Of all the technological revolutions we’ll live through in this next decade, none will be more fundamental or pervasive than the transition to digital cash. Money touches nearly everything we do, and although all those swipes and taps and PIN-entry moments may make it seem as though cash is already digital, all of that tech merely eases access to our bank accounts. Cash remains stubbornly physical. But that’s soon going to change.

As with so much connected to digital payments, the Chinese got there first. Prompted by the June 2019 public announcement of Facebook’s Libra (now Diem)—the social media giant’s private form of digital cash—the People’s Bank of China unveiled Digital Currency/Electronic Payments, or DCEP. Having rolled out the new currency to tens of millions of users who now hold digital yuan in electronic wallets, the bank expects that by the time Beijing hosts the 2022 Winter Olympics, DCEP will be in widespread use across what some say is the world’s biggest economy. Indeed, the bank confidently predicts that by the end of the decade digital cash will displace nearly all of China’s banknotes.

Unlike the anarchic and highly sought-after Bitcoin—whose creation marked the genesis of digital cash—DCEP gives up all its secrets. The People’s Bank records every DCEP transaction of any size across the entire Chinese economy, enabling a form of economic surveillance that was impossible to conceive of before the advent of digital cash but is now baked into the design of this new kind of money.

China may have been first, but nearly every other major national economy has its central bankers researching their own forms of digital cash. That makes this an excellent moment to consider the tensions at the intersection of money, technology, and society.

Nearly every country tracks the movement of large sums of money in an effort to thwart terrorism and tax evasion. But most nations have been content to preserve the anonymity of cash when the amount conveyed falls below some threshold. Will that still be the case in 2030, or will our money watch us as we spend it? Just because we can use the technology to create an indelible digital record of our every transaction, should we? And if we do, who gets to see that ledger?

Digital cash also means that high-tech items will rapidly become bearers of value. We’ll have more than just smartphone-based wallets: Our automobiles will pay for their own bridge tolls or the watts they gulp to charge their batteries. It also means that such a car can be paid directly if it returns some of those electrons to the grid at times of peak demand. Within this decade, most of our devices could become fully transactional, not just in exchanging data, but also as autonomous financial entities.

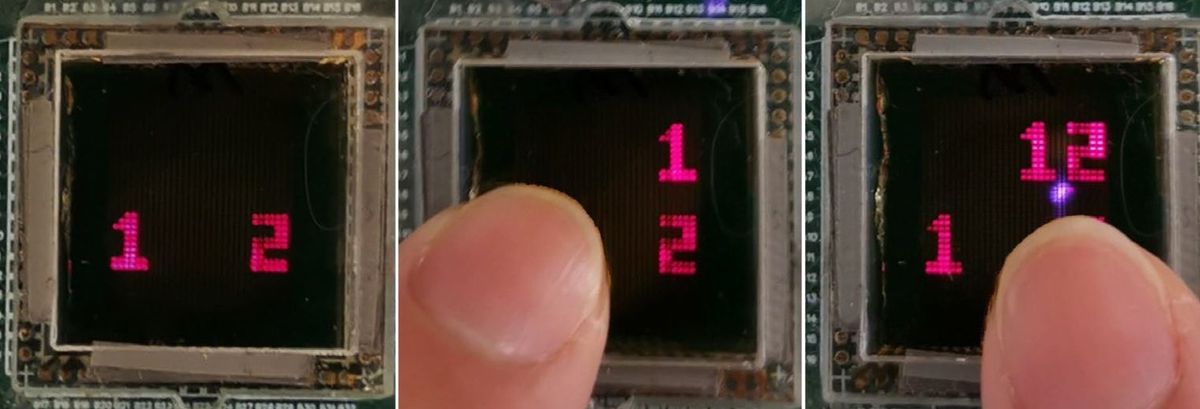

Pervasive digital cash will demand a new ecosystem of software services to manage it. Here we run headlong into a fundamental challenge: You can claw back a mistaken or fraudulent credit card transaction with a charge-back, but a cash transfer is forever, whether that’s done by exchanging bills or bytes. That means someone’s buggy code will cost someone else real money. Ever-greater attention will have to be paid to testing, before the code managing these transactions is deployed. Youthful cries of “move fast and break things” ring hollow in a more mature connected world where software plays such a central role in the economy.

This article appears in the February 2021 print issue as “SurveillanceCash.”

Mark Pesce founded, in 1991, the world's first consumer virtual reality startup. And he and others developed the Virtual Reality Modeling Language ( VRML). He also founded the first company to use VRML to deliver streaming 3D entertainment over the Web. He currently serves as Entrepreneur-in-Residence at the University of Sydney's Incubate program. In addition to being an engineer and a teacher, Pesce is also a popularizer. In 2005, the Australian Broadcasting Corporation invited Pesce to become a panelist and judge on the television series "The New Inventors." In 2011 Pesce published his sixth book, The Next Billion Seconds. In 2014, Pesce and Jason Calacanis launched the podcast This Week in Startups Australia. Later Pesce started The Next Billion Seconds podcast. And since 2014, he's been a columnist for The Register.