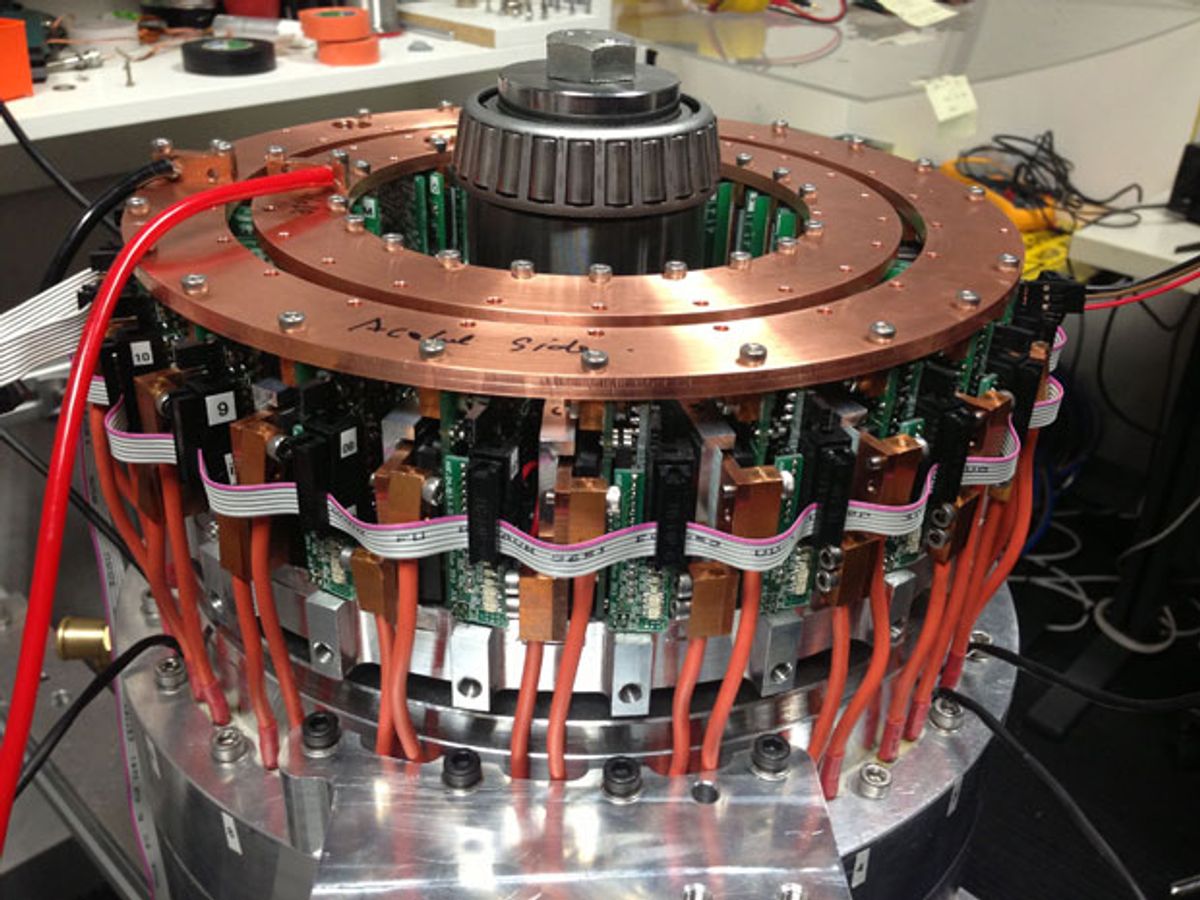

Look inside a typical electric motor and you’ll find a design that hasn’t changed in its essentials in more than a century. But when you open up an Axiflux motor, you’ll see something quite different, with green circuit boards and small metal coils, says Christopher Mosely. Mosely is the CEO of Axiflux, a Melbourne, Australia, start-up he founded in 2011 with David Jahshan, an honorary fellow at the University of Melbourne. The company has reinvented the electric motor with the goal of reducing the expense and increasing the efficiency of electric vehicles, wind turbines, and other machines.

