The Death of Business-Method Patents

From now on, you can get a U.S. patent only on a mousetrap—not on the idea of catching mice

On 30 October 2008, the much-maligned “business method” patent died at the hand of the U.S. Court of Appeals for the Federal Circuit, the very court that had given birth to it a decade earlier. The occasion was the case of In re Bilski, and although the U.S. Supreme Court has yet to utter the last word, the overwhelming likelihood is that you will no longer be able to patent the newest way of making a buck. If you want to protect new modes of shopping, delivering legal services, reserving a rest room on an airplane, or settling futures contracts, don’t ask the U.S. Patent and Trademark Office (PTO) for help.

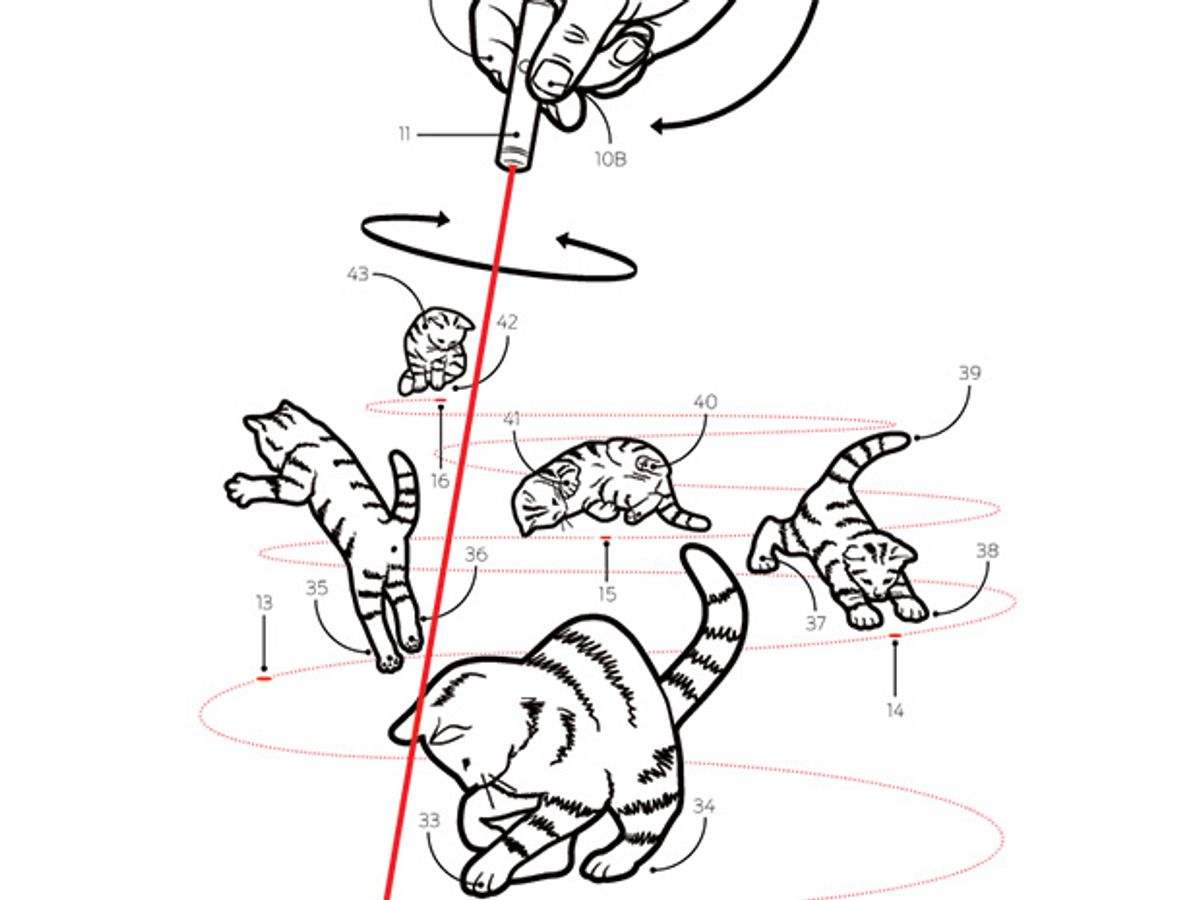

To critics of the business-method craze, the end could not have come soon enough. They’d complained that the patent system, designed to protect technology, was now spreading like a weed into all areas of life. Patents were being issued for using a laser pointer to tease a cat and for a way of playing on a child’s swing. (No joke—the patents were actually issued, in 1995 and 2002.) By covering almost any conceivable activity, the patent system was threatening to crush the very innovation it was meant to foster.

The system’s sudden expansion was almost accidental. For nearly a century, in fact, business methods had been expressly excluded. Patents, as the U.S. Supreme Court put it in 1980, were meant for “anything under the sun that is made by man.” Made, that is, of stuff—not ideas for doing things not involving stuff. That accorded with European patent guidelines, which provide that “technical character is an essential requirement for patentability of an invention,” and with a similar Japanese restriction to technical subject matter.

