulnerable to another problem at small scales called electromigration. As electrons speed through ultrathin wires, they dislodge atoms in the metal, bumping them out of the way like a harried commuter jostling a tourist off the sidewalk.

To protect copper interconnects, the thin wires are lined with other materials, such as tantalum nitride or even cobalt. “Copper moves easily, and you need a 1- to 2-nm barrier to contain it,” says Kevin Moraes, a product manager at Applied Materials, a supplier of semiconductor equipment.

As copper interconnects get smaller, the tantalum nitride liner remains relatively thick—it’s difficult to make the liner much thinner than a nanometer or so, and it reaches a point where there’s more liner than wire. “The liner steals area from the copper and raises line resistance,” says Edelstein.

Because of copper’s limitations, says Moraes, wiring is poised to cause a major bottleneck for the semiconductor industry. “If you can’t manage the wiring, you’re not going to get the benefits of your transistors,” he says.

Cobalt has three times as much inherent resistivity as copper but is far less prone to electromigration. For that reason, manufacturers are switching to cobalt for the metal layers that make up short-range connections within and between transistors. In other chip layers, the wires are thicker and connect over longer distances, so sticking with copper is best.

At IEDM, Intel reported that moving to cobalt interconnects for the finest-featured two layers of its 10-nm process technology, where interconnects are smallest, reduces electromigration by a factor of 5 to 10 and lowers resistance by a factor of 2. These improved interconnects should help the semiconductor industry shrink transistors ever further—without tripping over a wiring problem.

Intel is the first company to switch from copper to cobalt for this part of the chip. For its process update, the company also changed from tungsten to cobalt for the layers of metal that contact transistor gates. Tungsten had been the metal of choice because it is resilient and doesn’t allow electromigration to knock it around. But tungsten has high resistance.

GlobalFoundries also described a switch from tungsten to cobalt in its 7-nm process at the December meeting. Applied Materials’ Moraes says other customers are exploring this change as well. So far, chipmakers such as Samsung and the Taiwan Semiconductor Manufacturing Co. have not spoken publicly about adopting cobalt.

“The biggest issue is where to insert a new technology,” says Dan Hutcheson, CEO of semiconductor consulting company VLSIresearch. “If you insert early, you incur a lot of costs. Intel is willing to pay a premium for performance, and they have the scale to debug new materials.”

But Hutcheson notes that the proof is in the products. “You can announce it in a paper, but the real test is when they manufacture it and make money from it.”

This article appears in the February 2018 print magazine as “Cobalt Could Untangle Chips’ Wiring Problems.”