Berkeley, California banned the installation of natural gas pipes to new residential construction projects last month. The city is committed to slashing its carbon footprint, and natural gas is a carbon double-whammy: when burned, it releases carbon dioxide and, when leaked, its main ingredient, methane, is a far more potent greenhouse gas than CO2.

Several dozen California cities appear set to follow Berkeley's lead. Which helps explain why the U.S. government’s plan to scrap mandatory monitoring for methane leaks is getting few cheers from the oil and gas industry. Paying attention to gas leaks is critical to defending their product's social license.

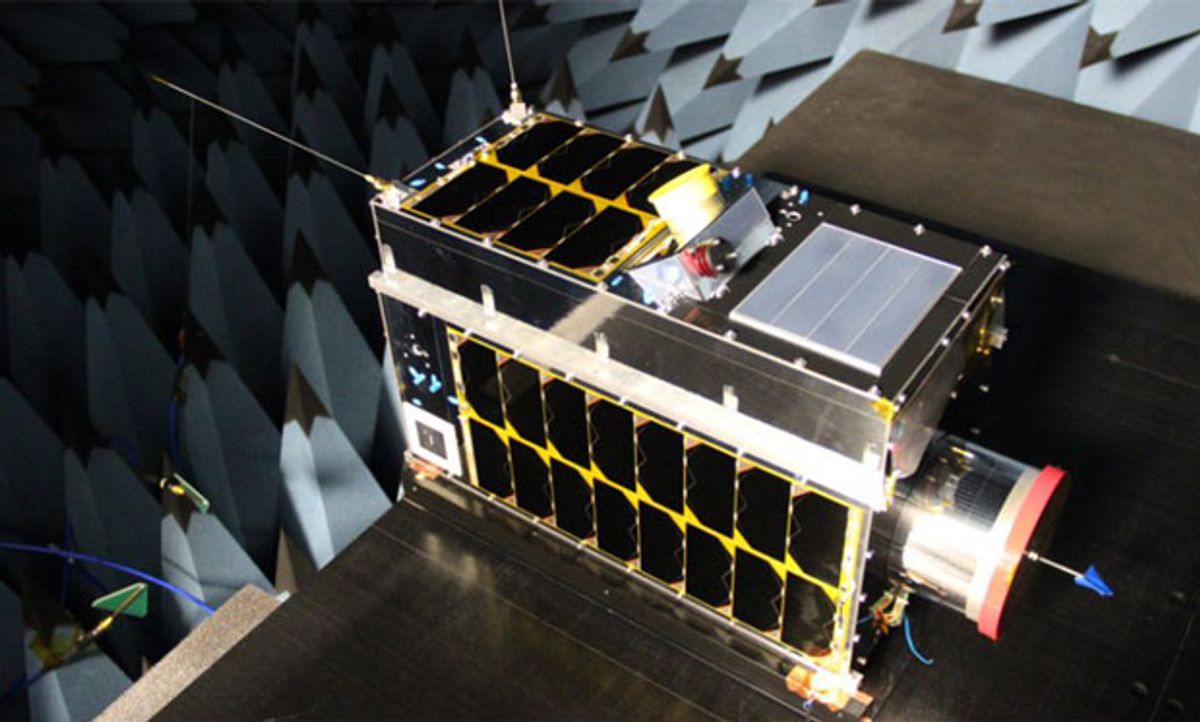

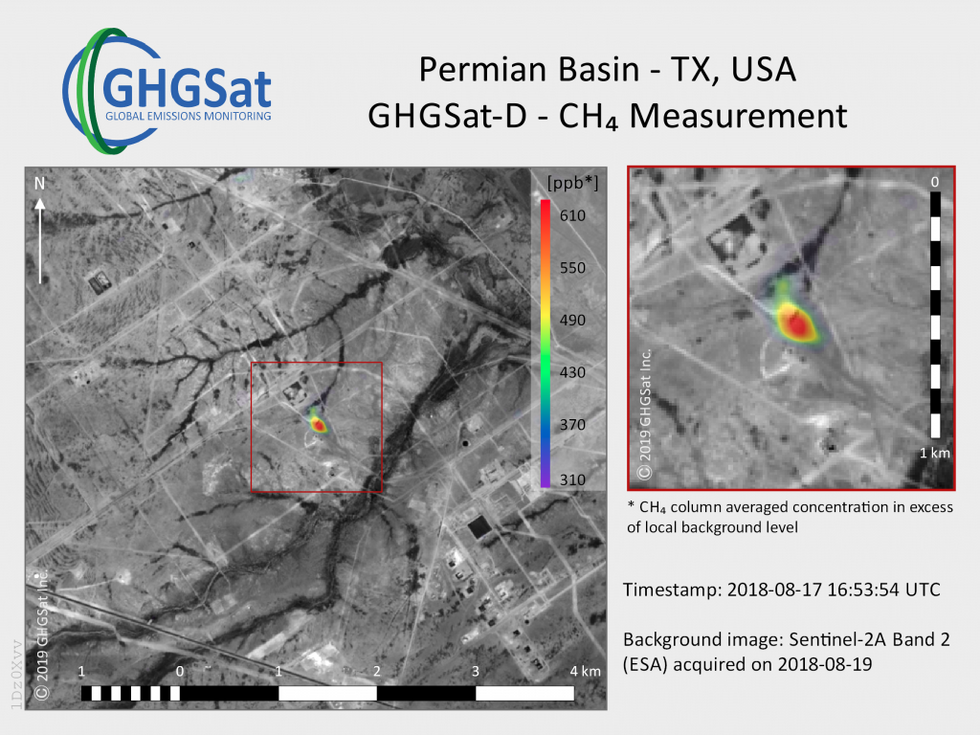

Those leaks, meanwhile, may soon have nowhere to hide thanks to a growing wave of private, methane-detecting satellites being placed in orbit. Canada's GHGSat led the charge in 2016 with its carbon-tracking Claire microsatellite, and the company now has a second-generation microsat ready to launch. Several more methane-detecting satellites are coming, including one from the Environmental Defense Fund. If gas producers don't find and squelch their own pollution, this proliferation of remote observers will make it increasingly likely that others will shine a spotlight on it.

