You might think of it as putting more backbone into a power line. At least a couple of companies are doing it—they’ve developed high-voltage power cables that don’t sag nearly as much as the lines they would replace. No, the power utilities are not replacing the aluminum that conducts the current; they’re replacing the steel core that gives the cable its strength. The reason: as steel heats because of the current in the aluminum, it sags a lot, sometimes so much that a power line can touch a tree limb and trigger a blackout.

A handful of utility companies are testing the new high-voltage cables in the United States. And one cable—from Composite Technology Corp. (CTC), of Irvine, Calif.—will be installed beginning this summer on a new 60-kilometer-long power line in China’s Fujian province.

Utah Power, a Salt Lake City utility that is owned by PacificCorp, in Portland, Ore., strung CTC’s cable in January. The company recabled a 10.8â''km line with CTC’s low-sag, composite-core transmission cable. And six months before that, Xcel Energy Inc., of Minneapolis, turned on a 16-km line outfitted with a low-sag cable produced by 3M Co., of St. Paul, Minn [see photo, " "]. The new power lines look like the cables already in service, but because of their novel materials, they can help alleviate some chronic problems on the grid. The two new cables are made to better resist stretching and sagging at high temperatures.

3M Co.’s composite-reinforced cable

Most of the power lines you see are 1950s-vintage steel-reinforced aluminum conductors. The aluminum is wrapped around a steel bar that maintains its stiffness at temperatures up to about 100 °C, which is roughly the temperature a 230â''kilovolt line will reach when it is transporting its average load of 400megavolt-amperes. But if the current gets too high and the temperature exceeds the cable’s thermal rating, the steel loses its tensile strength and the power line sags.

Sagging power lines touching overgrown trees have been a contributing factor in major power outages, such as the one on 14 August 2003, which started the chain of events that darkened eastern parts of the United States and Canada. A transmission line sagged and touched the top of a tree that had encroached on the line’s right-of-way, causing a short circuit. Circuit breakers immediately cut the current in that line, but the current was diverted to other cables, which then overloaded.

Sagging power lines have become a problem in recent years, because electricity demand has increased and long-distance power transfers have soared as systems have accommodated electricity trading. Because of the difficulty that utilities have in obtaining public approval for new rights-of-way, transmission capacity has not kept pace.

Less sag is not the only improvement in these two new cables. Both have composite cores that are thinner and lighter than the steel they replace. Hence, the cross section of a cable of the same overall thickness as today’s typical line can contain more aluminum, giving it more current-carrying capacity. That—and the fact that the new cables can operate at temperatures of around 200 °C—means that up to twice as much current can be transmitted, with less sag than before.

Though CTC’s composite core is rated for 180°C, the company says that in trials, it sagged one-tenth as much as steel would when the temperature of the conductor was raised to 210°C. That stands to reason, because the composite’s coefficient of thermal expansion—its susceptibility to stretching when heated—is 1.6 x 10â''6/°C, about one-sixth the coefficient of steel. Utah Power says that because of its higher current-carrying capacity, the CTC cable could allow the utility to meet projected demand for electricity for at least the next 15years without any new transmission corridors.