The original exclusion of business methods from the patent system may have stemmed from a quaint view of technology as something you cooked or cranked. The exclusion was later justified by the notion that free competition was so effective in encouraging new ways to do business that there was no need to add further incentives through the patent system. For decades, business methods stood outside the patent system because no one had made a case for their inclusion.

The problem was that even as the courts perpetuated the ban on business methods, they never really articulated exactly what business methods were. This deficiency irked the Federal Circuit when it decided State Street Bank & Trust Co. v. Signature Financial Group in 1998. Faced with a request to invalidate Signature’s patent on a data-processing system for calculating the best way to allocate the assets of a mutual fund, the court ultimately decided to let the patent stand. The court’s primary concern was whether software and data-processing techniques should be patentable. Along the way—almost as an afterthought, as we’ll see—it threw out the ban on business methods.

The patentability of software was an old and thorny question. The operations of a computer program might be too mathematical, too close to basic laws of nature. Where do you draw the line between math and its application?

In fact, the U.S. Supreme Court had tried three times to draw that line, most recently in the 1981 case of Diamond v. Diehr , which involved a patented rubber-curing operation based on a mathematical formula known as the Arrhenius equation. The court upheld the patent, saying that although math can’t be patented, an otherwise patentable process doesn’t become ineligible simply because it involves math. The Arrhenius equation might be no more patentable than gravity, but everyone agrees you can patent new ways to cure rubber, and their reliance on math shouldn’t matter.

The problem is that all software ultimately reduces to mathematical operations, yet only some software controls actual stuff, like the baking of rubber. If the rest is merely math and therefore unpatentable, does that mean we must deny patents to all software that runs nothing but itself?

Back in the 1990s, courts were uncomfortable going that far. Computers were infiltrating more and more traditional bastions of patent protection—consumer products, telecommunications, medical devices, automobiles—and computer software itself had become a distinct technology industry. It seemed wrong to read Diamond v. Diehr so broadly as to deny patent protection to new enterprises, thus leaving the rising tide of software technology outside the system—along with the dreaded business method. So the lower courts found themselves caught between the Supreme Court’s antipathy toward excessively mathematical inventions and the proliferating reality of computer software. Searching for a single principle that would exclude equations from patentability without crippling innovation, the courts experimented unsuccessfully with one patentability test after another.

By the mid-1990s, the PTO, attempting to maintain consistent examination practices despite the shifting legal sands, reached an uneasy truce with the courts. The patent office paid lip service to the latest court decisions, but its practice boiled down to rejecting claims that didn’t involve technology and demanding more from data-processing applications than simple number juggling.

That wasn’t a bad middle ground, actually, and the Federal Circuit probably didn’t really mean to disturb it when it decided, in the State Street case, that a mutual-fund management system was patentable. Signature’s system was no mere abstraction or equation but rather an obviously useful approach to managing specific business functions. So in its decision, the court welcomed into the patentable fold any “practical application” of an algorithm, formula, or calculation that produces “a useful, concrete and tangible result.”

Unfortunately, this test itself is neither concrete nor tangible. What the court probably intended was to broaden patent eligibility beyond software that controls physical stuff, like baking rubber, while precluding patents on computing mere numbers, such as pi or a Fourier transform. But the Federal Circuit thought its new patentability rule eminently clear—so clear, in fact, that it could revoke the ban on business methods. That way, a poorly defined category of exclusion would be eliminated, leaving the lawyers one less term to fight over. The idea was that every invention would stand or fall on whether it produced something useful, concrete, and tangible.

This approach might have worked, had the PTO and the legal community given a modest scope to those words. But the late 1990s did not favor modesty. The explosion of Web applications and new service models planted the Internet’s footprint over vast tracts of unexplored (and unpatented) business territory. Meanwhile, software development was surging, spurred on by plummeting prices for hardware and the proliferation of Web-based distribution channels. Web and software entrepreneurs feared their equally nimble competitors as much as they dreaded discovering their creations in the next version of Microsoft Windows. The rush was on to use the patent system to fend off competition.

Fatefully, the State Street court did not declare expressly that patents should be confined to technological subject matter. Perhaps the judges thought it implicit in their concept of “practical utility.” The foundations of the patent system, after all, lie in the U.S. Constitution’s mandate to “promote the progress of science and useful arts.” But because the court failed to articulate what it meant by “practical utility,” it removed a key restraint on patenting abstract ideas—such as business methods—without introducing a counterbalance. Maybe you couldn’t patent overnight delivery, but what about computing fees based on how far a package travels and when it arrives?

The floodgates flew open. Under relentless pressure from patent applicants, and lacking a clear legal basis to keep the door shut against almost anything, the PTO started admitting all comers. Filings for business-related ideas surged fivefold between 1998 and 2000. Actual grants for computer-implemented business patents rose fivefold from 1997 to 2006.

The party ended this past october, when the Federal Circuit upheld the PTO’s decision to deny a patent to Bernard L. Bilski and Rand A. Warsaw for a method of hedging risks in a commodity trading system. The court thus summarily ended its own State Street soiree, casting abstractions like legal relationships and marketing schemes into the same dustbin as equations and gravity: You can’t patent them. To qualify for a patent, said the court, a process must either transform one kind of stuff into another kind or it must be tied to a “particular machine.”

