The Long Life and Imminent Death of the Mag-Stripe Card

This love child of the airline and banking industries has survived for half a century. But the end is finally near

In 1967, the airlines were flying Boeing 727s and Douglas DC-8s. Air travel was still special, and the airlines were raking in cash. But a problem loomed, and it was potentially calamitous. The airlines had placed their orders for the first wide-body aircraft—the 747 and the DC-10—and these giant planes would dramatically boost the number of people arriving simultaneously at customer service counters. So to prevent chaos at those counters, the airlines had to find a way to speed up ticket sales and passenger processing.

Banks, too, were facing difficulties. Bank-backed credit cards were surging in popularity, and merchants were swamped with paperwork: Every time a customer charged an item, the merchant had to write out a charge slip and make a phone call to get the charge authorized. And all-night convenience stores and even the growing popularity of late-night television meant that people were no longer satisfied with banker’s hours and expected banks to make services available on evenings and weekends.

The only way to solve these problems without hiring hordes of staff, for both the airlines and the banks, was to let customers serve themselves, with the help of a computer. For banks, that meant the ATM. For airlines, a similar kiosk could track reservations and dispense boarding passes. It would be easy enough to design a machine to spit out money or documents. But to get customers to trust these machines, engineers would first have to come up with a way to let users identify themselves that was fast, easy, and secure.

The answer turned out to be the magnetic-stripe card. Developed by IBM, it rolled out in the ’70s, caught on globally in the ’80s, and was essentially ubiquitous by the ’90s. And in North America especially, it has withstood many challenges over the years to become one of the most successful technologies of the past half century. Consider the numbers: In 2011 alone, 6 billion bank cards around the world, along with transit tickets and other magnetic-strip media, went through card readers some 50 billion times.

The biggest challenge came in the mid-1980s, when smart-card technology emerged. Smart cards look much like mag-stripe cards—indeed, most still contain a mag stripe for use where smart-card readers aren’t available—but embedded within the plastic of the card is a microprocessor. That chip tracks the card’s activity, which means that some 85 percent of transactions can be authorized just from the information stored on the chip, without going online—a boon where network access is spotty. They can also have hidden personal identification numbers—that is, the card can check a PIN entered by a user without revealing it to the equipment reading the card, which is a big improvement in security. In Europe and some other regions outside of North America, the mag-stripe card has been fully eclipsed by the chip-based smart card. The former has continued to thrive, however, in the United States and Canada.

But the end is finally in sight for the mag-stripe card. Even in North America, emerging smartphone-based pay schemes making use of Near Field Communication are now starting to catch on and will likely eventually replace the venerable charge plate. So as we head into a new era of tech-enabled transactions, it’s a good time to sing the praises of the unsung engineering behind a technology that has been so stunningly successful.

So back we go to 1967 and the struggles of the airline and banking industries to serve their customers without drastically increasing their customer service staffs.

Along came Big Blue to the rescue. At IBM’s Advanced Systems Division, several hundred developers based in Los Gatos, Calif., and Armonk, N.Y., were charged with creating new computer applications to drive the sale of computers. The researchers came up with a card that was about the same size as existing raised-letter charge plates—and was readable by a machine. They decided that a single machine-reading scheme should be used for both the airlines and the banks, saving the consumer from carrying multiple cards and IBM from having to manufacture different kinds of card-printing equipment.

IBM did the work for free and didn’t even patent the machine-readable card it came up with. Rather, it offered its solution gratis to all comers, assuming that the more transactions conducted using machine-readable media, the more computers would be sold to process them. The strategy worked beyond anyone’s dreams: By 1990, every dollar IBM had spent developing the stripe technology had returned US $1500 in computer sales.

IBM’s engineers knew they wouldn’t have a lot of room on the card for machine-readable data; charge plates measured 5.4 by 8.6 centimeters. The front of the card contained the bank’s logo—that wouldn’t change. The machine-readable section would share the back of the card with information about the bank and card issuer and a signature panel. The engineers concluded that they could count on having a strip across the card that was about a centimeter wide. So the size was easy to settle—1 by 8.6 cm. But how to encode the data on that strip?

