Blockchains Will Allow Rooftop Solar Energy Trading for Fun and Profit

Neighbors in New York City, Denmark, and elsewhere will be able to sell one another their solar power

Would you pay slightly more for your electricity if you knew it was sourced from photovoltaic panels on your neighbor’s roof? Or, if you are that neighbor, would you use your solar power to charge a battery and dump that energy back onto the grid at peak hours, when the price was highest? The answers to these questions—which depend on how people would behave in an open energy market—are unknown, because that market does not exist. Net metering and feed-in tariff programs, the two dominant schemes for reimbursing residential energy production, pay out at a fixed rate, effectively decoupling producers from the price signals that might otherwise direct their behavior.

But that may be changing. And we may have the blockchain to thank. Multiple projects are now under way to use technology that was originally intended to account for transactions in digital currency to track electricity production and put it up for sale.

“The future is moving toward distributed energy, distributed generation for local businesses and for consumers,” says Susan Furnell, an energy industry consultant based in London. “It needs a new set of technologies and a new set of business processes and a way of interacting to make all of that work.”

For over a century, the electricity grid has been a top-down business with utilities and big power generators sending electricity to customers. But with the proliferation of renewables, the grid is rapidly transforming into a two-way street, where consumers at the end of the lines (the “edge of the grid”) are themselves putting power back on the lines.

The global market for rooftop photovoltaic panels was nearly US $30 billion in 2016 and is expected to grow by 11 percent over the next six years, according to a study by Research and Markets. Meanwhile, the shift toward solar is being complemented by an increase in the adoption of residential energy storage systems, whose ability to deliver is predicted to continue growing, from around 95 megawatts in 2016 to more than 3,700 MW by 2025.

If used properly, additional energy sources at the edge of the grid could help manage demand more efficiently. But some experts argue that this will happen only if the people who own these generating assets are fully incorporated into an energy market that sets prices in real time. Only then will residential energy producers know when their product is most needed, and therefore most profitable. This timing information will also give these producers the ability to do the most good for the grid.

“What that looks like is a more resilient, fast-acting, transactive grid at the grid edge, where you can pay somebody to turn things off, pay somebody to discharge a battery, pay somebody to start up generation at the right time, and send the economic signals to get people to do that stuff,” says Lawrence Orsini, the CEO of LO3 Energy.

