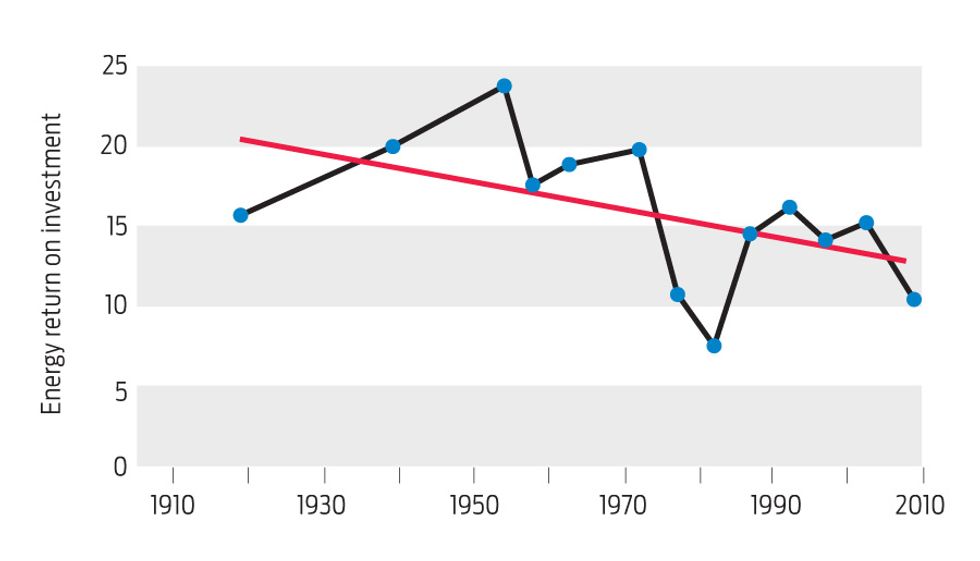

Oil producers are working harder than ever to replace their reserves and, increasingly, turning to nonconventional petroleum sources such as Canada’s tarry bitumen and ultra-deepwater offshore wells. As they do so, they are investing more energy to deliver each new barrel of oil. Similar trends are playing out for natural gas and coal, and a growing number of energy analysts are worried. They see these accelerating trends—what they call fossil fuels’ declining energy return on investment, or EROI—as an ill portent for the global economy.

The critical question for the future is whether renewable energy sources can fill the gap, sustaining the energy surplus that has supported explosive growth in human life span and population since the industrial revolution. A book due out later this year promises a hard-nosed look at solar energy—the fastest growing form of renewable energy—and is likely to raise plenty of eyebrows.

Coauthored by ecologist Charles A.S. Hall and Spanish telecom and solar systems engineer Pedro A. Prieto, the book is a case study of Spain’s utility-scale installations of photovoltaics. It will be, the authors claim, the first comprehensive analysis of large-scale PV based on data rather than models. Hall—a professor at the State University of New York College of Environmental Science and Forestry, in Syracuse—formalized the concept of EROI more than 40 years ago, as the energy yielded by an energy-gathering activity divided by the energy invested in that activity.

Oil and Gas Are Taking More Energy to Extract

While mum on their EROI numbers, Hall and Prieto say the book will demonstrate that building and operating PV requires considerably more energy than its promoters claim. And, they add, fossil fuels provide the bulk of the energy investment. “The conclusion is that solar PV systems are very much underpinned by a fossil fuel society,” says Prieto.

Prieto cites two dozen energy inputs left out of many life-cycle analyses of photovoltaic systems. He witnessed these inputs directly while building one of Spain's earliest utility-scale solar facilities—a 1-megawatt plant in Extremadura that began operating in 2006—and while supporting subsequent PV installations. The factors include construction of roads, water pipes, and transmission lines to serve the often-remote solar sites, and even international flights to get on-site help from specialist engineers.