IBM considered and rejected bar codes as well as perforated paper tape (an idea that Citibank would adapt for its short-lived “magic middle” cards). IBM eventually zeroed in on magnetics, used since World War II as an audio recording medium and more recently by the computer industry for disk storage. Only a magnetic technology could give the engineers enough data density to let them fit all the information they needed onto the strip. That data included both the alphabetic information, such as name and address—required by the airline industry to identify customers in its databases—as well as the numeric information that banks needed, including the account number and bank routing number.

IBM proved the concept with the world’s first magnetic credit card: a piece of cardboard with the magnetic strip literally Scotch-taped to it [see photo, "Mag Stripe 1.0"]. And then came the real challenge: figuring out how to create a durable card that could be manufactured quickly and cheaply and would stand up to everyday abuse.

To get the magnetic material—iron oxide—to stick to the back of the card, the developers needed a binder that when heated would melt and attach the iron oxide to the plastic card. Happily enough, the same binder they were using to attach the signature panel worked fine with the iron oxide. Nevertheless, it took more than two years to develop a machine that could lay down the magnetic strips reliably at high speeds, and the per-card costs—at $2 each, or about $11 in today’s dollars—were far too high. It took a decade—until 1980—for the cost of the cards to drop to an affordable 5 cents. Today, each card costs 2 or 3 cents.

Magnetic media has another problem. Counterfeiters can use a card skimmer to make a magnetic copy of a card swiped through it and then transfer that information to a blank card on the next swipe. The developers had to find a way to make the cards secure in spite of this weakness.

Some researchers deemed the problem intractable, arguing that the whole idea of magnetic cards should be abandoned. But others contended that large databases, just then coming into wide use, were powerful enough to track and analyze transactions and could compensate for the weakness of the cards themselves. The fact that IBM saw selling database systems as a prime business opportunity didn’t hurt.

Here’s how it works. When you or a checkout clerk swipes your credit card, the card reader captures the information encoded on the mag stripe that identifies you. That terminal—using either dedicated connections or, in the case of some smaller merchants, a dial-up line—forwards the information about you and the amount of your desired purchase to the bank that collects your card payments, which then passes it on to the card issuer via a card network like Visa. If the issuer determines you have enough credit, it sends an approval message to the bank, which forwards it on to the store. This normally takes just seconds. But the credit card issuer isn’t quite done with your transaction. Even after the sale is authorized and you walk away with your purchase, fraud-checking software at the card issuer examines the transaction to see if it fits in with your usual purchase patterns or flags it if it doesn’t.

