What would happen if the production of laptops, cellphones, and MP3 players suddenly halted? Oh, and no more hybrid electric vehicles and MRI machines? It probably won’t happen, of course, but the fact that it could is scary enough. A single country, China, mines more than 95 percent of the world’s supply of rare earth metals, found in permanent magnets, phosphors, lasers, capacitors, and superconductors.

That’s not to say that China has all the deposits. In fact, most of the 17 elements in this group aren’t rare at all. They got their name because the ores in which they’re found are notoriously difficult to extract from Earth’s crust. It’s expensive to mine them in the United States, Europe, and other places with relatively strict environmental laws. China, with fewer such scruples, has been able to flood the market. In 1992, the price of ore containing these elements plummeted, and Molycorp Minerals, in Greenwood, Colo., the owner of the largest U.S. repository of rare earth metals, stopped digging.

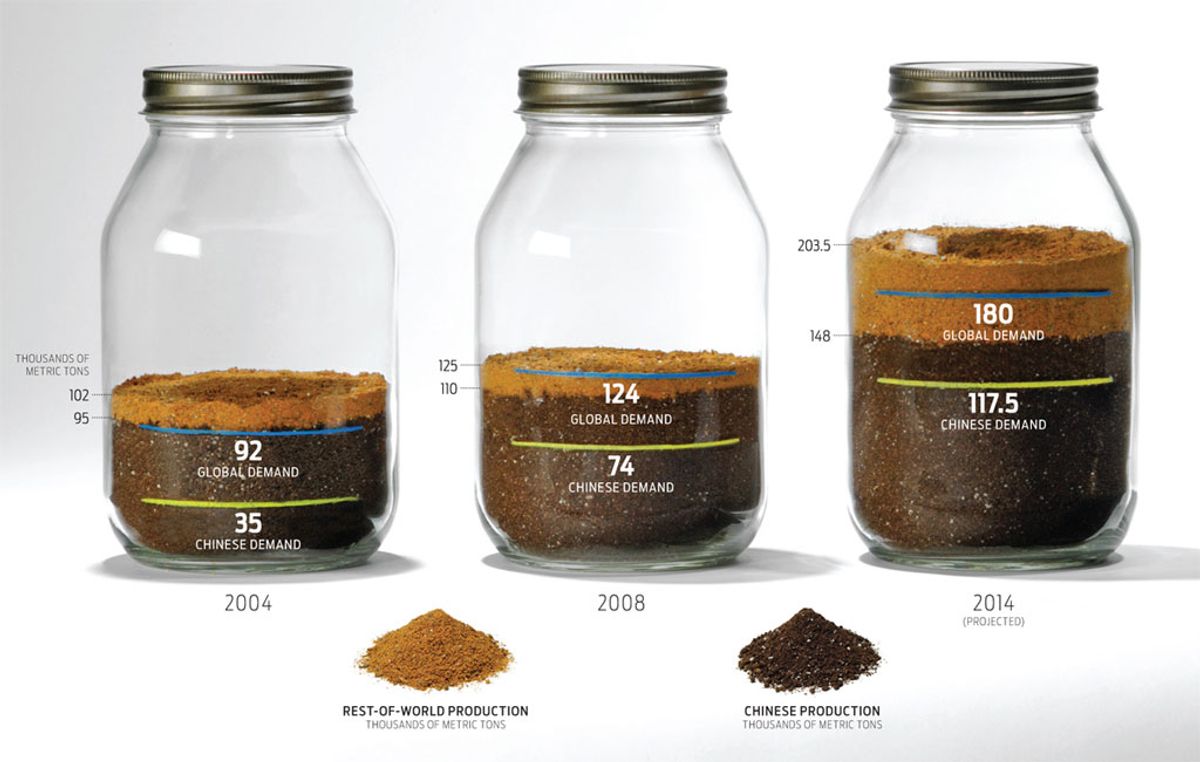

As recently as 2004, China used less than half of the rare earth metals it produced. But according to an estimate by the Industrial Minerals Co. of Australia, in Mount Claremont, China’s domestic demand will overtake its production in less than 10 years. Now Beijing is considering banning exports of some rare earth elements and limiting shipments of others to 35 000 metric tons a year, which would immediately threaten not just electronics manufacturing across the globe but also hybrid vehicles. A Toyota Prius, for example, requires about a kilogram of neodymium for its electric motor and as much as 15 kg of lanthanum for its battery pack.

In anticipation of China turning off its rare-earth spigot, Molycorp is gearing up to go back into full production. When mining restarts in 2012, the site is expected to turn out 20 000 metric tons of rare earth metals each year, says CEO Mark Smith. But the research site HardAssetsInvestor.com estimates that by then, annual world demand outside China is likely to exceed 60 000 metric tons.