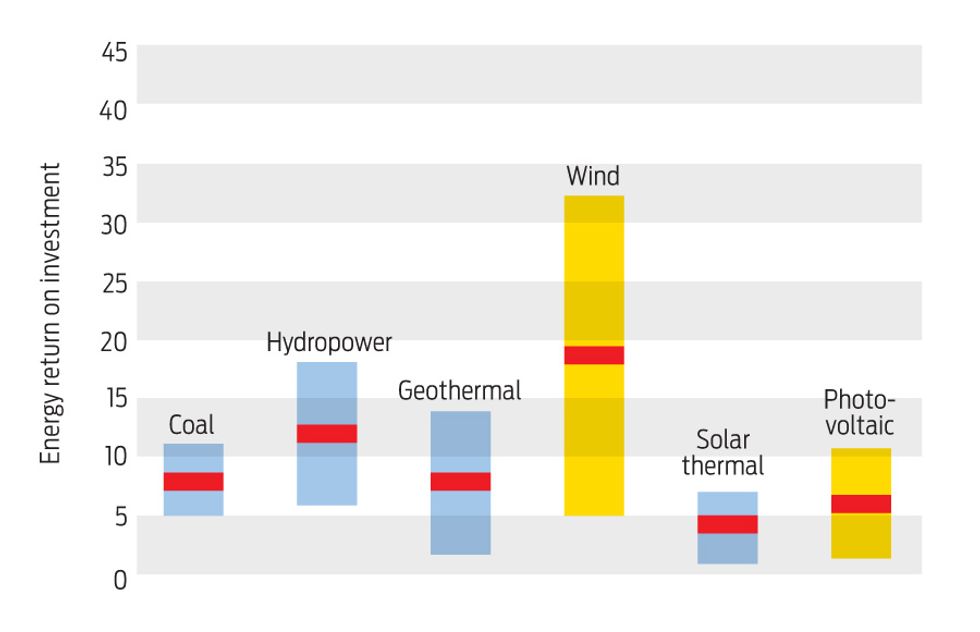

All told, says Prieto, the result could be an EROI figure even lower than the already controversial EROI of 6.8 that Hall previously cited for PV, which would make it inferior to most other forms of power generation [see charts, above]. According to Prieto we are “very far” from having solar power systems that provide substantial net energy to society, and he is not much more optimistic about similarly fast-growing wind power.

Renewables May Have a Hard Time Filling the Gap

Not all energy analysts tracking EROI accept this dim view of renewable energy. For one thing, analyses of fossil fuels likely neglect to count many real-world energy inputs such as those that Prieto is adding to solar’s baggage. For another, PV efficiency is rising fast. An updated analysis published this March by Marco Raugei, a life-cycle expert at Barcelona’s Universitat Pompeu Fabra, and two U.S.-based colleagues calculates EROIs of 19 to 38 for various PV module types.

Joshua Pearce, an associate professor of materials science and engineering at Michigan Technological University, notes that energy policies could improve real returns from solar energy by offering incentives for the use of the highest-EROI systems. Centralized solar farms full of cheap crystalline silicon modules—which EROI studies show to be the most energy intensive of PV installations—dominate the market because they are the most profitable to build. A deployment scheme designed to reward EROI instead would shift the calculus, says Pearce: “Before a single centralized PV facility was erected, we would have thin-film PV panels integrated into every appropriate rooftop.”

Stanford University energy systems expert Adam Brandt, meanwhile, discounts PV’s current reliance on fossil energy. What’s important, he says, is that a PV installation can use fossil energy to produce carbon-free power—a critical response to climate change. “If you consume one unit of fossil fuel and get something like 8 or 12 units of solar energy out, that’s a positive story,” Brandt says.

If the optimists are wrong, however, prepare for a shock. In a 2009 paper [PDF], Hall and his colleagues estimated that energy supplies with an EROI of at least 12 to 13 were required to support the trappings of modern developed nations, such as higher education, technological progress, and high art. Oil and gas production in the United States may have already fallen below that threshold, the paper says, and global production appears to be following fast.

The implications, according to Prieto and Hall, are sobering. In fact, Prieto believes he is already witnessing economic decline caused, in part, by petroleum’s dwindling EROI. He sees it manifested in Spain’s debt crisis. “Energy is the ability to do work. If we do not have more energy one year than the preceding year, we will hardly be able to grow,” he says. “And, if there is no growth, the financial system collapses.”