Energy storage could get a big boost if California officials green-light plans by utility Pacific Gas and Electric Co. to move forward with some 567 megawatts of capacity.

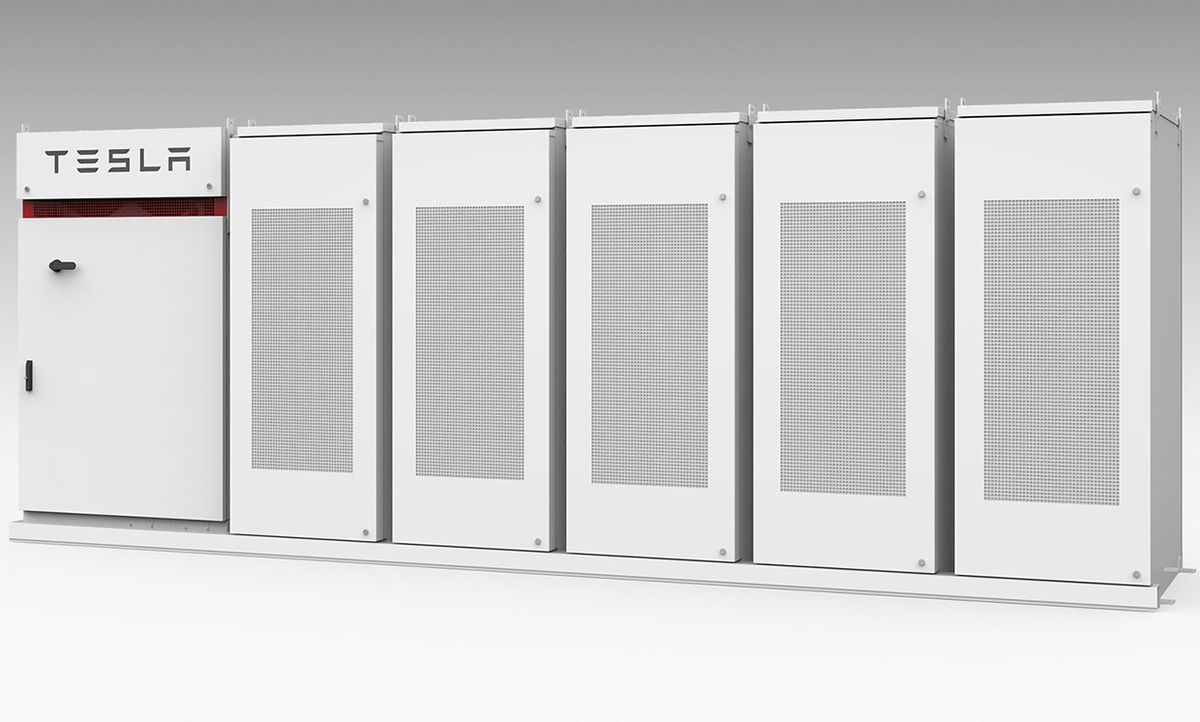

Included in the mix is more than 180 MW of lithium-ion battery storage from Elon Musk’s company Tesla. The Tesla-supplied battery array would be owned by PG&E and would offer a 4-hour discharge duration. The other projects would be owned by third parties and operated on behalf of the utility under long-term contracts. All of the projects would be in and around Silicon Valley in the South Bay area.

Once deployed, the storage would sideline three gas-fired power plants—the 605-MW Metcalf Energy Center, the 47-MW Feather River Energy Center, and the 47-MW Yuba City Energy Center—that lack long-term energy supply contracts with utilities. Even without the contracts, the state’s grid operator identified the units as needed for local grid reliability. It, and independent power producer Calpine, which owns the plants, asked federal regulators to label the plants as “must run.” That would let them generate electricity and be paid for it even without firm utility contracts.

Both PG&E and California’s utility regulators object to that idea. They argue that the must-run designation without firm contracts would distort the state’s power market and lead to unfair prices. Backing up their objection, regulators earlier this year directed the utility to seek offers to replace the gas-fired power plants with energy storage.

The utility says that its search prompted more than two dozen storage proposals with 100 variations. PG&E narrowed the list to four, which it presented to state regulators in late June.

