A carbon-free future will require many millions of batteries, both to drive electric vehicles and to store wind and solar power on the grid. Today’s battery chemistries mostly rely on lithium—a metal that could soon face a global supply crunch. Some analysts warn that as EV production soars, lithium producers won’t be able to keep up with demand. That could temporarily pump the brakes on the world’s clean energy ambitions, they say.

How big the lithium shortage will be, and how much turmoil it will cause, is far from certain.

Recently, Rystad Energy projected a “serious lithium supply deficit” in 2027 as mining capacity lags behind the EV boom. The mismatch could effectively delay the production of around 3.3 million battery-powered passenger cars that year, according to the research firm. Without new mining projects, delays could swell to the equivalent of 20 million cars in 2030. Battery-powered buses, trucks, ships, and grid storage systems will also feel the squeeze.

“A major disruption is brewing for electric vehicle manufacturers,” James Ley, senior vice president of Rystad’s energy metals team in London, said in a news release. “Although there is plenty of lithium to mine in the ground, the existing and planned projects will not be enough to meet demand for the metal.”

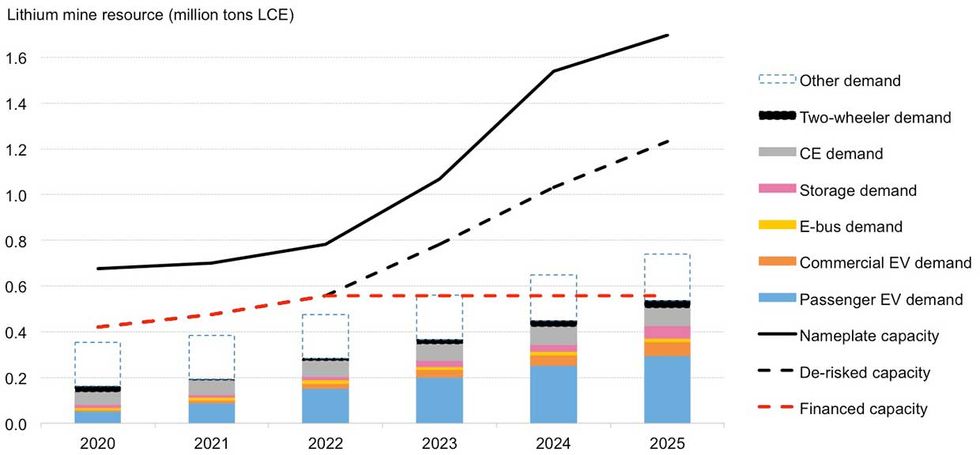

A lithium deficit would flip what is currently a surplus. Demand from battery manufacturers is now about 300,000 metric tons of lithium carbonate equivalent (LCE) per year, while there is 520,000 metric tons of existing mining capacity for battery markets. Rystad’s analysis shows that demand from manufacturers could reach 2.8 million metric tons in 2028. However, mining capacity is only expected to reach about 2 million metric tons that year, assuming no new mining projects are added to the current pipeline.

A world in which EV assembly lines gather dust while battery manufacturers scrabble for scraps of lithium is wholly avoidable. But for producers, the solution isn’t as simple as mining more hard rock—called spodumene—or tapping more underground brine deposits to extract lithium. That’s because most of the better, easier-to-exploit reserves are already spoken for in Australia (for hard rock) and in Chile and Argentina (for brine). To drastically scale capacity, producers will also need to exploit the world’s “marginal” resources, which are costlier and more energy-intensive to develop than conventional counterparts.

“It’s not that it’s a resource issue. There is no fear that there is not enough lithium to meet demand by 2030 or longer,” Sophie Lu, the head of metals and mining for BloombergNEF (BNEF), said by phone from Sydney. The larger question, she said, is whether the industry can continue producing lithium at similar costs as today, while also diversifying supply chains away from today’s dominant geographies and doing so without causing environmental damage.

In its latest outlook, published Wednesday, BNEF said there are enough lithium projects in the pipeline to meet demand out to the late 2020s—assuming projects are successfully financed and developed. But a supply deficit may kick in around 2028, Lu said. Nearly $14 billion is still needed to finance the pipeline of lithium production capacity out to 2025, though this pipeline surpasses BNEF’s forecast for demand by that year.

Concerns about supply constraints are driving innovation in the lithium industry. A handful of projects in North America and Europe are piloting and testing “direct lithium extraction,” an umbrella term for technologies that, generally speaking, use electricity and chemical processes to isolate and extract concentrated lithium. So-called DLE could revolutionize the industry, akin to how the SX/EW (solvent extraction-electrowinning) process has transformed the copper industry, or how electric arc furnaces have enabled steel production using electricity instead of coal.

In southwestern Germany, Vulcan Energy is extracting lithium from geothermal springs that bubble thousands of meters below the Rhine river. The startup began operating its first pilot plant in mid-April. Vulcan said it could be extracting 15,000 metric tons of lithium hydroxide—a compound used in battery cathodes—per year. In southern California, Controlled Thermal Resources is developing a geothermal power plant and lithium extraction facility at the Salton Sea. The company said a pilot facility will start producing 20,000 metric tons per year of lithium hydroxide, also by 2024.

Another way to boost lithium supplies is to recover the metal from spent batteries, of which there is already ample supply. Today, less than 5 percent of all spent lithium-ion batteries are recycled, in large part because the packs are difficult and expensive to dismantle. Many batteries now end up in landfills, leaching chemicals into the environment and wasting usable materials. But Lu said the industry is likely to ramp up recycling after 2028, when the supply deficit kicks in. Developers are already starting to build new facilities, including a $175 million plant in Rochester, N.Y. When completed, it will be North America’s largest recycling plant for lithium-ion batteries.

Further into the future, however, the outlook for lithium gets rocky.

Researchers in Finland and Germany recently modeled 18 scenarios for when lithium resources might actually be depleted. They considered different assumptions about how much lithium is still available in the world’s brines, rocks, oilfields, and other natural features. A scenario with “very high” amounts of lithium, or 73 million metric tons, would see lithium fully depleted shortly after 2100. That’s if 3 billion EVs hit the road and if the world takes robust steps to recycle batteries, use vehicle-to-grid applications, and develop second-life battery uses.

Lithium availability “will become a serious threat to the long-term sustainability of the transport sector unless a mix of measures is taken to ameliorate the challenge,” the researchers wrote in the 2020 study. Such measures include developing new battery chemistries, producing more synthetic fuels, and building more railways—options that don’t require lithium.

- Could Sucking Up the Seafloor Solve Battery Shortage? - IEEE Spectrum ›

- Will Turntide’s Reluctance Motor Disrupt EVs? ›

- Tiny Ultrasound Sensors Could Monitor EV Batteries - IEEE Spectrum ›

- A Rich Harvest in the Desert - IEEE Spectrum ›

- Could Direct Lithium Extraction Be a Game-Changer? - IEEE Spectrum ›