Methane molecules trap heat more than 80 times more effectively than CO2 during their first two decades in Earth’s atmosphere. Today, there are 2.5-times more methane molecules up there than there were prior to the Industrial Revolution. In all, rising methane emissions contribute about one-fifth of the thickening radiation blanket that has already warmed the world by nearly 1 degree C since 1850.

The extra methane comes from a wide range of sources, including wetlands, cattle, landfills, and all segments of the natural gas supply chain. The latter is under particular scrutiny thanks to recent research coordinated by EDF showing that U.S. oil and gas operations leak about 60 percent more methane than the U.S. Environmental Protection Agency had estimated. Fixing those leaks will be on the agenda next week as global leaders gather in New York for the United Nations Climate Action Summit. Their task is to accelerate action toward climate change mitigation goals agreed to in Paris in 2015: limiting warming to 1.5 degrees Celsius or, at most, 2.0 degrees this century.

Stéphane Germain, GHGSat’s president, says his firm built its second satellite—named Iris—to meet demand from clients. While Claire proved out GHGSat's equipment and analytical methods for carbon pollution tracking, Germain says Iris will provide better resolution, precision, and throughput required to expand the business.

The technology improvements on Iris are a mix of lessons learned from Claire and some original engineering. Tweaks to Claire’s spectrometer and optics will make Iris more sensitive. In order to measure small emissions sources with Claire, GHGSat must combine at least 10 or so images of a site, sometimes from multiple flyovers, to get a statistically significant reading of methane emissions. “Whereas it might have taken us 20 measurements to see smaller plumes with Claire, we should be able to see those plumes with a single pass with Iris,” says Germain.

Much of the boost comes from better optics that reduce stray light and internal reflections. Some improvements are possible thanks to a tighter spectral detection range. Whereas Claire was designed to detect both CO2 and methane, Iris’s spectrometer will only see the telltale light absorption patterns for methane.

Trading breadth for performance makes business sense because market intelligence firms already provide good estimates of CO2 pollution from industrial facilities. (Pollution provides competitors with a proxy for each others' production.) In contrast, the presence of methane leaks is something that oil and gas operators—with thousands of wells, processing stations and pipelines—are still trying to learn about in their own operations. They need good data, says Germain, to focus leak prevention investments where they will pay off fastest through increased gas delivery and, where applicable, avoided carbon taxes.

GHGSat has also squeezed a potentially game-changing system onto Iris’s microwave-sized platform: an optical communications downlink, which is virtually nonexistent on large commercial satellites and will be a first for a microsat. If the experimental 1-gigabit-per-second laser-based transmission works, it will replace Iris's 2-megabit-per-second radio and smash GHGSat's greatest operational bottleneck. “We could have a thousand-fold increase in downlink capacity, which would allow us to take many, many more observations per satellite,” says Germain.

Most satellites stick to radio transmission because of the precision required to safely beam powerful lasers down at Earth. Iris’s optical downlink, called Darkstar-Q8, uses steerable MEMS mirrors guided by a star tracker from Toronto-based Sinclair Interplanetary to lock the laser signal on to GHGSat’s ground stations. Data processing happens on the latest industrial-grade processor from Montreal-based Xiphos Technologies, the Q8, which Iris will help certify for spaceflight.

The only question is—when? Iris’s scheduled launch this month was pushed back to early 2020 after satellite launch leader Arianespace suffered the first failure of its Vega rocket in July. GHGSat’s planned 2020 launch of its third satellite, already in development, may also be pushed back.

GHGSat's launch delays may be a source of stress at the firm as additional commercial players circle its market. One, Palo Alto-based startup Bluefield Technologies, vows to launch its first methane-detecting satellite next year. Many more firms are developing ground- and drone-based methane sensing, which EDF and Stanford University highlighted last week with the publication of results from a multi-year mobile monitoring challenge.

Germain says the EDF-led satellite project—MethaneSAT—should be complimentary to GHGSat’s. Iris will take 12 kilometer-by-12 km snapshots with 25 meter-by-25 m pixels, offering pinpoint detection over a relatively narrow field of view. MethaneSAT, in contrast, will shoot a 200 km-by-200 km picture with great precision but comparatively coarse 1-square-km pixels. If they both work as promised, methane hotspots identified by MethaneSAT can be traced to specific sites by Claire, Iris, and their successors.

Editor’s note: This story is published in cooperation with more than 250 media organizations and independent journalists that have focused their coverage on climate change ahead of the UN Climate Action Summit. IEEE Spectrum’s participation in the Covering Climate Now partnership builds on our past reporting about this global issue.

Peter Fairley has been tracking energy technologies and their environmental implications globally for over two decades, charting engineering and policy innovations that could slash dependence on fossil fuels and the political forces fighting them. He has been a Contributing Editor with IEEE Spectrum since 2003.