Networking Assets

Will distributed generation pan out as a panacea?

This is part of IEEE Spectrum's special report: Always On: Living in a Networked World.

The Swiss power engineering company that has vied with General Electric Co., Fairfield, Conn., for the title of the world's best-managed company--who else but ABB Ltd.?--surprised industry observers six months ago by announcing it was retiring from the business of building large power plants. Considering that global demand for gas-fired, combined-cycle plants is booming, and that the Zurich company has long been a major supplier, this news was startling to say the least.

ABB said it was selling its 50 percent share in the French turbine manufacturer Alstom back to Alstom SA, Paris, and its nuclear business to the Westinghouse division of British Nuclear Fuels Ltd., Cheshire, in order to focus on a "new growth market"--distributed generation. This strategy, according to the company, would enable it to draw on its strengths in transmission and distribution (especially control systems and high-voltage direct-current, or HVDC, transmission technology) as well as combined heat and power for buildings (cogeneration), microturbines, and wind technology.

The new strategy certainly has its points. For example, the company is devising a simpler wind turbine that dispenses with a gear box by using its HVDC-light system to convert variable ac current from the turbine to dc for transmission, then back to ac at the grid frequency. Similarly, its experience in building large cogeneration systems for communities should enable it to build highly efficient microturbines to provide individual buildings or building complexes with both heat and power.

ABB's move is a striking vote of confidence in the concept of distributed generation. The idea is that by relying on dispersed small-scale generators, combined with other distributed resources such as flywheel storage devices and sophisticated control equipment, utilities can avoid costly investments in large, often polluting central plants. They can also deploy generating assets more flexibly as needed, and at the same time reduce transmission and distribution losses.

ABB makes a strong case for the usefulness of smaller-scale power in the poorer parts of the world. These areas, after all, are where some 750 million families still lack electricity. But how much of a dent can distributed generation make in the industrial countries? Will technical developments be truly revolutionary, or more evolutionary?

