In the home, the internet of things (IoT) is quickly becoming ubiquitous in terms of how it connects multiple devices and appliances to the internet in order to make it easier to enable home automation.

These smart devices — such as thermostats, locks, lighting, security, appliances, curtains and more — are generally controlled through a proprietary app allowing homeowners to control these home automation features either directly or remotely. There are also a multitude of smart speakers — such as voice assistants from Amazon, Google and Apple — that can control these IoT devices through voice recognition.

While many consumers have already adopted a smart thermostat or smart lock or are currently using an Amazon Alexa-enabled device or Google Home, one of the more interesting aspects to the IoT is what it is enabling in other adjacent markets.

While offering more efficiencies in the home, IoT is also bringing these same efficiencies into the insurance market — from homeowners to automotive. As adoption levels in the IoT increase, the benefits of having connected devices in the home and in the car will bring new ways to experience return on investment in the insurance world while at the same time providing insurance with more data on users to determine fair rates and provide services that keep people and assets safe.

Protecting the Home While Getting a Discount

Sure, the IoT can allow users to stream music from lightbulbs or monitor a home security system through a smartphone, but it can also save users a load of money on homeowners insurance.

Damage from plumbing problems and from household appliances can result in thousands of dollars in repairs or insurance claims. With the IoT, these problems can be prevented or mitigated by installing monitoring devices next to plumbing fixtures and appliances such as washing machines, dishwashers, water heaters, toilets and sinks.

When a leak is detected, a signal is sent to an electronic unit that closes the home’s main water supply and alerts the homeowner. Other systems limit damage by connecting leak detectors to a central monitoring system, which then relays the problem to the homeowner to prevent a bigger disaster. Because of this, insurance companies, such as The Personal, are starting to offer first alert detectors for free for homeowners that install smart home appliances.

Other discounts can be found through installing IoT sensors and devices in and around the home that can detect and monitor threats for potential fire, smoke or carbon dioxide.

Rewarding Driving Behavior

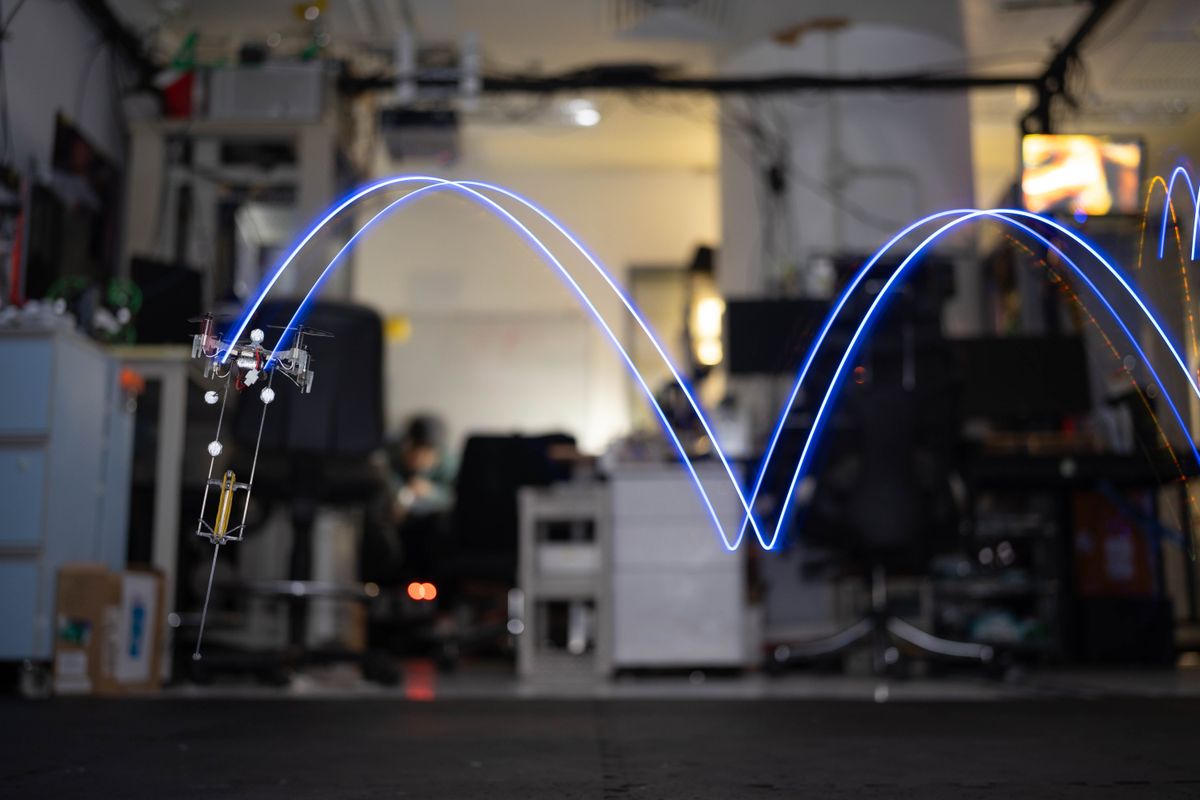

Auto insurance companies are beginning to use IoT technology to monitor driving behavior, including speeding and braking, and rewarding safe drivers with lower premiums. Simply, drivers that have a proven record of safe driving — demonstrated through the use of telematics and the IoT — are given better rates, while those found to be unsafe drivers are not.

The Personal, a provider of group auto and home insurance in Canada, through its Ajusto rogram uses telematics to monitor driving smoothness, speed, time of day and distance traveled. A driver’s final score could turn into a discount on their auto insurance after a 100-day trip analysis period and once the driver has driven 1,000 kilometers. The company receives usage-based information via smartphone to help monitor driving habit. Currently, this program is only available in Ontario, Canada.

The Ajusto program provides feedback to encourage drivers to improve and earn a higher score based on:

- How a driver accelerates, brakes and takes corners

- Obeying the speed limit to decrease the risk of accidents

- What time of day a person drives as certain periods during the day are lower in risk

- The distance a driver travels; shorter trips boost a driver’s score

Learn more about how the internet of things devices can save you money on insurance with The Personal and exclusive savings for IEEE members in Canada.