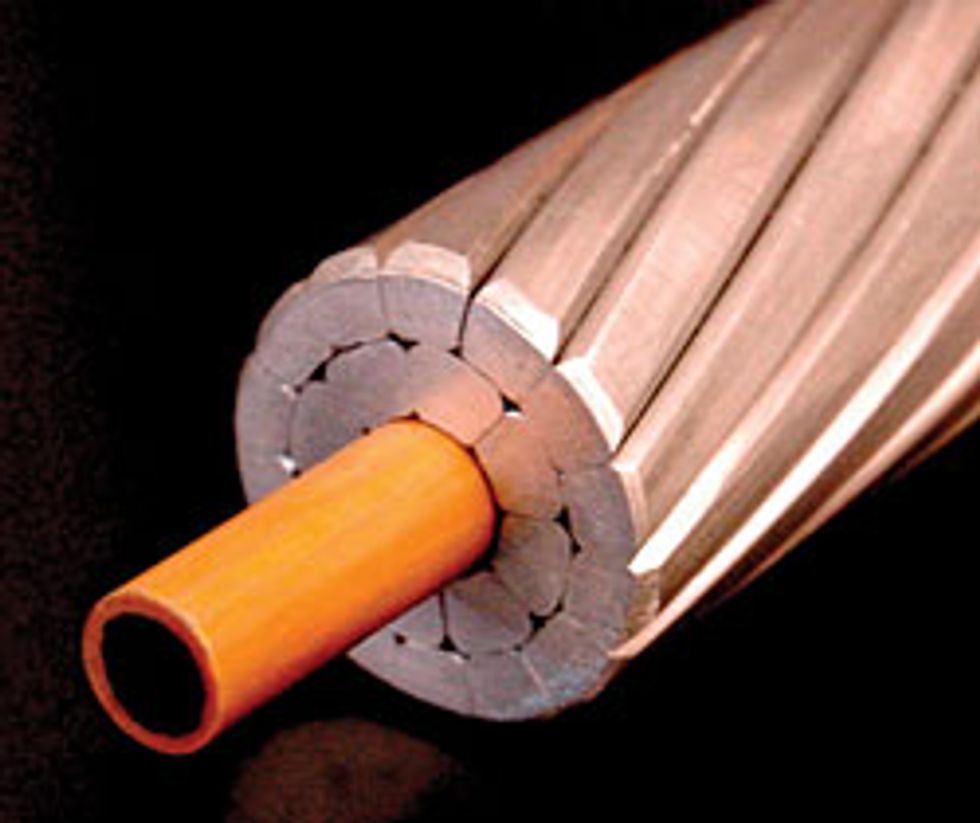

CTC’s product, Aluminum Composite Conductor Core (ACCC) cable, gets its strength and resilience from fiberglass-encased carbon fiber—”the same carbon used in the tail section of a Boeing 777 jet,” says CTC spokesman Kevin Coates. A machine pulls both the carbon and glass fibers off reels, saturates them with a temperature-resistant epoxy, and winds them in a pattern that puts the carbon in the center and the fiberglass on the outside. The epoxy-soaked fibers are pulled through a giant die containing heaters that cure the epoxy to a solid almost instantaneously. The final product is straight and solid but bendable, like a fishing rod.

Composite Technology Corp.’s aluminum composite cable

The carbon fibers—40 percent stronger than steel—prevent the core from stretching. The fiberglass forms a barrier between the carbon and the aluminum conductor, preventing the galvanic corrosion that ordinarily takes place when two dissimilar metals are in contact. (Carbon has been found to act as if it were a metal in this situation.)

The core of 3M’s cable is different from that of CTC’s. Called Aluminum Conductor Composite Reinforced (ACCR), it’s composed of strands made from a matrix of aluminum oxide (the company calls it ”alumina ceramic”) fibers embedded in pure aluminum, which are surrounded by wires made of hardened aluminum doped with zirconium for strength. Though the aluminum oxide core’s coefficient of thermal expansion is more than three times that of CTC’s composite core, the aluminum-zirconium wires are highly temperature resistant, so much so that the conductor can operate at 210 °C, and at 240 °C for short bursts. Another benefit: because the core also is made of aluminum, it contributes to conductivity and does not suffer from galvanic corrosion.

Although each of the new cables is considerably more expensive than steel-core cable, the economics of using them are attractive because of their greater current-carrying capacity. Utah Power found that although CTC’s cable costs three times as much per meter, it was more than cost-efficient because no transmission towers needed to be erected. The composite-core cable is also lighter, so Utah Power had to replace only seven of 150 supporting towers in the corridor. If the utility company had boosted capacity by adding conventional cable to the existing towers, it would have had to replace almost all of them because of the added weight.

CTC’s Coates says that such savings were an important factor in China’s decision to use the cable. Support towers can be farther apart, and the Chinese found they could use 16 percent fewer towers, he says.

Minnesota’s Xcel chose 3M’s low-sag cable for a power-line corridor that runs through an environmentally sensitive wetland, where it wanted to avoid construction. ”Without it, we would have had to replace existing towers to accommodate larger conventional conductors,” said Doug Jaeger, the utility’s vice president for transmission.

The work at 3M on ceramic fiber goes back 40 years. Anderson says 3M has used the material for other applications, such as the Space Shuttle’s heat-resistant protective tiles. He notes that the company has been working on fiber-reinforced conductors since the early 1990s.

”Developing a new core for this industry is not for wimps,” says CTC vice president Dave Bryant. ”It’s a lot of work.” The company began its first demonstration projects early last year. Bryant says that since then the company has been obsessed with product longevity testing. ”This is a very conservative market,” observes Coates, ”and utilities are slow to embrace new technology. They want to deliver more power cheaply, but they can’t do so at the risk of affecting reliability.”

When it comes to cables with the new cores, most utilities are taking a wait-and-see stance. Seeing the medium-term results of these recent installations will help them determine whether they switch from steel cores to their low-sag alternatives.