Types of distributed resources

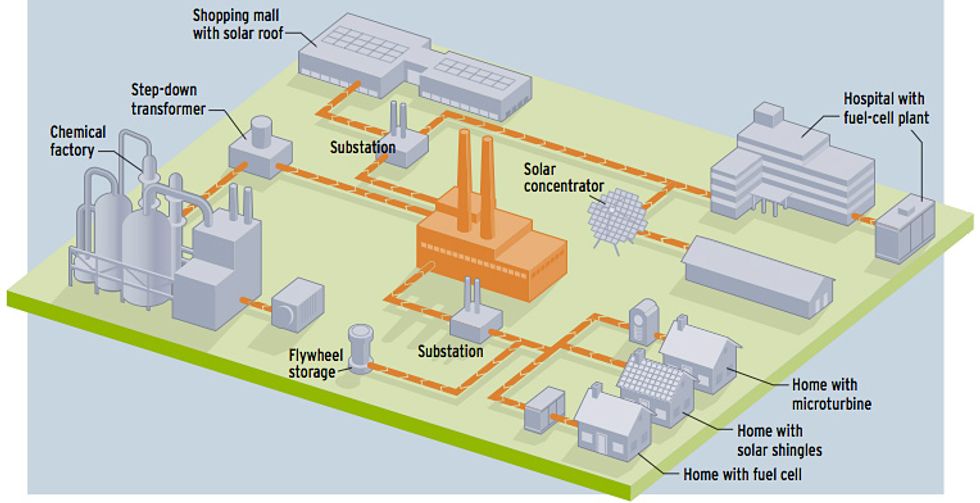

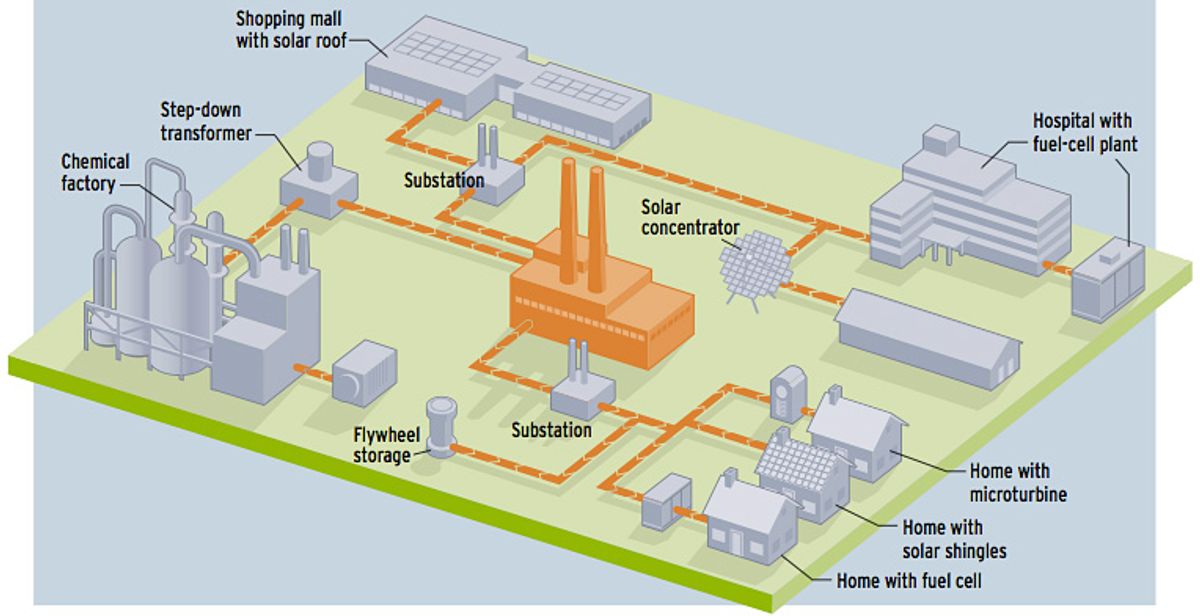

In principle, any of the alternative or renewable energy sources, from biomass to photovoltaics, is suitable for inclusion in the kind of "microgrid" that ABB visualizes itself as devising for the "virtual utility" of the future [see illustration, below].

Even with a modest sustained rise in natural gas prices [see "An Unnatural Rush to Natural Gas?"], techn0logies only recently seen as merely near-competitive could suddenly become much more attractive. And utility plans allowing customers to opt for "green power" are helping promote greater reliance on renewables [see " Deregulation May Give a Boost to Renewable Resources"].

But wind and biomass are constrained by the availability of wind and land, and photovoltaics will become cost-competitive only if gas prices double. Partly for those reasons, the two candidate technologies for distributed generation that are arousing the most excitement right now are fuel cells and microturbines. Companies touting novel approaches to the design of fuel cells and microturbines have been experiencing the kind of Wall Street roller-coaster rides ordinarily reserved for dot.coms. And in those stories there are good grounds for excitement, but also some cautionary tales.

Pint-sized fuel cells

So fashionable are fuel cells, suddenly, that even general-interest nontechnical magazines such as The New Yorker have carried articles describing them to the lay public. Hardly a month passes, indeed, without news from another fuel-cell start-up.

Meanwhile, as the field benefits from hitherto unheard-of public support, research groups devoted to fuel cells are being formed at academic institutions like the Georgia Institute of Technology, in Atlanta. This past fall, the U.S. Congress for the first time appropriated R&D funds for fuel-cell research in excess of the President's budget request (though admittedly still just US $100 million).

One of the fuel-cell R&D companies getting the most attention is Plug Power, based in Latham, N.Y. It has been developing a 7-kW, proton-exchange (PEM) fuel cell, almost unique in being sized for the residential market (in contrast to cells produced by more established manufacturers). It works either independently of the grid or in a grid-parallel mode, taking electricity when needed from the grid and feeding excess electricity back. (Grid-parallel is the preferred mode, as the cell otherwise has to adjust its output to changing loads, making control much trickier and requiring storage capacity.) The cell runs on natural gas, propane or methanol--fuels readily available in most residential districts--and operates at a relatively low temperature of about 70 °C.

The system can be configured so that waste heat is recovered and used in the home, and in fact heat must be drained from the cell for its exchange membrane to work efficiently. What's more, reported a company official at a New York State energy conference late last year, Plug Power would like to raise its cell's operating temperature somewhat to make its membrane less vulnerable to certain pollutants. That capability could mean more recovered heat available for home heating, air conditioning, and water boiling.

Plug Power's stated aim is to be the first company to mass-produce and sell one million fuel cells--an intriguing ambition, inasmuch as mass production of distributed power devices could result in an industry more like today's automobile industry.

Feedback on the fuel cell has been positive. Long Island Power Authority, Uniondale, N.Y., has reported good results from its test of the first six pre-commercial Plug Power cells, conducted at several sites on Long Island. The utility has placed an order for 28 cells of the next pre-commercial generation, for further testing and evaluation.

While Plug Power appears to have a jump on competitors, it will not monopolize the residential market. The Canadian company Ballard, in Vancouver, B.C., which is the leading name in fuel cells optimized for vehicular applications, has a deal with Tokyo Gas Co. to develop a 1-kW cell with Japanese homes in mind.

Other companies fielding relatively small-scale cells include: Avista Laboratories, a subsidiary of Avista Corp. in Spokane, Wash., which plans to introduce a modular PEM system with just one moving part this year; and Ida Tech, a subsidiary of Ida Corp. in Copenhagen, Denmark, which has demonstrated 1- and 3-kW systems. The Danish company expects them to be ready in 2002 for emergency power and uninterruptible-power applications, and in 2003 for the home market.