Both options cry out for greater clarity, and the judges did not supply it. And they compounded the ambiguity with an arbitrary distinction, holding that mere numbers can qualify as stuff as long as they represent stuff: X-ray data corresponding to a patient’s anatomy, for example, is equivalent for patent purposes to the anatomy itself. Yet all data is ultimately generic: It can just as easily represent something tangible as something abstract. What a byte represents hardly seems relevant to the objective of protecting commercially useful innovation while leaving pure science free to all.

Also, the court did not explain what it meant by a “particular machine.” That failure left open the question of whether a general-purpose computer can qualify. If the answer is yes, then in effect, an equation is patentable—as long as you solve it on a computer, which is how most people solve them now.

If that reasoning seems so excessive as to invite pure math back into the world of patents, consider the alternative: If the answer is no—that a general-purpose computer cannot qualify as a particular machine—then Bilski has gone far beyond reintroducing a technology requirement into the patent system. Virtually all of commercially useful computer science, including Google’s search methods and IBM’s techniques for secure data storage, will be ineligible for patent protection (unless they run only on special-purpose hardware). Vast technology industries will now be excluded from the patent system. Either way—with too much math or too little computer science in the patent system—the results are untenable. So the notion of a particular machine only confuses matters.

Unfortunately, what makes sense often gets obscured in the Talmudic dissection of legal principles and the cacophony of competing commercial interests. In the wider debate over patent reform, big industrial incumbents lobby to trim the scope of patents and thereby spare themselves tiresome and expensive lawsuits. Opposing them are pharmaceutical companies and technology upstarts, which rely more heavily on patents and champion the status quo. Each side claims to seek only a level playing field (and to safeguard our children’s future, of course). All too rare is the dispassionate, empirical analysis of how well the patent system is performing or of the economic effect of providing patent protection to specific categories of innovation.

In an ideal world, patents would be available only when the social benefits of encouraging innovation through the grant of exclusive rights outweighed the innovation-stifling effects of withholding them. At an estimated average cost of US $1 billion for discovering and developing each new drug treatment, for example, no one would get into the pharmaceutical business without a guarantee of exclusivity.

But that's an impossible standard to implement. No one, and certainly no governmental institution, can reliably assess whether patents help or harm particular forms of innovation. The U.S. Congress often drowns in the conflicting analyses supplied by partisan players, as recent experience with patent reform amply demonstrates. The courts, for their part, aren’t supposed to make social policy, which partly explains why they prefer to reason by analogy, deciding what can be patented by comparison to what is or isn’t already patentable.

But reasoning by analogy doesn’t always work well for new forms of innovation. Software, for example, is on one level just zeroes and ones. Yet it transforms a general-purpose computer into a specialized, task-specific machine. Indeed, a program’s very ability to run on any suitable platform means that protecting that program can affect an entire industry.

The upshot is that these endless debates about whether software is more like a patentable machine or an unpatentable abstraction are completely beside the point. What we really need to know, but lack the tools to reliably assess, is whether software patents help or hinder innovation.

If that question is obvious to ask but impossible to answer, then how are we to decide whether to admit a new candidate into the pantheon of patentable subject matter? Perhaps the best place to begin is where the world’s various patent systems tend to agree. One common feature is the focus on what’s made (as opposed to merely thought) by man. Other well-established boundaries include the universal unpatentability of laws of nature, physical phenomena, abstract or disembodied ideas, and pure math. Maybe we should exchange lofty expressions of legal principle for practical standards based on these recognized exclusions. Perhaps if patent claims call for hardware and operations that don’t reduce to “numbers in–crunch numbers–numbers out,” we should consider the subject-matter eligibility bar cleared.

Qualifying as patentable subject matter, after all, is only the first hurdle that any invention must clear. The invention must also be different from past efforts and, critically, sufficiently innovative beyond them to merit the distinction of a patent. This latter requirement of “nonobviousness” is a tough standard, and the courts have been making it tougher. Even the most creative way of teasing your pet or playing on a swing would surely fail to meet this standard today.

Let’s also not forget the system’s existing capacity for self-correction. Competitors who feel (or fear) a patent’s sting can ask the PTO to reconsider its decision to grant the patent, challenge the patent’s validity informally or in court, design around it, or pay a license fee. While none of these options may seem attractive to the party on the receiving end, their very existence ensures that most patents ultimately hinder rather than destroy competition. Legislatures will also act when the social costs seem too high, imposing restrictions on patents for surgical procedures, for example.

In fact, if judges conceived of themselves as practical surgeons rather than visionary healers, excising the dangerous outliers with a fine scalpel but otherwise doing no harm, then the system they preside over might well be healthier.

About the Author

STEVEN J. FRANK is a graduate of Harvard Law School and an intellectual-property attorney in Boston. His turn-ons are Italian Barolo wines, bicycle touring, and Mediterranean travel. Turn-offs include mean people, air pollution, and cruelty to animals. Frank’s latest book is Intellectual Property for Investors and Technology Managers (Cambridge University Press, 2006).