CES 2017 wasn’t the show of the shiny new product. Wearables drew yawns, TV manufacturers spent more time talking about how to install their products on consumer walls than about the products themselves, and the lines to try on VR headsets were surprisingly short. Without the distraction of the next possibly big thing, it was easy to focus on the frustrations of the things we have now.

And one big frustration is Wi-Fi that isn’t always there, fast, and reliable. That frustration is why two router companies made the final round of the annual “Last Gadget Standing Event,” and earned their fair share of cheers: Ignition Design Labs, with its Portal home Wi-Fi system, and Linksys, with its Velop home mesh network.

The two take different approaches to addressing Wi-Fi frustration. The Portal’s approach of using Wi-Fi fast lanes and looking ahead for traffic jams (described in detail in Spectrum’s “Why Wi-Fi Stinks—and How to Fix It”), is suited for urban areas crowded with WiFi hotspots. Linksys, and other mesh network providers, makes sense for suburban customers, eager to get Wi-Fi signals to the outer edges of large houses and yards.

Off the show floor, antenna designer Ethertronics suggested a third approach: an automated antenna optimization technology it calls active steering.

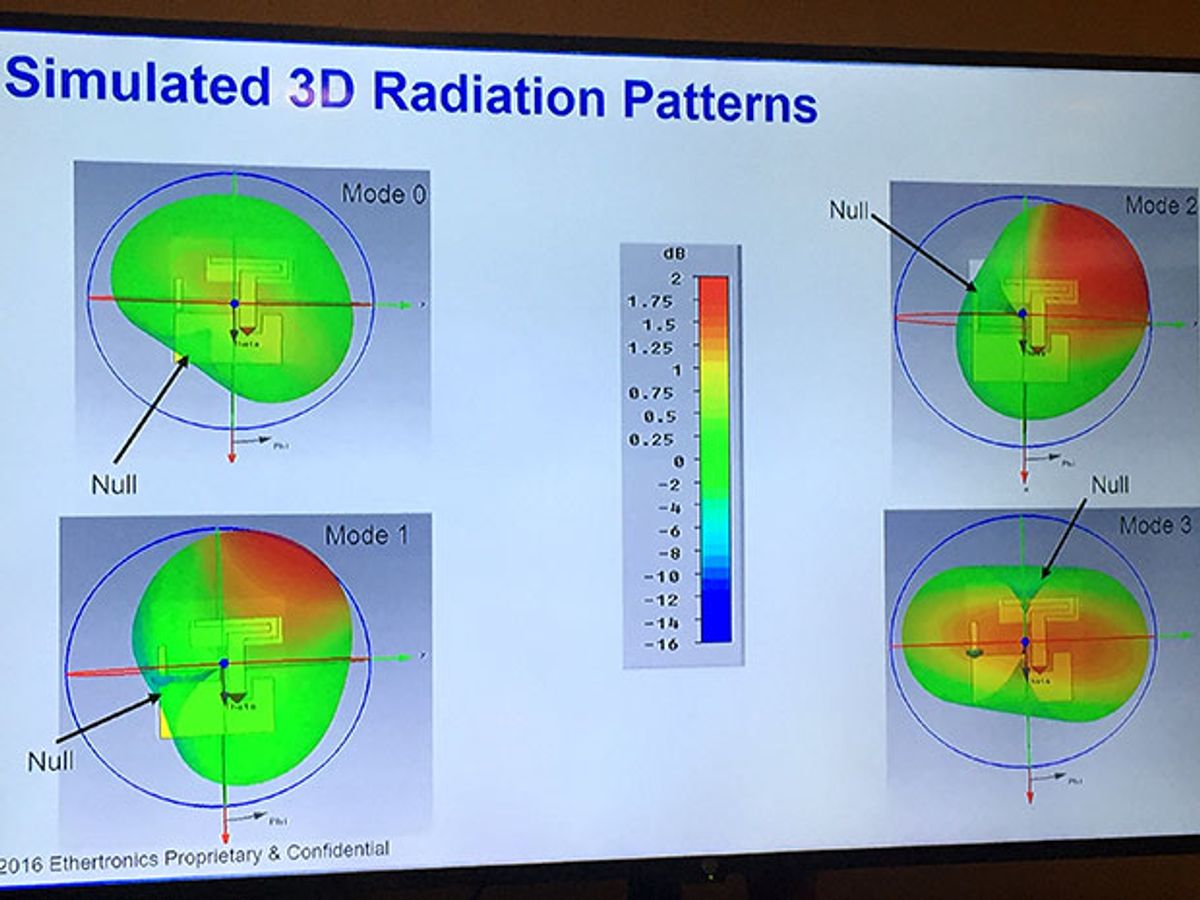

The San Diego-based company says that its technology can generate four different radiation patterns from a single antenna. For devices with multiple antennae—like cell phones and Wi-Fi routers—these patterns can combine exponentially. The Ethertronics antenna systems monitor signal strength in order to select the best pattern, constantly switching between patterns if necessary. What’s more, as they are used in a particular environment, they learn which patterns tend to be optimal for that space.

That means, explained, Jeff Shamblin, Ethertronics chief scientist, that a Wi-Fi router using the technology would automatically react to a home’s layout to pick a signal pattern that would reduce dead spots, changing that pattern, say, when a group of people cluster in one room and affect signal strength. Or, he said, an indoor TV antenna could switch its RF characteristics when you change stations (the equivalent of manually fussing with rabbit ears) while the antenna itself remains motionless on the wall; that’d be appealing for cord-cutters who use a combination of broadcast TV and streaming services to avoid cable television bills.

Shamblin said that the company’s antenna systems will start showing up in Wi-Fi routers in the second half of 2017; TV antenna hardware is also in the works for this year.

Tekla S. Perry is a senior editor at IEEE Spectrum. Based in Palo Alto, Calif., she's been covering the people, companies, and technology that make Silicon Valley a special place for more than 40 years. An IEEE member, she holds a bachelor's degree in journalism from Michigan State University.