ABB makes a strong case for the usefulness of smaller-scale power

Microturbines spinning into webs

As for miniature gas-fired turbines, they are arousing just as much excitement. More or less arbitrarily defined as micro (30-200 kW and above), mini (500-1000 kW), and small (up to 15 MW), such turbines are generally expected to be reliable (even though their rotation rates are high), quite efficient (albeit less so than large combined-cycle plants), and readily produced and deployed (despite the concerns about grid interoperability discussed below).

Companies entering the market with interesting technology include Capstone Turbine Corp., Chatsworth, Calif., which has a prototype 30-kW, low-pressure, air-bearing device, the 330, being tested in both vehicular and stationary modes. Then, too, Honeywell International Inc., Albuquerque, N.M., has a 75-kW, air-bearing unit, the Parallon75 that reputedly produces electricity for $0.04/kWh in a cogenerating mode. Meanwhile, Solar Turbines Inc., San Diego, Calif., a subsidiary of Caterpillar Inc., Peoria, Ill., probably the leading U.S. manufacturer of conventional reciprocating engines for industrial use, is producing a 7-MW turbine intended for peak shaving.

Capstone, a start-up that saw its stock soar from $16 to $90 after a June initial public offering (IPO), only to fall back to $20, has sold about 1000 of its 330 units. Roughly one-quarter are used in hybrid-electric vehicles, one-quarter as micro-cogenerators, one-quarter in situations requiring high power quality or reliability, and one-quarter for waste recovery from oil and gas operations or landfills.

Ake Almgren, the chief executive officer of Capstone, told IEEE Spectrum that his company's unique technology drew on previous developments in small turbines and in turbochargers used in aviation. The 330 turbine's very high rotation rate of 9600 rpm posed special challenges, which were solved by means of advanced power electronics.

Microturbines and fuel cells can be deployed not only in isolation but also in combination. Marrying the two technologies could have prodigious advantages. Among the gains are overall system efficiency and recovery of pollutants, including greenhouse gases. In a project supported by the U.S. Department of Energy and located in Irvine, Calif., Siemens Westinghouse is installing a 220-kW fuel-cell plant, made up of 1152 tubular ceramic solid-oxide cells. The pressurized hot gases the plant emits will drive microturbines.

Companies also are developing several external combustion engines, notably some new Stirling engine concepts, which can be fueled in a variety of ways. One approach that received considerable scrutiny in the 1970s and '80s, and which would be poised for a comeback, is to obtain the drive energy from solar concentrators.

Will turtles win the race?

While there is no shortage of announcements of "breakthroughs" about to "revolutionize" the way energy is converted and distributed, when attempts are made to follow up on some of them, calls sometimes go unanswered. To a reporter inured to corporate hype, many of these revolutionary technologies seem not ready for prime time. In the end the impression is that the more substantial developments in distributed generation are evolutionary, and come largely from firms already well-established in their fields of endeavor.

Some of Plug Power's recent experiences are illustrative. On 1 November 1999 it sold stock in an initial public offering that resembled the IPOs of high-flying dot.coms. Two months later, an analyst at the MSN financial news service predicted its stock would appreciate enormously over the years to come, lifting the stock from near $15 to over $150.

Naturally this initial burst in Plug Power's capitalization made a lot of people at the company ecstatic, not to speak of executives at General Electric and DTE Energy, Detroit, Mich., which have stakes in the company. All the greater, then, was the disappointment last May when Plug Power's stock took a big hit after the company announced it had failed to meet development targets negotiated with its distribution partner, GE Power Systems, Schenectady, N.Y., and that GE accordingly would be released from its legal obligation to buy 485 of the company's first units--now not scheduled for production until 2002.

Greater still was the dismay when, on 21 September, shareholders filed a class action suit against the company's officers, alleging they had not adequately disclosed the full extent of the company's difficulties in May. The suit also claimed that officers had improperly unloaded large batches of stock they owned, pocketing millions of dollars and contributing to the stock's precipitous fall. (Note, however, that the allegations were based in part on SEC form 144 filings of intent to sell stock that may not reflect actual sales.)

The suit against Plug Power in no way implies that its technology is fundamentally flawed, of course, or even that its ambitions are unreasonable. Nonetheless, its business plan is under a cloud, and its experiences are a warning that not all technical claims can be taken at face value.