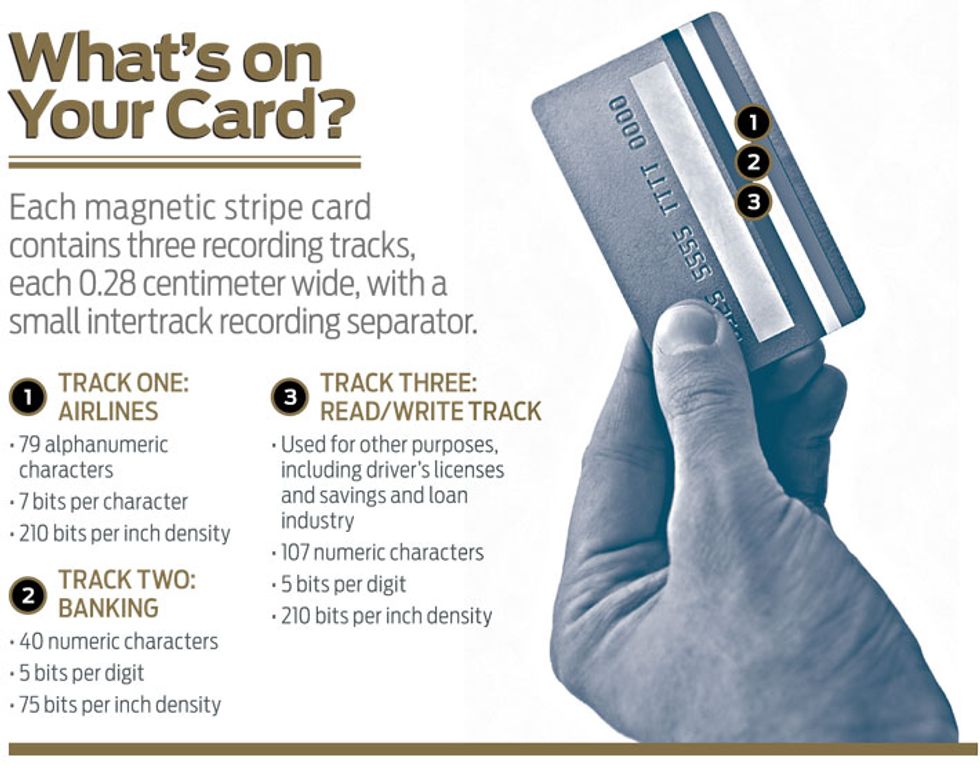

After settling on the mag-stripe technology, the developers had to figure out how to place the data on each card. They initially thought to include all the information—the numeric codes for the ATMs and the alphanumeric codes for the airlines—in a single set of data and let the machine readers sort it out. Then they hit on a simpler solution—multitrack recording, a relatively new technology that would allow them to encode two separate sets of data on a single magnetic strip. This scheme allowed IBM to get out of the way—each industry could then go off and create standards for its own track. There was even enough room for a third track, one that allowed the savings and loan industry to record transaction information on the card itself.

Each of the three tracks is 0.28 cm wide, with a small intertrack recording separator. Track One, allocated to the airline industry, includes, among other data, the account number (19 digits), name (26 alphanumeric characters), and miscellaneous data (up to 12 digits). Track Two, allocated to banks, contains the primary account number (up to 19 digits) and miscellaneous data (up to 12 digits). That very same format is still in use today.

In January 1970, American Express issued 250 000 mag-stripe cards to its Chicago-area customers and installed self-service ticketing kiosks at the American Airlines counter at Chicago O’Hare International Airport. Cardholders could opt to get their tickets and boarding passes from the kiosk or from a human agent. They flocked to the kiosks. In fact, United Airlines customers walked to American Airlines—at the other end of the terminal a quarter mile away—to use the kiosks.

The mag-stripe technology quickly became the ubiquitous mechanism for transactions. Its persistence in North America has been a result of happenstance as well as good design. When smart-card technology became available in the mid-1980s, the major credit card issuers had just spent tens of millions upgrading their North American networks. Going to a smart-card technology would have made much of that investment superfluous.

With that outlay largely amortized by now and security problems growing, the industry isn’t so wedded to the mag-stripe card, and smart cards are finally trickling into North American wallets. But smart cards will have a short reign in North America because mobile phone–based transactions will quickly supplant them.

Today, every new point-of-sale device designed to process transactions can also communicate with smartphones using a set of wireless standards called Near Field Communication. North Americans and Asians aren’t using this capability that often yet, but it is increasingly available [see “Phone-y Money,” in this issue]. Meanwhile, some airlines have already installed readers that eliminate the need to use a self-service kiosk—passengers simply present an electronic boarding pass displayed on their smartphones.

Ironically, one of the most recent technical developments, Square—a tiny plastic attachment that turns smartphones into card readers and allows anyone to accept credit card payments—may actually slow down the rate at which mag-stripe cards give way to smartphone-transaction technology. Square makes it simpler for people to continue to use mag-stripe cards rather than migrate to new systems.

Over the next few years the mag-stripe card will fade away. But its legacy will live on. The original information standards—the way the data is physically laid out on the mag stripe—has survived every migration of transaction media, from mag-stripe cards to smart cards, from smart cards to smartphones. And just as many of us have forgotten the origins of the QWERTY layout of the keyboards we tap on for so many hours each day, we’ll soon forget—as we snap photos of checks to deposit them, wave our phones across scanners to pay for our lattes, and glide through turnstiles in mass transit without even removing our phones from our pockets as our accounts are automatically debited—that it all started with a magnetic stripe.

Acknowledgements

The author would like to credit key players in the development of the mag-stripe card, in particular the late George Waters at American Express, who saw the opportunity to speed the handling of large-body aircraft passenger loads and convinced American Airlines to participate in a pilot test; the late Louis D. Stevens, IBM ASDD Laboratory manager, with his vast body of knowledge of magnetics, its capacities, and usage; the late Perry Hudson of Chase Manhattan Bank and the American Banker’s Association, who foresaw the role of machine-readable media in the development of retail banking functions and led the ABA’s standards-definition effort; and IBM chairman Frank Cary, who decided that magnetic stripes played an integral role in standard IBM products and approved their use in banking subsystems (the IBM 3600).

About the Author

For more about the author, see the Back Story, “The Mag-Stripe Era Ends.”