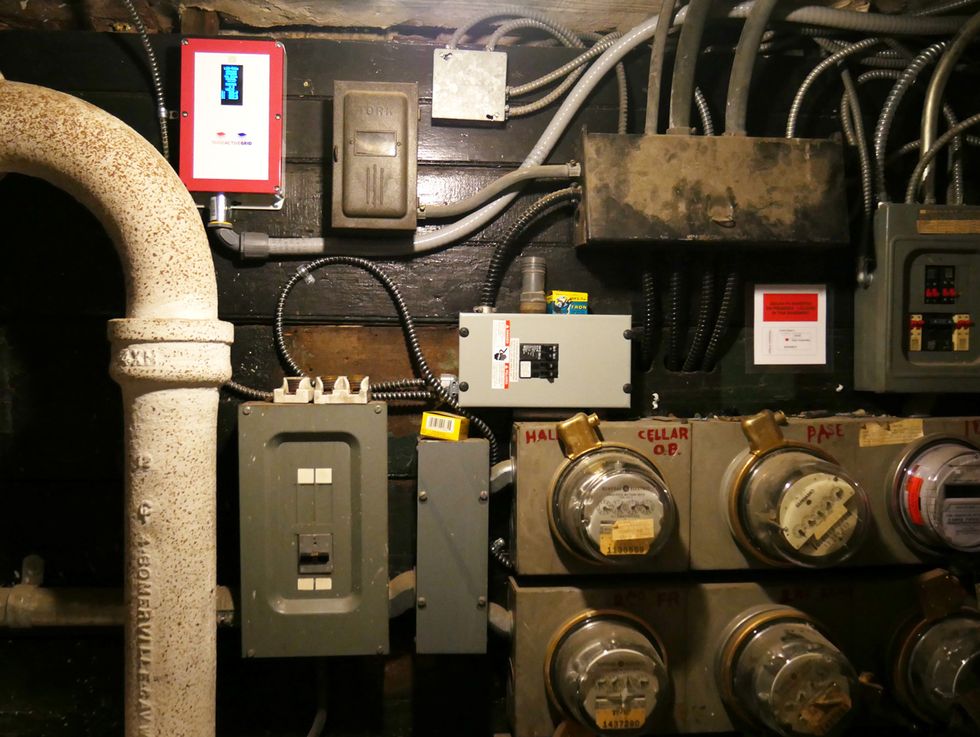

That’s where blockchain technology comes in. Orsini’s company is using it to send those economic signals. With a project called TransActive Grid, LO3 Energy has installed 200 smart meters in five neighborhoods in the borough of Brooklyn, in New York City—areas that are speckled with rooftop photovoltaic installations. In houses that produce renewable energy, the meters record the supply and send it to a custom-built blockchain. Neighbors of these producers have their own smart meters, which act as their nodes on the blockchain, informing them of the energy available. A smartphone application then ties the whole thing together.

For now, the application shows residents only where renewables are located in their area and how much energy they are producing. The next step for the project will be a feature that allows neighbors to set the prices that they are willing to pay. At that point, the TransActive Grid blockchain will begin actually recording transactions among neighbors. Consumers will be able to slide a bar on the application interface to indicate the maximum price they are willing to pay for different energy sources in their network. Producers can then set their price and begin loading their contributions onto the grid when there is a matching bid. As the laws of physics demand, customers in the TransActive Grid network will use whatever electrons are flowing closest to them on the grid. But the system is intended to make sure that customers’ money goes to the sources they want to support.

The ledger for TransActive Grid will serve as an alternative accounting system, in addition to the one that Consolidated Edison Co., the local utility, keeps for its billing purposes. Turning these records into a real market will require convincing Con Edison or an energy retailer serving the Brooklyn market to settle transactions in real dollars.

That will happen very soon, Orsini claims. “We’re in the very final stages of that,” he tells IEEE Spectrum.

In September, TransActive Grid planned to offer the software on the Apple App Store so that other neighborhoods can start their own community markets.

A similar project is under way in Germany, where the battery supplier Sonnen is partnering with the grid operator TenneT Holding to record and coordinate the operation of several thousand residential energy storage systems. This ledger will be built on a variant of blockchain technology called Fabric—a product of Hyperledger, which is a collaborative blockchain project run by the Linux Foundation.

Europe may be an early adopter of blockchain technology, says Steve Callahan, vice president for energy and utilities at IBM, one of the companies contributing to Hyperledger. That’s because markets there are not as fragmented as in the United States—with its dozens of investor-owned utilities, multitudes of municipal utilities, and 50 independent state regulatory authorities.

“The hotbed is in Europe, predominantly Germany and Denmark,” which have liberalized markets, Callahan says. In the United States, Texas, New York, and a handful of other states have opened their retail markets sufficiently to potentially allow blockchains to be tested, he says. Both the TransActive Grid and the project in Germany are opting for “permissioned ledger” technology, where the only participants are preapproved electricity customers and vendors. But other developers are working on providing similar services on open blockchains—systems more like Bitcoin and Ethereum, in which anyone can participate. Consensys Systems, a blockchain studio in Brooklyn, has an application very similar to TransActive Grid in the works for the Ethereum blockchain.

By enabling transactions between individual suppliers and consumers of energy, all of these projects seek to optimize the functionality of renewable power sources, using market logic to encourage producers to bolster the grid at times of peak consumption.

But if these markets are to compete with utilities, they will have to deliver energy reliably. Some are still waiting for proof that such delivery is possible.

“When it comes to smaller and even residential customers, there are many issues,” says Diego Dal Canto, an innovation manager at Enel, a multinational utility in Rome that is developing a blockchain-based market for energy wholesalers in Europe. “What about forecasting of consumption and generation? If you want to offer 1 kilowatt-hour, [available] tomorrow at five, and you offer that and someone buys, you have to actually deliver.”

An increase in the efficiency at the edge of the grid does not necessarily align with the business model of centralized utilities. These companies are accustomed to making their money by investing in large power plants and paying for those investments by selling as much energy as possible. The renewable energy that residents add to the grid is competition—competition that makes use of the utility’s own infrastructure.

“You may imagine this is a pretty big disruption for the whole utility business,” says Olaf Lohr, the director of business development at Sonnen. “If you really think this all the way through to the end, we may not really need the utility that much anymore, or maybe not at all,” he says. “That’s why it’s really significant.”

This article appears in the October 2017 print issue as “Energy Trading for Fun and Profit.”