Axiflux

Website: Axiflux.com

Founded: 2011

Headquarters: Melbourne, Australia

Founders: David Jahshan and Chris Mosely

Employees: 10

Funding: Undisclosed

Electric motor designs use the attractive and repulsive interactions between magnets—usually a permanent magnet and one or more electromagnets formed from copper coils—to make a rotor spin. Generators, of course, do just the opposite, using electromagnetism to convert spin into electrical current. In conventional designs, there are usually just a few large coils. That doesn’t allow for much control of power consumption, and they are “efficient only at specific speeds and loads,” says Mosely. That leaves some opportunity for efficiency improvements, especially important for electric and hybrid vehicles or wind turbines. Cars stop, start, and change speed all the time, and so does the wind, which often necessitates complex gearing arrangements to keep the motor or generator turning at its optimum. Being able to adjust to these variations directly would boost efficiency and reduce complexity.

To this end, Axiflux motors use small, modular copper coils. Depending on the application, hundreds of the modules could be used in a single motor, but the number is usually 20 or so. Together, the smaller coils act like a single larger coil. However, each has its own set of control circuitry—hence the green circuit boards—and software that can turn it off at lower speeds and loads and back on again as needed. The company is working on adaptive software for electric vehicle motors that could learn drivers’ preferences—such as whether they prefer power and acceleration over range—or for generators in wind turbines that can respond better to the weather in a particular location.

The company recently demonstrated its motor in a prototype electric sedan built by EV Engineering, a collaborative venture between Australian industry and government research organizations. The sedan, a revamped version of a car made by Holden, an Australian subsidiary of General Motors, normally uses a 145-kilowatt motor and drivetrain that cost around US $26 000. Mosely says that replacing this motor with one from Axiflux produced a 20 to 30 percent improvement in driving range with a motor that weighs 30 to 40 kilograms less and costs less than $5000 to make. The smaller size also freed up space that could be filled with more batteries to further improve the range.

For a company trying to enter the electric vehicle market, however, having a unique technology can be more of a handicap than a selling point, says Thilo Koslowski, a vice president and automotive analyst at Gartner. Automakers like having multiple suppliers. And electric motor technology has been stable for a long time, because it works. “The benefit of a typical motor is that it’s so reliable,” says Koslowski. To convince a car company to go for a new motor with a different physical design and a different kind of electrical control technology, Axiflux will have to prove its robustness.

But even if the company wins the hearts and minds of car makers, the electric vehicle market will be difficult for many years to come, says Cosmin Laslau, an automotive analyst at Lux Research, in Boston. Laslau predicts that by 2020 only 100 000 electric vehicles worldwide will be sold each year, due to their continued high costs and low battery storage capacity. And Axiflux will be competing not only with existing electric motors but also with other new designs, including those being developed by such start-ups as Yasa Motors, based in the United Kingdomand Missouri-based QM Power, as well as established players like Arnold Magnetic Technologies Corp.

“We’re under no illusions about the difficulty of the car industry—it will take 5 to 10 years to get traction,” says Mosely. In the meantime, the company hopes to produce products for mining and other industrial markets by 2015. Wind turbines will be next, and then finally electric vehicles.

About the Author

Katherine Bourazac is a freelance journalist based in San Francisco. In 2012 she wrote for IEEE Spectrum about Intel’s efforts to develop the Silvermont chip for smartphones.

Katherine Bourzac is a freelance journalist based in San Francisco, Calif. She writes about materials science, nanotechnology, energy, computing, and medicine—and about how all these fields overlap. Bourzac is a contributing editor at Technology Review and a contributor at Chemical & Engineering News; her work can also be found in Nature and Scientific American. She serves on the board of the Northern California chapter of the Society of Professional Journalists.