This April 1st will be no laughing matter for Japan’s 10 regional power suppliers. The Japanese government has chosen All Fools Day to start the second phase of its energy reforms: the liberalization of the electricity retail market. The third phase, the unbundling of transmission and distribution from the generation of electricity, is to follow in 2020.

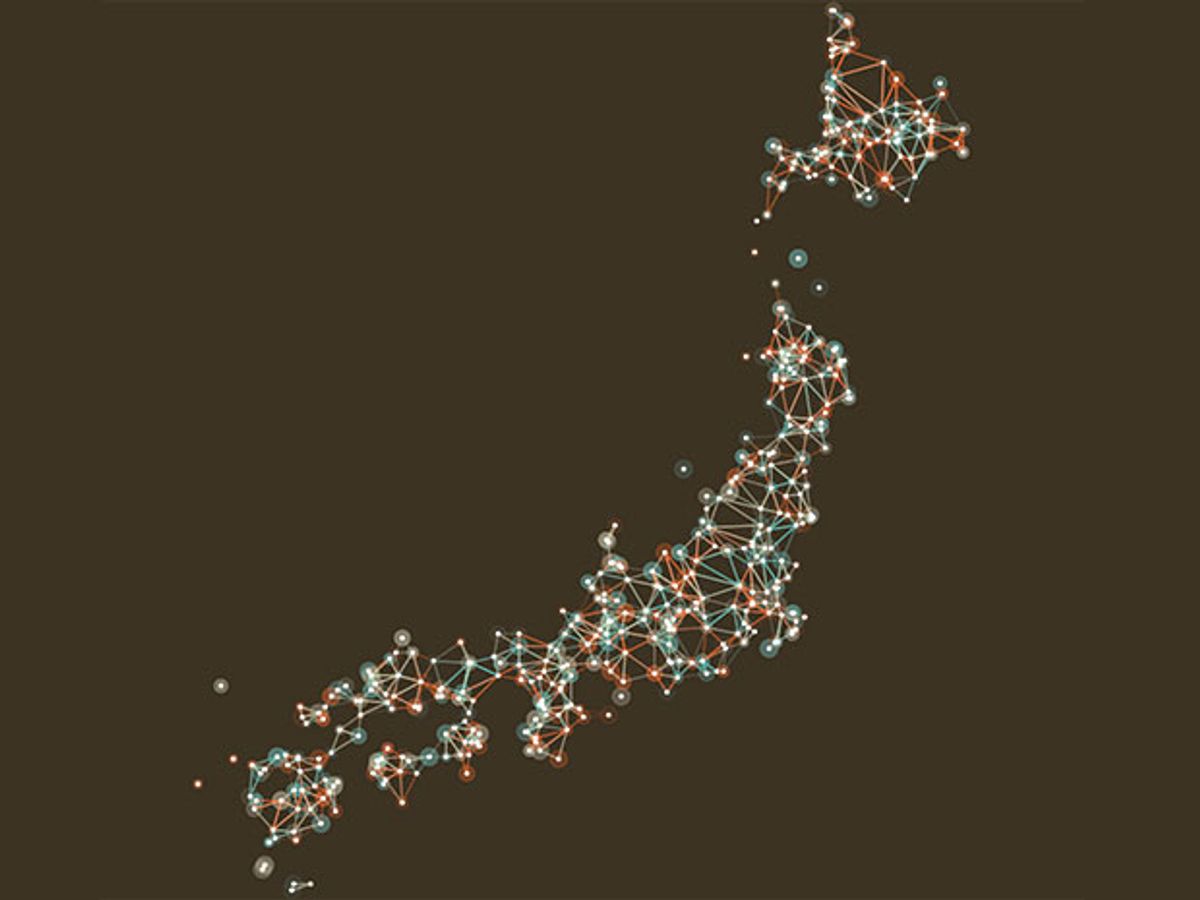

The first phase got under way last April when the government established the Organization for Cross-regional Coordination of Transmission Operators (OCCTO), an independent institution to promote and coordinate wide-area operations.

