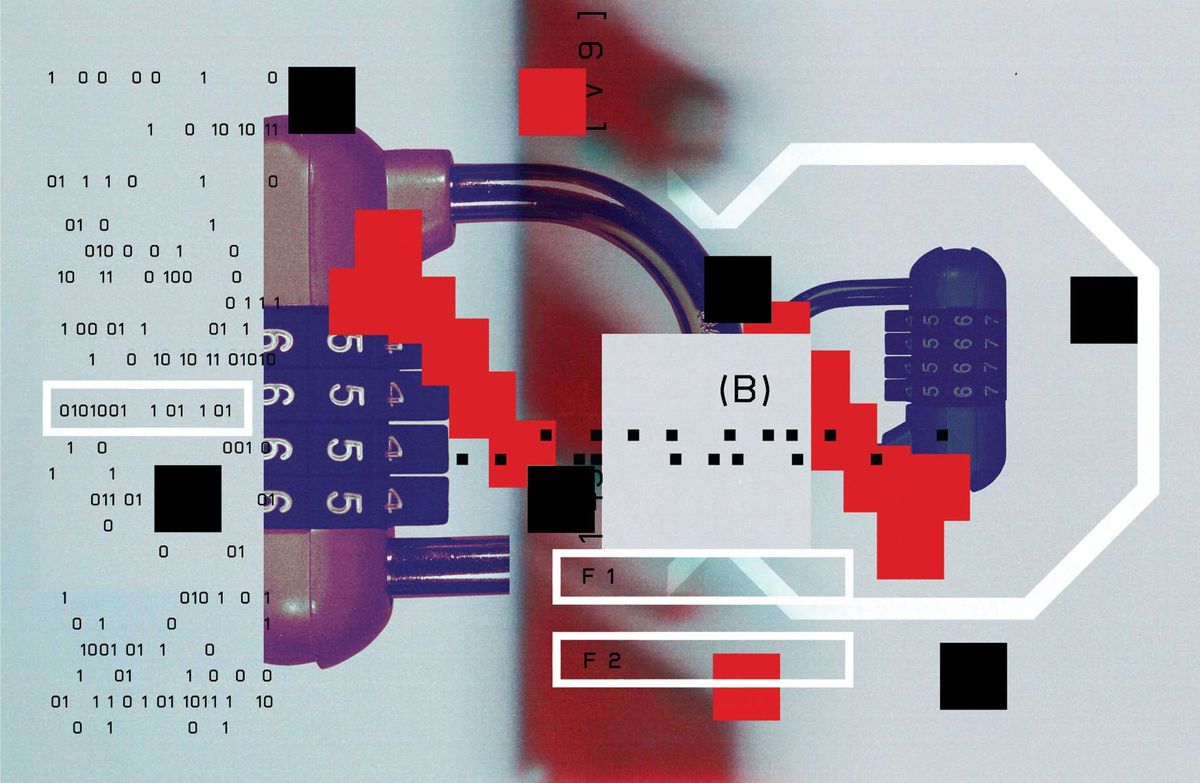

A recent theft at Bitcoinica, one of the largest Bitcoin exchanges, resulted last week in a debut for the currency in the California court system. Four prominent members of the Bitcoin community, including Jed McCaleb—the original developer of Mt. Gox, the largest Bitcoin exchange and a competitor to Bitcoinica—filed a lawsuit on 6 August against the company, seeking reimbursement for US $460 457 in lost funds.

While there have been multiple hacking incidents since the cryptocurrency went online in 2009, this is the first time members of the community, have taken legal action.

The whole affair started in March when hackers skimmed over 46 000 BTC from the exchange with an attack aimed at the Webhost, Linode. Three months later, Bitcoinica Consultancy, which has supposedly been handling the exchange since this April, announced that it lost another 40,000 BTC (about $350 at the time) through an unauthorized withdrawal from a Mt. Gox account that the company had set up while disbursing refunds to its customers.*

Amir Taaki, speaking for Bitcoinica Consultancy, explained that after the initial breach, Bitcoinica failed to change some of its passwords. One of those was a duplicate of the password they were using for their Mt. Gox API key. On June 12th, someone tried using this password to gain access to Bitcoinica's Mt Gox wallet, and it worked.

The announcement ignited a backlash of accusations from victims who now suspect that the theft was an inside job. While waiting for satisfaction, their losses have only increased. At the end of the July, Bitcoin was trading below $7. Today, it hit $12 for the first time since 2011.

The situation has been especially complicated by the fact that no one seems to really know who is responsible. Zhou Tong, the 18-year old Chinese developer who originally started Bitcoinica claims to have sold the company right after the March theft to the British Bitcoin exchange, Intersango. He now also claims to know who broke into the Mt. Gox account and to have squeezed a confession from a Chinese Multi-millionaire named Chen Jianhai, a story which many victims quickly interpreted as cover for his own involvement. Meanwhile, the Bitcoinica Consultancy is thought to have control over Bitcoin's legal operations, but in emails, they have declined to confirm this role, and have reportedly stopped responding to disgruntled customers.

And so, it seems that those who want to help have no power. And those who have the power aren't talking.

Under these circumstances, it will be very interesting to see what happens when many of those involved convene next month at the Bitcoin Conference in London.

*The original article erroneously stated that 4,000 BTC had been removed.