LevelUp

Founded: 2011

Headquarters: Boston

Founder: Seth Priebatsch

Employees: 148

Funding: $41 million (includes capital raised by SCVNGR)

In a few years, paying for goods and services with a smartphone could be as commonplace as swiping a credit or debit card today. According to the analyst firm Gartner, the global market for mobile payments is projected to grow to US $617 billion annually by 2016. But for now it’s still early days, with a hodgepodge of technologies and businesses models vying for mindshare and market share, such as Google Wallet, Isis Mobile Wallet, and Orange’s Quick Tap.

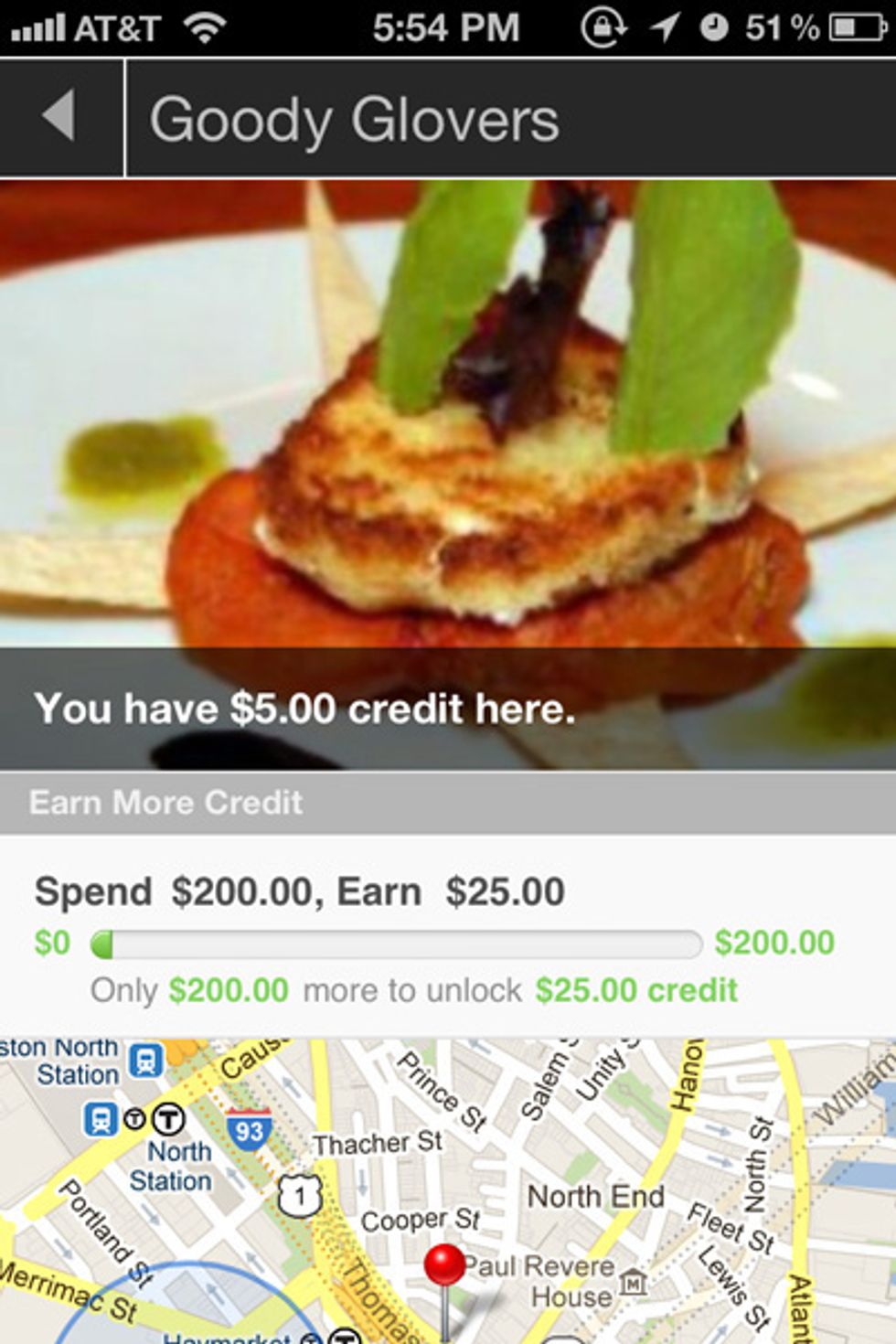

Boston-based LevelUp entered this arena last year with a free phone app that customers link to a debit or credit card. When it’s time to pay at a store, the app generates and displays an onscreen QR code (a type of high-capacity bar code). Holding the screen up to an in-store reader completes the transaction. No credit card information is transmitted. Instead, starting with the initial QR code scan, a series of tokens is passed from the customer, through the merchant and LevelUp’s servers, and finally to one of LevelUp’s payment processors: Braintree Vault and Bank of America. The tokens are then paired with credit card account information, and the charge is made.

The hook for customers is automated discounts: Typically, the first time users make a purchase from a merchant with LevelUp, they receive an instant credit from the merchant, usually in the range of $1 to $3 (merchants have the option of choosing to participate in this program). Subsequent purchases can then be tracked as part of a loyalty program determined by each merchant; for example, every $50 or $100 spent with a given merchant could trigger an immediate reward of, say, a $5 credit.

On the merchant’s side, the appeal is the absence of per-transaction fees. With credit cards, these fees normally run to a few percent of each purchase. With LevelUp, merchants are billed only when a customer redeems a credit. Then, in addition to the cost of the credit itself, merchants are charged 35 cents on the dollar—for example, a $2 initial credit would cost a merchant a total of $2.70.

LevelUp claims that it can avoid charging per-transaction fees because of the system’s low processing costs, which it attributes in part to the security of the token-based approach. LevelUp’s stated fraud rate is 1 percent of that for conventional credit card use.

The company is the brainchild of Seth Priebatsch, who rose to prominence as the founder of SCVNGR, an early leader in “gamification,” in which gamelike elements are used to persuade people to participate in nongame activities, such as visiting a physical location and sharing that visit via social networks. The LevelUp technology was developed after Priebatsch saw that the original SCVNGR mobile app was “really good at getting people to do things at places but wasn’t really driving transactional revenue for businesses,” says Christina Dorobek, vice president of partner development. “LevelUp is a tool to connect people to places, but through a transaction rather than social media.”

LevelUp is available from at least one vendor in 25 U.S. cities at press time, with larger cities such as New York or San Francisco sporting hundreds of locations where LevelUp is accepted. This summer it raised $21 million in funding (in total, SCVNGR and LevelUp have raised nearly $41 million since 2008). Google Ventures is an investor, as is Continental Investors, a venture capital firm founded by Phil Purcell, creator of the Discover credit card.

LevelUp’s stiffest competition is likely to come from banks licensing similar bar-code and token-based technologies from companies such as FIS (an established banking and payment technology provider), says Peter Wannemacher, an analyst with the business intelligence firm Forrester Research. The banks can label the technology with their own brands and exploit their existing relationships with merchants and customers to gain market share.

To prevail, LevelUp must continue to differentiate itself with customers and merchants with such features as its reward system, in order to build its active user base. So far, if the company’s claim of 200 000 current active users “is accurate, that’s pretty good; that’s exactly where they want to be,” says Wannemacher.

The start-up is also working with cash register manufacturers to develop built-in support for LevelUp’s system and is demonstrating a prototype e-commerce system, in which a QR code on a customer’s phone is captured via webcam to authorize online payment.

This article was updated on 24 September 2012.