“It is OCCTO’s job to plan how to lay out an efficient transmission network across the country,” Hiroshi Ohashi, professor of economics at the University of Tokyo, told IEEE Spectrum. “It must also decide how much reserve power each region should have, as well as write up new rules governing the use of transmission rights.”

Reform became a priority, according to a 2015 Ministry of Economy, Trade and Industry report, after the Great East Japan Earthquake of 11 March 2011 revealed that: the regional monopolies were unable to transmit electricity beyond their fiefdoms; they had become inflexible in changing their energy mix; and they had difficulties in increasing the ratio of renewable energy they could use.

Now, come 1 April, not only will the Big Ten electricity providers have free reign to compete in each other’s domains, they’ll also face competition from more than 150 new start-up energy groups, as well as 30 existing small competitors. All these new entrants want a share of a retail electricity market worth more than 6.5 trillion yen (US $67 billion), representing 40 percent of the country’s total energy usage.

The gas industry will also undergo similar deregulation in April 2017. With that in mind, gas companies have become a significant presence among the electric energy start-ups by creating strategic partnerships and alliances. They’ve linked up with each other and with: the major mobile telecom firms NTT Docomo, Softbank, and KDDI’s au; major trading companies; convenience-store chains such as Lawson; and other industry sector leaders.

New entrants’ share of the electricity market, as of last summer, had already reached roughly 10 percent, according to the Institute of Energy Economics, Japan (IEEJ), a private think tank in Tokyo. By early February, 106,000 customers had applied to switch suppliers—though 99 percent of these switches will occur within the regions currently dominated by Tokyo Electric Power Co. (TEPCO) and Kansai Electric Power Co. (KEPCO, which covers Osaka and Kyoto in western Japan).

Being the two largest power suppliers partly accounts for this concentration of applicants in the TEPCO and KEPO regions, as does the fact that both suppliers have a number of nuclear power stations that remain off line in the wake of the Fukushima Daiichi Power Station accident in March 2011.

“Nuclear power generation represents a major share of their energy mix, so the costs for these utility companies are rather high,” says Masakazu Toyoda, chairman and CEO of IEEJ, who briefed the press recently on the ongoing energy reforms.

Among developed economies, Japan has come late to the energy deregulation party, so it has been able to study how energy liberalization has gone in the United States and Western Europe. One area of concern noted by Toyoda is that those regions’ reforms have not brought about adequate investment in the reformed industries. This is attributed to the uncertainty over energy sources and prices, and the fact that power-generation facilities have high fixed costs, which require a lengthy time to recover.

“This [issue] has required some form of government intervention such as [introducing] the capacity market,” notes Toyoda.

A capacity market mechanism is the creation of some form of compensation paid to the suppliers for building energy capacity beyond what is presently needed, but based on future projections, may be required in a few years or in the case of a natural disaster.

Japan, too, will require some kind of capacity market mechanism, says Ohashi. “If only to maintain existing conventional generating facilities, which face lower levels of utilization over the long term because of increasing penetration of solar and other renewable generation.”

Another area where the government may need to step in—and is already doing so—is revising the feed-in-tariffs (FITs), which were set at high levels after the Fukushima Daiichi nuclear accident led to the shutdown or decommissioning of all its 55 nuclear plants. But this led to a surge in new producers, most mainly focused on solar generation. However, the former regional monopolies have balked at taking on more new applicants, voicing concern about their ability to maintain stable energy supplies.

According to IEEJ data, resource-poor Japan charged industrial customers 20.4 cents per kilowatt-hour in 2012; residential customers paid 29.01 cents. Thanks in part to tariff reductions, these charges had decreased to 18.8 cents and 25.3 cents respectively by 2014. By comparison, in the resource-rich United States, the average industrial customer was paying 7 cents per kWh, and the average household paid 12.5 cents in 2014.

“FIT has been heavily biased towards unstable, renewable power supplies, especially solar,” says Ohashi. “As the government decreases FIT prices, this will become less of an important issue. But it will take time to see the consequences of this policy.”

FIT adjustments aren’t the only point of uncertainty. Given the various challenges Japan faces in transforming its energy market, it is safe to say that no one can foresee the consequences of the changes that are about to get underway on All Fools Day.