By late this year or early in 2018, two nuclear reactorscould start operating in China—an event that might be a lifesaver for the units’ crippled builder and designer, Westinghouse Electric Co., and for the technology they represent. Both Westinghouse and its prized AP1000 reactor design have suffered a series of humbling setbacks this year.

The AP1000 is arguably the world’s most advanced commercial reactor. It is designed to passively cool itself during an accidental shutdown, theoretically avoiding accidents like those at Ukraine’s Chernobyl power plant and Japan’s Fukushima Daiichi. And for over a decade, it has been the presumed successor to China’s mainstay reactors, which employ a 1970s-era French design.

Yet after more than three decades of engineering, regulatory reviews, salesmanship, and construction, the AP1000 has yielded zero electricity and plenty of trouble. Delays and cost overruns at the four reactors under construction in China and another four in the United States drove Westinghouse into bankruptcy this March. And in July, South Carolina utilities abandoned their pair of partially built AP1000s—on which they and Westinghouse have spent US $9 billion.

But the Chinese reactors, at the Haiyang Nuclear Power Plant in Shandong and at the Sanmen plant in Zhejiang, could press the reset button for the AP1000 and Westinghouse. And China is where success really matters most because it is the only country building reactors by the dozen.

The question, say experts, is what share the AP1000 can capture of a Chinese reactor market that has taken a downturn since the Fukushima accident and may slow even further. Government plans to tie nuclear power rates to wholesale prices for coal-fired power will “definitely mean a slowdown of nuclear power construction down the road,” says Henry Chan, an Asian geopolitics expert at the National University of Singapore who tracks China’s nuclear energy sector.

The AP1000’s ascent in China began in 2004 when the government launched a rigorous two-year evaluation aimed at selecting an advanced Western reactor design that would underpin its future nuclear sector. The Westinghouse reactor beat out the latest French-German EPR and Russian VVER designs, thanks to its promised blend of safety, affordability via modular construction, and the company’s willingness to progressively transfer ownership of the intellectual property to China.

China’s domestic nuclear giants, China National Nuclear Corp. (CNNC) and China General Nuclear Power Corp. (CGN), opposed reliance on a Western design. So, in 2009, Beijing launched a new entity, the State Nuclear Power Technology Corp. (SNPTC), to oversee construction of two pairs of AP1000s: the plants at Haiyang and Sanmen.

The Fukushima accident, in 2011, seemed to further cement the AP1000’s status as the preferred reactor for the future, with its emphasis on passive safety. However, to seal the deal, Westinghouse and SNPTC needed a completed AP1000 project in order to prove that the design worked and was cost effective. It has been a long wait for the first Sanmen and Haiyang reactors, which were to begin operating in 2013 and 2014.

Post-Fukushima safety inspections and requirements have contributed to the delays, but no more so than design flaws and construction mishaps. In 2015, safety inspectors discovered that the steam pipe exiting one of Sanmen’s reactor pressure vessels had been improperly installed.

Meanwhile, water circulation pumps critical to the reactors’ safe operation had to be modified after delivery. The massive pumps worked fine under normal conditions. But when the power shut off, their blades stopped spinning—and cooling water stopped flowing—before the AP1000’s signature passive cooling could kick in.

Such delays mean major cost overruns. The projected cost to complete the AP1000 pair abandoned in South Carolina had spiraled upward from $10 billion to an estimated $25 billion. The Chinese AP1000s’ ultimate price tag is hard to project. “We know very little about the actual costs. The data sources are pretty opaque,” says M.V. Ramana, an expert in international security and energy supply issues at the University of British Columbia, in Vancouver.

What is clear, says Ramana, is that missed deadlines and cost escalation have hurt the AP1000’s future prospects. While the AP1000 schedule slid, CNNC and CGN raced to certify their own competing enhanced-safety design.

The Hualong One reactor design was certified by China’s nuclear authorities in 2014, and construction of the first four units began in 2015 and 2016. Since then, several projects originally slated to feature AP1000 reactors have switched camps.

Westinghouse and SNPTC, meanwhile, have recently shifted strategy, according to the World Nuclear Association. As of May 2017, AP1000s had accounted for over half of the 38 reactors in the advanced planning stages. By August, nearly all of the planned AP1000s had been supplanted by an SNPTC domestic adaptation of the Westinghouse reactor, dubbed the CAP1000.

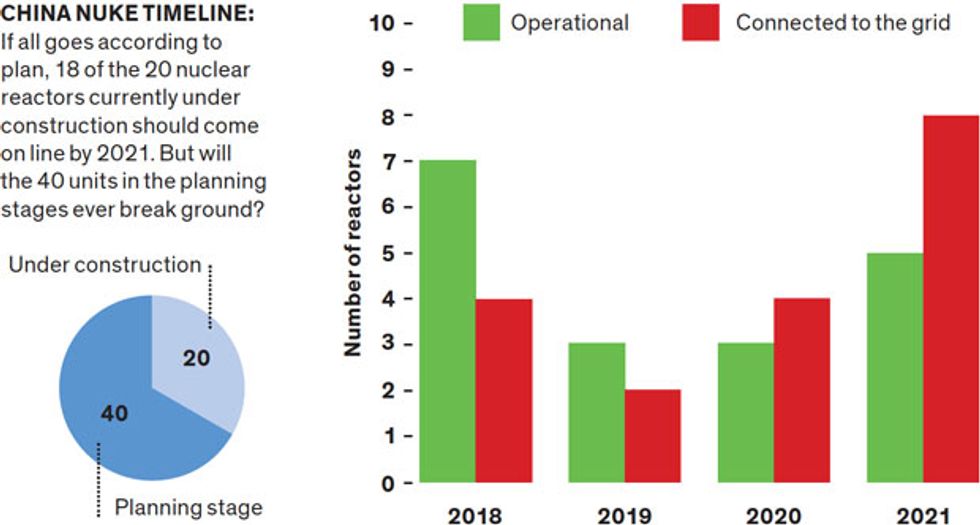

Regardless of which design dominates, a bigger question remains: How big a piece of China’s overall energy sector will nuclear command? Renewable power has eclipsed nuclear in terms of investment and output. And at the current rate of construction, say analysts, China is likely to fall short of its 2020 nuclear generation target. That goal was set at 70 to 80 gigawatts in 2010, then slashed to 58 GW after the Fukushima accident. But even with the completion of all reactors being built as of August 2017—several of which are scheduled to start up in 2021— China’s output will be less than 56 GW.

Further endangering nuclear power’s prospects are the Chinese government’s moves to cut wholesale rates for nuclear energy and a growing power supply glut. In Ramana’s view, China’s nuclear sector may have already peaked: “The rapid growth of nuclear power in China is a thing of the past.”

This article appears in the October 2017 print issue as “A Pyrrhic Victory for Nuclear Power.”