One of the projects, Vistra Energy Moss Landing storage project, would be owned by Dynegy Marketing and Trade, a unit of Vistra Energy Corp. The holding company manages more than 40 gigawatts of generating capacity across 12 states. The project would be a transmission-connected, stand-alone lithium-ion battery energy storage resource in Monterey County. The facility, which would feature a 300-MW, 4-hour duration battery array, could enter service in December 2020 under a 20-year contract.

A second project, Hummingbird Energy Storage, would be owned by a unit of esVolta, a new company that is partnering with Oregon-based Powin Energy Corp. and Australia-based Blue Sky Alternative Investments. The Santa Clara County–sited resource would include a 75-MW, 4-hour-duration Li-ion battery array. It also could enter service in December 2020 and would operate under a 15-year contract.

One so-called behind-the-meter proposal also was accepted by PG&E. It came from Micronoc and would total 10 MW of 4-hour-duration storage. In practice, the project would bundle the discharge capacity of lithium-ion batteries located at multiple customer sites. That’s in step with Micronoc’s business model of developing distributed energy storage projects, most of them so far in South Korea. A 10-year service contract with PG&E could start in October 2019.

PowerPack lithium-ion batteries from Tesla would form the backbone of a 182.5-MW array with a 4-hour discharge duration. The batteries would be located at a PG&E substation in Monterrey County. The array could enter service by the end of 2020 and include a 20-year performance guarantee from Tesla.

The regulatory mandate directing PG&E to seek energy storage proposals was not the first time California regulators acted to boost storage.

In February 2013, regulators told utility Southern California Edison to secure energy storage and other resources to meet an expected shortfall stemming from the closure of the San Onofre nuclear power plant. In that instance, the utility’s energy storage target was 50 MW. It ultimately procured more than 260 MW of storage capacity.

Then, in May 2016, regulators again directed SoCalEd to procure storage to ease electric supply shortages that were feared as a result of a leak at a natural gas storage facility. As a result, more than 100 MW of grid-level energy storage was placed into service.

In announcing the Silicon Valley projects, PG&E sought to play up storage’s role in helping to integrate increasing amounts of renewable energy onto California’s grid. It also cited recent decreases in battery prices as enabling energy storage to compete with “traditional solutions” such as fossil-fueled power plants.

No cost details were provided by the utility in making its announcement. And a supporting document [PDF] justifying the four projects was scrubbed of cost details before being released to the public.

Evidence is growing, however, that battery energy storage can beat natural gas on price when it comes to a specific type of power generation known as “peaking capacity.” Known as peakers, the fast-start power plants typically are called on to generate power on days when consumer demand for electricity is highest. For most places, that’s a hot summer day when air conditioners are cranked up.

One milestone came earlier this year when Arizona Public Service signed a 15-year deal for peaking power from a solar-powered battery. The 50 MW of storage beat out other forms of peaking generation, including natural gas. A field of solar PV panels from FirstSolar will energize the storage array when the sun is high in the sky, allowing electricity to be delivered to customers during times of peak demand.

Over the next 15 years, Arizona Public Service says it plans to put more than 500 MW of additional battery storage capacity in place. In January 2018, Arizona utility regulator Andy Tobin proposed that the state’s utilities deploy 3,000 MW of energy storage by 2030.

Efforts to increase the amount of energy storage in places like Arizona and California received a boost in February when the U.S. Federal Energy Regulatory Commission (FERC) voted 5-0 to remove what it said were nationwide barriers that kept storage sources from taking part in various markets that are run by regional transmission organizations and independent system operators.

In a November 2016 proposal, the Obama-era FERC said that market rules designed for traditional generation resources created barriers to entry for emerging technologies such as electric storage resources. The February action was the next step in that effort to reduce or remove barriers to entry.

Contributing Editor David Wagman has been covering energy issues for three decades, focusing on all forms of electric power generation, regulation, and business models. He is particularly interested in the ongoing electrification of advanced economies and the effects that distributed generating resources could have on efforts to decarbonize national grids. Wagman, who is based in Colorado, is currently editorial director for IEEE Engineering 360, a search engine and information resource for the engineering, industrial, and technical communities.