Some solid milestones

Much of the more credible news in distributed generation has been associated with well-established names. In July, Chugach Electric Association Inc., in Anchorage, Alaska's largest utility, completed and commissioned a 1-MW fuel-cell project to power the U.S. Postal Service's general mail facility in Anchorage. The plant consists of five 200-kW cells manufactured by Onsi, a subsidiary of United Technologies based in South Windsor, Conn. Onsi originated as the maker of the cells that powered the Apollo and Gemini space probes and is probably the only company in the world with an assembly line steadily churning out cells for stationary applications. (Ballard has attained a similar position in the market for vehicular cells and is poised to enter the power-generation market as well as the Tokyo Gas deal mentioned earlier.) Onsi's other showcase project is a $3.4 million, 800-kW, four-cell plant it recently supplied to the First National Bank of Omaha. The plant will power--with more reliability than the local grid could guarantee--its national credit card processing operations.

One especially promising feature of distributed generation is its ability to supply the power-hungry electronics installations that account for a substantial share of demand growth. Oracle Corp., for example, has spent $6 million to build a dedicated generator facility for its headquarters in Redwood Shores, Calif.

A liability, on the other hand, has to do with the separation of distribution from generation in states restructuring their grids. At least as William T. Miller, the president of Onsi, sees it, the distributors--who are best situated to determine where new distributed generation is most needed--"can't talk to the generation company about siting."

Still, headway is being made. FuelCell Energy Inc., Danbury, Conn., also well known in the field, demonstrated a 250-kW molten-carbonate grid-feeding fuel-cell power plant in Santa Clara, Calif., several years ago. It now has a contract with Kentucky Pioneer Energy LLC, in Clark County, to build a 2-MW, $34 million plant--again, an array of cells--which will be part of a 400-MW, $800 million Department of Energy clean-coal project. The cells will be fed by synthesis gas from an integrated coal gasification combined-cycle plant.

The idea in such "powerplex" projects, which their proponents claim will be able to generate electricity more cheaply and efficiently than a gas-fired plant, is for all usable fuels to be converted and for carbon emissions to be fully sequestered, so that the technology essentially emits no carbon.

The difficulties of connecting distributed resources to a grid are not to be underestimated

Grid interconnection issues

What has made the concept of distributed power especially attractive is, of course, all the innovative electronics that has lowered the cost of protective relaying, improved remote control, and simplified interfaces between generating resources and the grid.

But even so, the difficulties of connecting distributed resources to a grid are not to be underestimated. First of all, any visitor to a photovoltaic-powered home can see how much extra equipment is required in the basement to handle dc-to-ac conversion, to regulate current flows from or to the grid, and to meter flows--a lot more equipment than most consumers, even assuming they are willing to confront the high costs of photovoltaic panels or tiles, would be willing to deal with.

The issues on the grid side, where trained electrical and electronics engineers are available to cope with them, also are far from trivial. Unwanted flows back into the grid can be a serious threat to maintenance personnel, as well as to equipment. Design of protective relaying systems is much more complicated because, for example, ways must be found to feed current back into the network through protectors designed to be regulating current going the other way. Conversely, when a protector opens a circuit, a distributed generator might continue to feed a subdistribution system, blowing a fuse, which would then stay open when the larger circuit recloses.

Those concerned about interconnection issues credit an IEEE standards process, P 1547, with doing much to help clarify matters. It originated as an initiative of the Edison Electric Institute, Washington, D.C., involving some 125 utilities. The thrust has been to develop a matrix in which all generation types are charted against all distribution system types, so that exact specifications can be made for safe interconnection placement of breakers, reclosers, and so on.

Limited impact on fuel conservation

Just about any smaller-scale energy source has the potential to help reduce reliance on natural gas: by providing peaking power where needed, cutting losses and costs associated with distribution and transmission, and providing a backup to centrally generated electricity. Distributed generation and storage also can yield greater trustworthiness than the "three nines" (99.9 percent reliability) that has been the power industry standard.

A major limitation of the distributed-generation concept, however, is that the two most promising technologies--both fuel cells and microturbines--almost always rely on natural gas as the preferred feedstock. Thus they can do little to cut back on use of gas beyond improving distribution efficiencies--by reducing line losses, for example, and allowing for energy to be used more flexibly.

To Probe Further

Much more information on the IEEE grid-interconnection standard P 1547 is on the Web at https://grouper.ieee.org/groups/scc21/1547/.

For an assessment of how distributed generators stack up environmentally, see "Exploring Emissions of Distributed Generation and Pollution Prevention Policies," by Nathanael Greene and Roel Hammerschlag, in The Electricity Journal, June 2000, pp. 50-60.

Several Web sites of interest focus on the Capstone microturbine (https://www.microturbine.com), the Honeywell microturbine (https://www.parallon75.com), Caterpillar's Solar Corp. (www.cat.com), the Stirling concept (https://www.STMPower.com), and International Fuel Cells/Onsi https://www.internationalfuelcells.com/).

The sites for ABB Ltd. and Plug Power Inc. are the obvious ones (https://www.abb.com and https://www.plugpower.com).